Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: The Regressive Council Tax Should Be Reviewed

Published on: 11 Feb, 2017

Updated on: 11 Feb, 2017

Hon alderman and former mayor

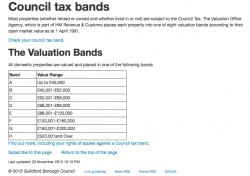

The government should look again at the council tax. It is a regressive tax hitting hard the more unfortunate amongst us. Additionally, the banding is now completely out of date and should be re-evaluated.

Families living in quite modest homes now pay as much tax as those living in multi-million pound properties. This more wealthy section of society tend to have larger disposable incomes and so the tax is not such a burden on them as it is on the lower paid, struggling to pay mortgages or living in rented accommodation.

The tax is also a considerable burden on pensioners and those on fix incomes.

The figures available from GBC up until last October showed that there was them 1,600 properties where no council tax was paid at all. A figure that has increased over the previous twelve months.

In rented accommodations where no council tax is paid it allows landlords to use this non payment to charge even higher rents. Most of these are properties are let to students. In such cases landlords should make a contribution to paying towards the upkeep of local services especially as the very nature of this occupancy can place a higher burden on the borough services.

All social care costs should be paid by central government where national taxes can more equitably share the financial burden amongst us all.

Responses to Letter: The Regressive Council Tax Should Be Reviewed

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Guildford Museum Works to Encourage Interest in Town’s History

- Missing 15-year-old girl located

- What Ash Wants – Village’s Neighbourhood Plan Goes out For Consultation

- St Nicolas’ Infant School Celebrates ‘Good’ Ofsted Rating

- Former Guildford Policeman Admits Misconduct In Public Office

- Letter: Nothing Prepared Me for the Scene of Destruction

- Have You Seen Missing Scarlet-Rose?

- Guildford’s MP Cuts the Ribbon at Merrow Post Office Opening

- Letter: Recreational Rowing Might Be the Answer

- A281 Closure – Additional Works To Take Advantage of Road Closure

Recent Comments

- Ian Mackrell on Stoke Park Was Bought 100 Years Ago with Plans for a Public Open Space and Houses!

- Caroline Freeman on Letter: Recreational Rowing Might Be the Answer

- Diane Harris on Letter: Recreational Rowing Might Be the Answer

- alexander Ford on Guildford’s Green Day Shows Commitment to Net Zero by 2030 Remains

- Adam Aaronson on Letter: How Surveys of Public Opinion Should Be Organised

- Ben Paton on Flashback: Council Report Accepts Juneja Case Has Caused ‘Reputational Damage’

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Martin Elliott

February 11, 2017 at 1:09 pm

Oh dear. Wasn’t “Local Government Finance Bill: policy factsheets” published at the end of January? You may not agree with the content, but it seems the government will be looking at council tax. Perhaps Mr Parke you should read and comment on the shortcomings of those proposals?

Banding is a (crude) mechanism for ranking property, but it works. The only issue might be when property values vary naturally, such as by an area becoming more fashionable. Modification of a property has always been covered by a re-assessment.

https://www.gov.uk/government/publications/local-government-finance-bill-policy-factsheets