Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Concerns Expressed Over Student Accommodation Loan As GBC Agrees Budget

Published on: 8 Feb, 2018

Updated on: 9 Feb, 2018

A significant number of Tory councillors remained concerned about a proposal to lend £81 million for student accommodation as they agreed the Guildford Borough Council (GBC) budget last night (February 7, 2018).

A significant number of Tory councillors remained concerned about a proposal to lend £81 million for student accommodation as they agreed the Guildford Borough Council (GBC) budget last night (February 7, 2018).

It is understood that the council will borrow the money from central government at a low rate of interest and charge a higher rate to the borrower, widely believed to be the University of Surrey, to provide a new revenue stream for GBC.

In a written question, Cllr Bob McShee (Con, Worplesdon) said: “…a number of local residents have contacted me expressing there concerns about the Borough Council spending such a large sum on student housing.”

Supporters of the proposal point out that that by financing the creation of more student accommodation on campus, pressure will be relieved on the private housing market in the town.

But critics question the advisability of the council forming an even closer relationship with the university in this way, considering its other plans for expansion, some of which will require planning approval from the council. They also question, the level risk associated, its effectiveness, if student numbers are to be increased as expected, and also whether a better return on investment could be achieved elsewhere.

Although not required to do so, Council Leader Spooner has agreed to bring details of the proposal back to full council for approval.

The vote of approval followed party lines. Of the 42 councillors present, all 30 Conservative and the two Labour councillors voted approval, all eight Lib Dems voted to abstain, as did one GGG member. The only vote against was cast by Cllr Susan Parker.

The budget has confirmed a strategic change in the approach to the borough council finances. With the disappearance of a central government grant the council says in a press release that they are employing a “combination of focused savings, wise investment and effective management ensures that the council remains in a very strong financial position.”

Lead councillor for finance, Michael Illman (Con, Shalford) says: “Planning ahead, our goal to become self-funding and our commercial approach to investing in our own borough will help the council cope without any overall government funding for the very first time in 2018-19.

“We start from a very strong financial position, thanks to the bold decisions based on our ambitious plans to improve our borough by increasing income, reinvesting in growth from our share of retained business rates and transforming the way the council works.

“All of this enables us to provide the wide range of vital services and future opportunities that our residents and businesses need to prosper. It also helps us manage the impact of reduced funding from the government and Surrey County Council, without having to significantly increase our share of council tax.

“We believe that every person matters, whatever their circumstances and wherever they live in the borough. Another benefit of our strong financial position is the ability for the council to provide and build a mix of homes to meet the different needs across our communities.”

The council is planning to invest £92 million in services, local property and infrastructure planned for 2018-19.

In addition to council projects, the council says it is working closely with partners and jointly investing to deliver key infrastructure improvements across the borough:

“This includes working with the EnterpriseM3 Local Enterprise Partnership (LEP), Surrey County Council and Network Rail on projects such as:

- new Guildford West railway station in Park Barn

- improving the A331/A31 Hog’s Back road junction

- new Walnut Tree town centre pedestrian and cycle bridge

- new road bridge over the railway in Ash.

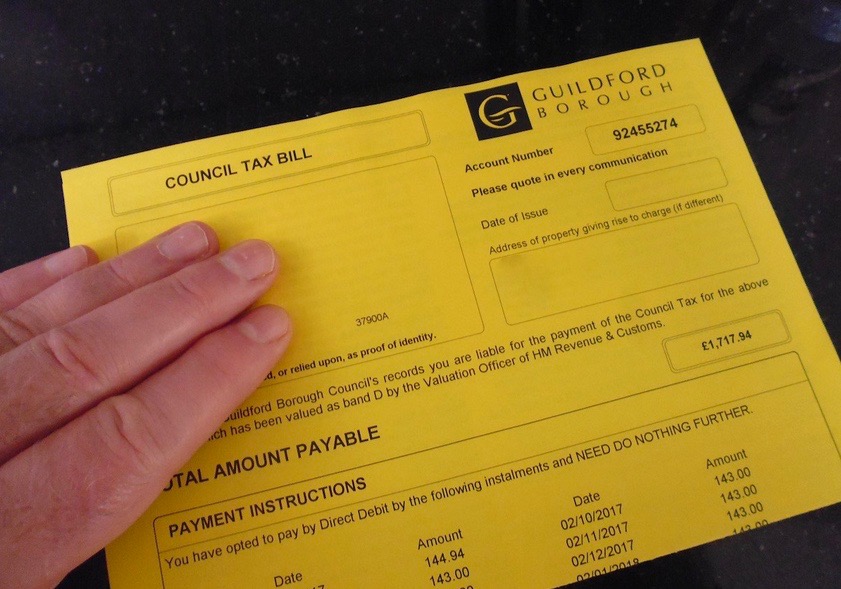

And the council is keen to highlight within the background of record council tax rises being announced nationwide that Guildford has: “the second lowest council tax in Surrey in 2017-18 – with an increase of 9.6p per week agreed for 2018-19”.

The GBC press release states: “We keep less than 10% of the council tax that we collect, with an increase of £5 per year (3.09%) in our proportion of the bill in 2018-19.

“We have saved approximately £10 million since 2013, partly by improving how we work, and plan to make almost £800,000 of savings and extra income in 2018-19.”

“This means we can provide the wide range of services that our residents and businesses rely on in the most effective way.”

Services provided by the borough council include:

- care for families, the homeless and providing transport, meals, activities and support to help older and vulnerable people;

- collecting recycling, rubbish and garden waste;

- safeguarding and showcasing our heritage and local attractions;

- ensuring the enjoyment of and access to parks and countryside;

- looking after public health and ensuring taxis and food outlets are safe;

- enabling a variety of sports, leisure and entertainment opportunities for all;

- supporting and developing the local economy and encouraging tourism.

The council is also budgeting to provide a mix of homes to buy and rent at market and “affordable” prices.

In the press release it is stated: “We own, manage and rent a wide range of 5,200 homes at social housing rents and these rents are decreasing for the third year in a row, by 1% in 2018-19.

Building schemes underway are:

- Guildford Park Road on previous open-air car park site (160 homes, 64 for affordable rent)

- Apple Tree pub site in Park Barn (18 homes, all for affordable rent with nine fully wheelchair accessible)

- Ladymead site near the new Fire Station (12 homes, all for affordable rent)

- other smaller scale previously-developed sites (21 homes across five sites, all for affordable rent).

Cllr Ilman added: “It is not just the excellent financial management over many years, for which the council is independently audited and recognised as providing great value for money.

“We also take an entrepreneurial view to tackling the considerable challenges the council faces, particularly now that funding has to come from locally raised income, the proportion of business rates that we can keep and our less than 10% share of residents’ total council tax bill.

“This view leads to positive outcomes, such as rental income from investing locally in property, which then helps keep our council tax as low as possible.

“There are further challenges ahead and we’ve already had to find extra money and make difficult choices about future projects. As this latest budget shows, we will continue to prioritise our essential services and improvements that benefit local people and support our economy.”

Responses to Concerns Expressed Over Student Accommodation Loan As GBC Agrees Budget

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- SCC Calls on the Government To Protect the Environment

- Two-Week Road Closure on Portsmouth Road for Gas Network Upgrade

- Charlotteville Cycling Club Organises Another Successful Race Event

- Waverley Council To Bring Green Space Maintenance In-house

- A New Dementia Centre for Guildford

- Lib Dems Easily Hold Three Council Seats in Surrey By-elections

- UK Students to Launch International Space Mission

- New Skate Park Proposed for Cranleigh

- Retrofit Planned for Guildford Office Building

- Museum Shines a Light on Victorian Send, Ripley and Pyrford

Recent Comments

- Richard Cooke on Letter: Snail-paced Progress for Full Weir Repair

- Bethan Moore on Guildford’s First “Bike Bus”

- Andy Friend-Smith on Guildford’s First “Bike Bus”

- Peter Mills on Guildford’s First “Bike Bus”

- Des Flanders on Making History As Pewley School’s Class of ’54 Hold Their Final Reunion

- Margaret Rotherham on Guildford Festival Burst with Colour, Culture and Community Spirit

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Martin Elliott

February 8, 2018 at 1:13 pm

I’m obviously confused by the specific semantics.

Matt Furniss tweeted:

“@GuildfordBC does not invest outside the Borough. There are no LEP loans for property investment. Only grants for infrastructure.”

Obviously a loan immediately passed on with increased interest to be used for property investment by a third party isn’t property investment.