Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

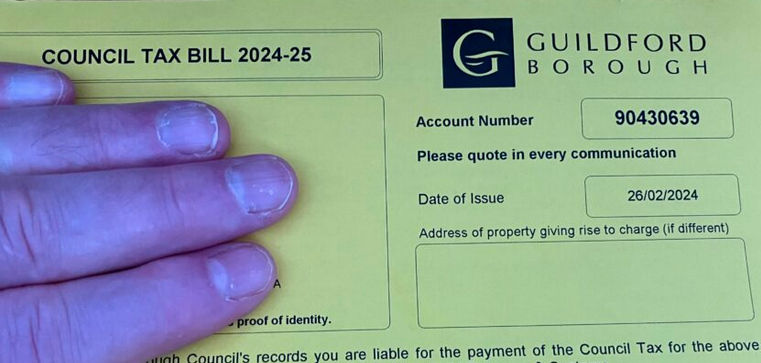

Council Tax Hike Not Currently Planned Despite ‘Black Hole’

Published on: 15 Nov, 2024

Updated on: 15 Nov, 2024

On Wednesday (November 13), Conservatives were warning that a “£2.4 billion” budgetary “black hole” in local government funding would mean a hike in council tax bills, despite Prime Minister Keir Starmer once promising to freeze council tax in his first year in government.

But yesterday (Thursday), subsequent to Prime Minister’s Questions, the government confirmed it was sticking with the current cap on increases.

During Wednesday’s PMQs, the new Tory leader Kemi Badenoch confronted the Prime Minister about a response given to a written Parliamentary Question, tabled by Shadow Levelling Up, Housing and Communities Minister David Simmonds MP, in which the Conservatives asked Labour how much of the increase in local government spending, announced in the Budget, will come from higher council tax.

In a response, given by both Chief Secretary to the Treasury Darren Jones MP and Housing, Communities and Local Government Minister Jim McMahon MP, Labour confirmed that local government core spending power would rise from £64,786 million in 2024-25 to £68,459 million in 2025-26 as part of the government’s upcoming Local Government Finance Settlement.

According to the Conservatives: “This reveals that core spending power is set to rise by £3.7 billion, but with grants only rising by £1.3 billion, this leaves a £2.4 billion blackhole in local government finances that Labour will need to fill with local taxes.”

And they believe that the Treasury could be planning to raise council tax by £2.4 billion across England next year – a potential hike, they say, of £143 more a year for an average Band D property’s bill a rise of 6.6 per cent increase in council tax across the board.

Asked by the leader of the opposition: “Will the Prime Minister confirm that he will keep the cap on council tax?” the PM dodged the question.

Ms Badenoch pursued the point saying: “I think the House would have heard that the prime minister could neither confirm nor deny whether the cap on council tax was being raised.”

Before the government confirmation that the caps were not to be raised was announced, The Dragon sent the Conservative comment to Guildford Borough Council with a series of questions. Here are the responses from Joint Strategic Director of Finance and Resources and Section 151 Officer Richard Bates:

Has GBC been given any notice of an expected council tax rise as described or otherwise?

We have not had any notice of the council tax limits for 2025-26. Our expectation is that the 5 per cent limit will continue to relate to upper tier authorities and the existing 3 per cent limit will remain for district and borough councils.

The council tax limits relate to the cap on increases beyond which a referendum would be required. These limits are set annually, with different rules applying to different types of precepting authorities (such as county councils and parish councils).

How would council tax rise work? Could extra revenue raised be distributed elsewhere in the country?

Council tax is collected by the district councils and 100 per cent is kept locally by the county council, district councils, Police and Crime Commissioner and parish and town councils. There is currently no mechanism for this to be redistributed to other parts of the country.

However, the government can change the methodology for how other grants are allocated, so any redistribution is likely to come through that, rather than council tax. We are anticipating a new Fair Funding Review in the spring, which would feed into a three-year financial settlement for Local Government from 2026-27 onwards.

At this point, the opportunity for wider redistribution across the country will be much greater. In my opinion, councils who have gained significantly from historic growth in Business Rates are likely to see some of these gains reallocated elsewhere.

When would the council expect to hear any proposals for a council tax rise by?

We are expecting a policy statement from the government in late November. This is likely to set out the proposed council tax referendum limits for 2025-26. Confirmation will come as part of the provisional Local Government Finance Settlement which we are expecting in the week commencing 16 December.

Can the government simply raise the referendum threshold?

Yes, the government issues legislation annually to confirm the council tax referendum principles for the forthcoming year.

Guildford Labour was invited to comment.

Recent Articles

- ‘Help Us To Track Wildlife This Autumn’ – Surrey Charity’s Plea To Nature Lovers

- Letter: Are Vendor-linked Awards the Way to Go for Schools’ ICT?

- Letter: How Not to Engage the Public

- GBC Takes Legal Action Over Unauthorised Bramley Traveller Site

- Developers Release Early Plans For 950 Homes on Normandy Farmland

- Open Day at Silverbirch House Care Home and a Special Gift for One of its Residents

- Birdwatcher’s Diary No.336

- Behind The Picture Of Wealth and Prosperity – Surrey Has a Story of Inequality and Poverty

- Guildford Fringe Founder Steps In To Save The Electric Theatre

- Letter: How Residents Can Take Part in Talks About the Ash Neighbourhood Plan

Search in Site

Media Gallery

Cllr Townsend on Waverley’s CIL Issue

August 27, 2025 / Comments Off on Cllr Townsend on Waverley’s CIL Issue / Read MoreMP Zöe Franklin Reviews Topical Issues

August 27, 2025 / Comments Off on MP Zöe Franklin Reviews Topical Issues / Read MoreMP Hopes Thames Water Fine Will Be ‘Final Nail in Its Coffin’

August 27, 2025 / Comments Off on MP Hopes Thames Water Fine Will Be ‘Final Nail in Its Coffin’ / Read MoreNew Guildford Mayor Howard Smith

August 27, 2025 / Comments Off on New Guildford Mayor Howard Smith / Read MoreA New Scene for a Guildford Street

August 27, 2025 / Comments Off on A New Scene for a Guildford Street / Read MoreDragon Interview: Sir Jeremy Hunt MP on His Knighthood and Some Local Issues

August 27, 2025 / Comments Off on Dragon Interview: Sir Jeremy Hunt MP on His Knighthood and Some Local Issues / Read MoreDragon Interview: Paul Follows Admits He Should Not Have Used the Word ‘Skewed’

August 27, 2025 / Comments Off on Dragon Interview: Paul Follows Admits He Should Not Have Used the Word ‘Skewed’ / Read MoreDragon Interview: Will Forster MP On His Recent Visit to Ukraine

August 27, 2025 / No Comment / Read MoreDragon Interview: Fiona Davidson on the ‘Devolution’ Proposals for Surrey

August 27, 2025 / No Comment / Read More

Recent Comments