Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Council Tax Changes: Thousands May Pay More, Including Empty Home Owners

Published on: 12 Sep, 2012

Updated on: 14 Sep, 2012

Up to four thousand Guildford Borough taxpayers who receive Council Tax Benefit (CTB) might have to face a council tax increase because of changes to council tax funding arrangements being imposed by central government.

Up to four thousand Guildford Borough taxpayers who receive Council Tax Benefit (CTB) might have to face a council tax increase because of changes to council tax funding arrangements being imposed by central government.

Councillors and council officers are exploring ways of minimising the impact on those affected.

From next April the national CTB scheme will be abolished and Guildford Borough Council (GBC) will receive £700,000 less from central government to fund benefits. Councils will, instead, need to create and run their own Local Council Tax Support Scheme (LCTSS). Every council will have their own scheme with its own eligibility criteria.

The Council Executive have agreed to consult on the new draft scheme widely, with the the public and with others on whose behalf GBC collect the tax. The consultation will take place from September until November. Those consulted will be asked for views and feedback on the council’s proposals.

A GBC spokesperson said: “We will receive 10% less funding for CTB from the government and councils need to decide how to find the necessary savings or fund the shortfall. The current CTB bill for Guildford Borough Council is approximately £7million each year, so our annual grant will be reduced by £700,000.”

Lead Councillor for Finance, Cllr Nigel Manning, says: “We are already facing a challenging financial future because of a reduction in our government grant. The cuts to our funding for CTB will make matters worse, but increasing Council Tax or cutting the costs of providing other services is not an option.

“We want to develop a Local Council Tax Support Scheme that is fair, simple and cost efficient. Also one that protects the most vulnerable members of our community and cushions the impact of the impending changes in April. The reduction in funding means that we will have to make some difficult decisions about who gets financial support and how we can assist those in need.”

Cllr Sarah Creedy, Lead Councillor for Housing and Social Care, added: “We want to emphasise that those affected by reductions in CTB can get help. This may be just one of many challenges to a household’s budget but there are people and organisations willing to advise. It is important that anyone affected asks about their options as early as possible, before any difficulties start to build up.”

Apart from pensioners, who are exempt from the changes, every working age person currently entitled to CTB is potentially affected – approximately 4000 people in our borough. GBC say they want to protect as many people as possible from any reduction in their benefit, but some may have to pay part of their bill for the first time; others may have to pay a little more than they do now.

Empty and Second Homes

The government has also announced changes to the main Council Tax system from April 2013. From this date councils will be able to change Council Tax discounts and exemptions given to certain properties. These changes mainly affect empty properties and second homes that are not occupied all of the time. This will also support an important aim of the Council to bring empty properties back into use as homes.

A GBC spokes person said: “One option we are looking at is to use this opportunity to increase empty home income by reducing the current level of CTB and reducing the time properties are allowed to be empty before paying Council Tax, which is currently six months

“This will help reduce the impact of the changes for vulnerable groups affected by the LCTSS, at least for the first year. This will also support our aim to reduce the number of empty properties and encourage their proper use within our local community.

“Our draft LCTSS scheme also proposes to fund some of the shortfall with £242,000 of CTB savings that would potentially affect about 950 working age claimants. With the remaining £458,000 funded from the increased empty properties income.

“We encourage everyone, even if they don’t currently receive Council Tax Benefit, to look out for our consultation and tell us their views on the savings and scheme we propose.”

Peter Webb from STAG (Surrey Tax Action Group) said: “This is just an example of difficult decisions being forced on councils by central government seeking relief from the still increasing national debt and deficit of £1.2 trillion.

“However it does seem to give GBC an opportunity to decide on its own benefit scheme taking account of local wishes and circumstances.

“I suggest that consultation should be wide with facts and proposals in context. An ideal vehicle for that context would be a conventional ‘Annual Report’ for all residents. But GBC arrogantly chooses not to be accountable in that way by providing one.”

A final decision on the scheme will be made by the Council at its meeting on 6 December 2012.

Responses to Council Tax Changes: Thousands May Pay More, Including Empty Home Owners

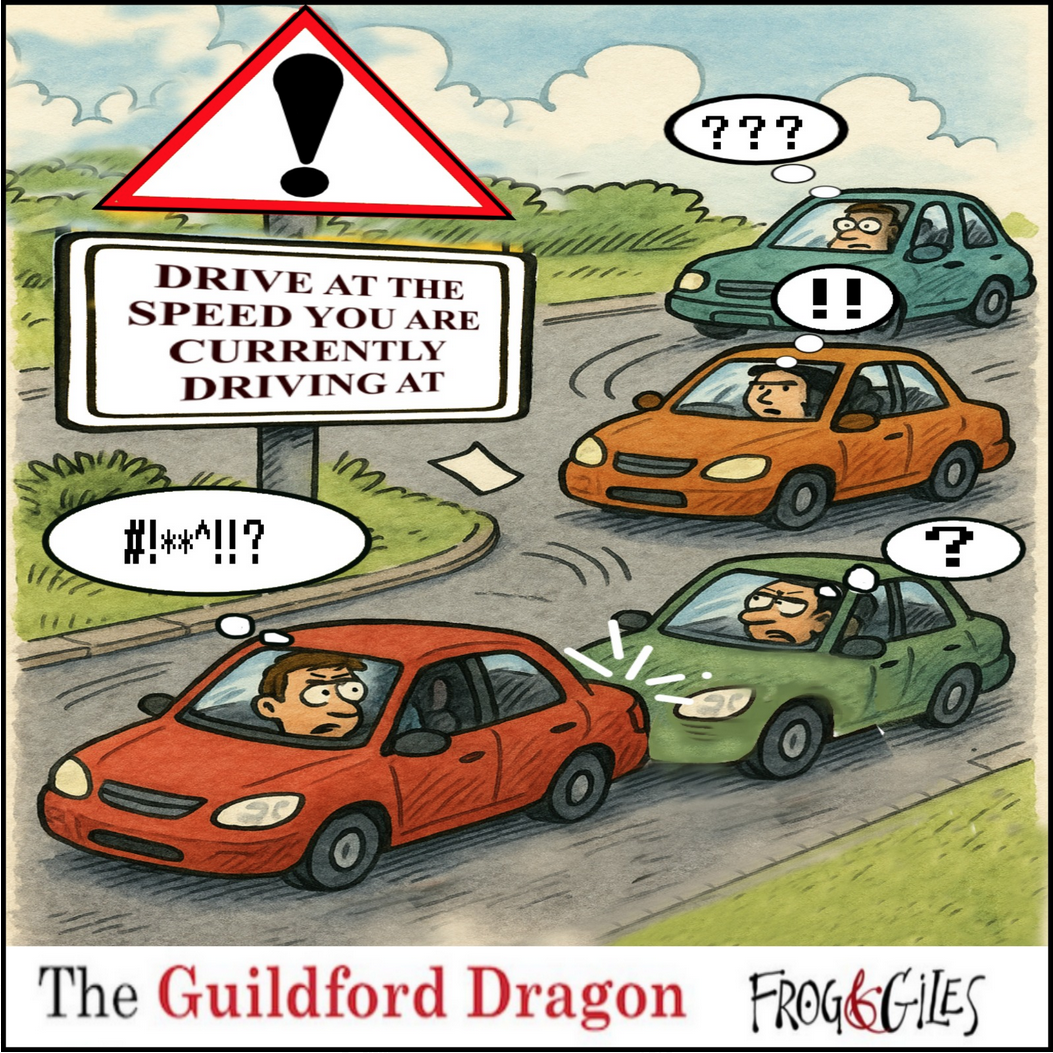

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Mayor of Guildford Drops In on One of His Chosen Charities

- The Church’s Message Is As Relevant As Ever, Says Ash’s Retiring Priest

- CANCELLED: Have a Blooming Picnic – June 7

- Eight Out of Ten PIP Claimants in Guildford Face Cuts to Their “Lifeline”

- Waverley’s New Discretionary CIL Review Scheme To Be Revealed Soon

- Council Accepts Responsibility of Meeting Farnham Museum’s Ballooning Repair Costs

- Notice: Cut It Out!

- Stoke Park Was Bought 100 Years Ago with Plans for a Public Open Space and Houses!

- Dragon Review: The Pajama Game – Yvonne Arnaud Theatre

- A Hidden Gem in the Hills: Michelin-Backed William IV Pub Brings Refined Dining to Albury

Recent Comments

- Bernard Quoroll on Community Councils Proposed to Maintain Local Representation

- John Lomas on A Look Back at Perry Hill’s New Inn and a Family That Once Ran It

- Robert Garbolinski on Dragon Review: The Pajama Game – Yvonne Arnaud Theatre

- Philip Camp on A Look Back at Perry Hill’s New Inn and a Family That Once Ran It

- RWL Davies on Community Councils Proposed to Maintain Local Representation

- Stephen Spark on Major Disruption on the Railway During Hot Day in 1900

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Bernard Parke

September 12, 2012 at 4:10 pm

Council tax is only part of local government funding.

It is also made up with a central tax called The Rate Support Grant.

There is no reason why council tax should not be abolished and local government financed completed from central funds,