Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

GBC ‘Will No Longer Be Able to Afford the Current Range of Services’ Provided

Published on: 26 Jul, 2023

Updated on: 28 Jul, 2023

By Chris Caulfield local democracy reporter

By Chris Caulfield local democracy reporter

and Martin Giles

Services will be cut back to the bone as Guildford Borough Council looks to carve out more than £18 million from its medium-term projected budget deficit to avoid effective bankruptcy.

The level of cuts was agreed at yesterday’s, July 25, full council meeting to address the authority’s £300 million debt.

Cllr Richard Lucas (Lib Dem, Ash Vale), lead member for finance and property said , the borough would have to make “structural changes” and dispose of some assets if it wanted to get its house in order ahead of a revised November budget.

He told the meeting: “Our officers are trying to deal with the reality of the situation.

“We won’t deal with this by pretending there is no problem.

“This is going to result in difficult decisions for the operational spending and capital disposal.

“This is not Section 114. We are taking action to avoid this.

“However, if we do nothing Section 114 comes into play which would pretty much make this council useless.”

See General Fund Budget Update Report here

A Section 114 notice is when a council declares itself effectively bankrupt and can no longer run a balanced budget.

It stops all but essential spending to ensure a council can continue to provide its legally obligated services to its most vulnerable residents.

The approved measures, however, are not too dissimilar after the council said that new spending would need the explicit agreement of its chief finance officer (CFO) until further notice, and that breaches would be “considered a disciplinary matter”.

Recruitment and contract renewals have to be signed off by the corporate management board and the council’s investment programme has been suspended immediately, save for existing contracts that need to be fulfilled.

This applies to all council services, including statutory ones. The only exemptions are the council-owned housing company North Downs Housing Ltd and the Housing Revenue Account.

These controls will remain until at least the end of the 2023-24 financial year.

Cllr Philip Brooker (Con, Worplesdon) said: “We as a council must take immediate action to solve this” but called on it to be done in a way that minimises the impact on services.

Cllr Bob Hughes (Con, Shere) said: “it was doubtless services would go” and that people “would get hurt”.

The authority will undergo radical change as it “reconfigures services so they can be managed within the financial resources available to the council”.

He concluded the report should be “noted” rather than “endorsed”, as described in the motion, because details of the remedial plan were not yet known and everyone should know “who knew what, and when”.

Cllr Joss Bigmore (Merrow) leader of the Residents for Guildford Villages, also found it impossible to endorse the report and offered the only criticism of its content.

He felt it painted too pessimistic a picture. While praising its openness, he said: “I find it very odd that it talks about debt without any mention of assets. £300 million of debt sounds a huge number but when the council is sitting on £1.1 billion of assets it becomes less big and less scary, making the report unbalanced.

“I find odd the conflation of the HRA (housing revenue account) and the general fund. We are talking about general fund issues yet we are assessing debt that is assigned to the HRA which is completely separate.” He also questioned the figures relating to the Ash Road bridge project.

But Peter Vickers the interim CFO countered the criticism. He agreed that the impact was not all on the general fund. “There is housing debt within that and there are housing reserves. Those elements absolutely have nothing to do with the general fund. They aren’t ring-fenced monies that belong to and are tied to the HRA.

“So it’s appropriate to understand that nuance that the HRA assets are not in scope. We’re absolutely not about to sell any housing asset that we have.”

“Yes, this authority has got a significant asset base, however, as a local authority, there is absolutely no link whatsoever, on the balance sheet, between the assets and the debt.

“This report tells us we don’t have four years to find it [the four-year deficit shortfall] at the moment. We’ve literally got the next six months, plus a bit more, depending on how good a plan we come up with, to resolve this issue because the reserves are not there.”

Every service and budget, the bleak report reads, will undergo a review to establish minimum viable service levels and options for savings and income growth.

The report states: “The council will no longer be able to afford to deliver the current range of services or maintain some services at existing levels and significant rationalisation of the current service offer will be required to live within a reduced financial envelope.”

Services that protect the most vulnerable residents would be prioritised for protection with the remaining services transformed “to ensure they are as efficient and cost-effective as possible”.

The authority announced it had to impose a series of strict cuts to its budgets to cover an £18 million deficit by the end of the financial year if it was to avoid effectively declaring itself bankrupt this autumn.

The deficit, council papers said, equates to 145 per cent of its net budget and “will fundamentally change the services the council delivers and will require political will and a step change in activity to reconfigure services accordingly”.

The motion to endorse the report was passed by 27 votes to no votes against with 13 abstentions (figures to be confirmed). The voting was largely on party lines: the Lib Dems, Labour and GGG councillors voting in favour and the Conservatives and R4GV abstaining.

See webcast of council meeting here.

Responses to GBC ‘Will No Longer Be Able to Afford the Current Range of Services’ Provided

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

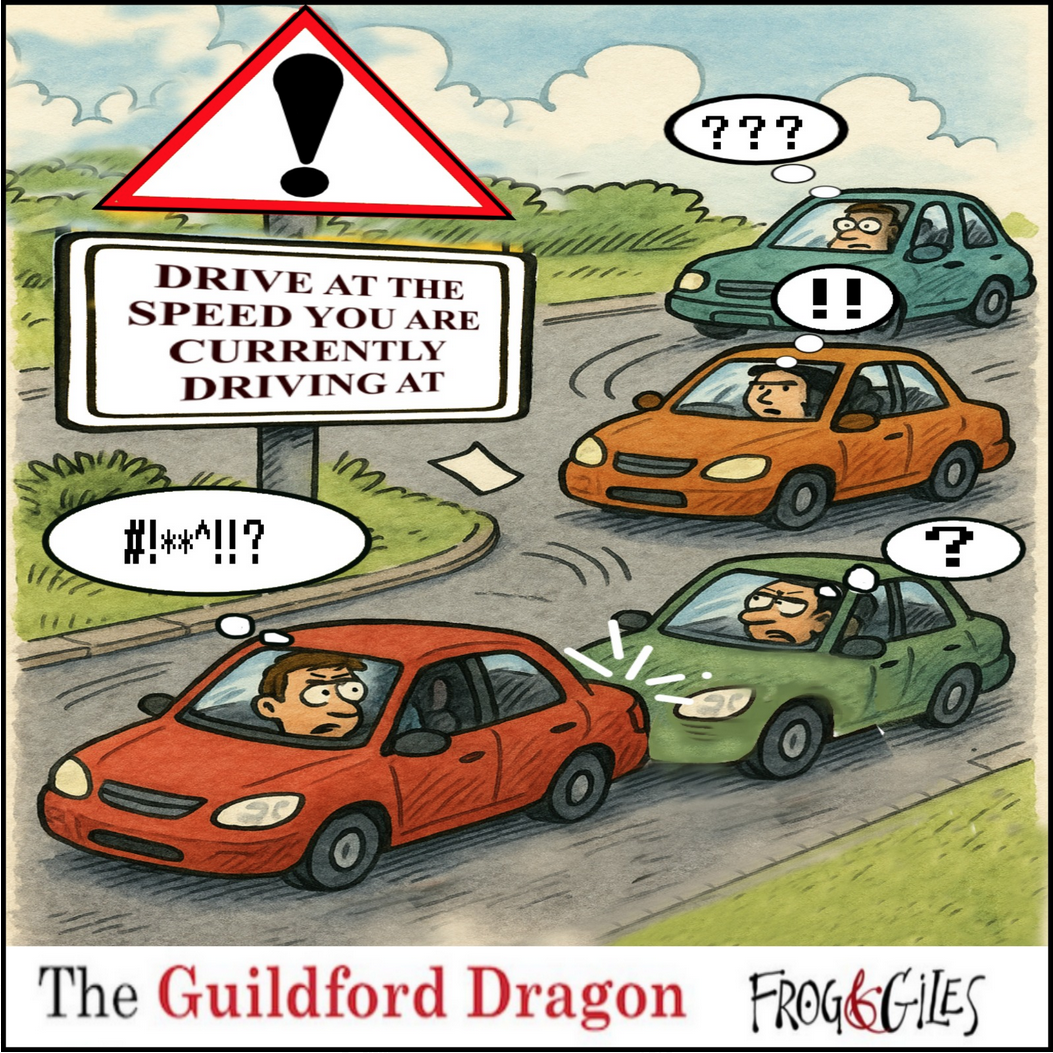

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Eight Out of Ten Pip Claimants in Guildford Face Cuts to Their “Lifeline”

- Waverley’s New, Discretionary CIL Review Scheme To Be Revealed Soon

- Council Accepts Responsibility of Meeting Farnham Museum’s Ballooning Repair Costs

- Notice: Cut It Out!

- Stoke Park Was Bought 100 Years Ago with Plans for a Public Open Space and Houses!

- Dragon Review: The Pajama Game – Yvonne Arnaud Theatre

- A Hidden Gem in the Hills: Michelin-Backed William IV Pub Brings Refined Dining to Albury

- Letter: Help Reduce Speeding By Joining a Community Speedwatch Team

- Hospital Apologises ‘Unreservedly’ After Death of Disabled Girl

- Birdwatcher’s Diary No.328

Recent Comments

- Bernard Quoroll on Community Councils Proposed to Maintain Local Representation

- John Lomas on A Look Back at Perry Hill’s New Inn and a Family That Once Ran It

- Robert Garbolinski on Dragon Review: The Pajama Game – Yvonne Arnaud Theatre

- Philip Camp on A Look Back at Perry Hill’s New Inn and a Family That Once Ran It

- RWL Davies on Community Councils Proposed to Maintain Local Representation

- Stephen Spark on Major Disruption on the Railway During Hot Day in 1900

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Martin Elliott

July 26, 2023 at 3:24 pm

Strangely GBC has been increasing charges for non-statutory services for several years without much consultation.

The car park scheme charging scheme imposing a 3-hour minimum payment and cost per hour was excused as a measure yo encourage more footfall. However, I’ve seen no analysis to back up success either in visitor numbers or amount collected. Does £0.5 million still go to support the non-self financing after a decade, Park & Ride?

Less controversial is the garden waste collection charge. The excuse given was that it was only a small price increase each year (£4) but that isn’t valid when it’s well above inflation.

I raised the issue of using services as a ‘cash cow’ with my local councillor, now a senior Lib Dem councillor, a few years back. His attitude, even then, was surprising:

“…charges go up because it’s a non-essential service which the council doesn’t have to provide at all and so it’s considered better to raise money there than elsewhere”.

“With something like the garages I don’t know the official reason off the top of my head but I know it’s within the context of needing to save millions of pounds this year and within the context of garages being an area where there are no government limits on how high we can set them.”

John Perkins

July 29, 2023 at 9:26 am

If the council does not have to provide the service at all then perhaps it would be better if a commercial organisation were to take it over. At least that would spare us the arrogance of councillors who apparently consider abuse of a monopoly acceptable.

Ben Paton

July 26, 2023 at 5:38 pm

An interesting article. But it poses as many questions as it answers.

Could we have a link to the report?

What is the £300m debt – ie who is it owed to; what is its term/payment date(s); is it on fixed or variable interest rates?

What is the debt secured on?

Why was the debt incurred? Presumably to purchase assets? Some years ago the Council voted to buy retail shopping centre assets in other parts of the UK. What are those assets? Have they kept their value?

Can the Council sell any assets to pay off the debt?

What does the summarised income statement and balance sheet look like?

What does this statement:’there is absolutely no link whatsoever, on the balance sheet, between the assets and the debt’ mean? Why is there no link?

The Housing Revenue Account – which owns the Council’s stock Council Houses – is plainly separate. But was none of the debt incurred to build or upgrade Council Houses?

If the debt was not taken on for social housing purposes then we should know who took on the debt, when and why? Was it those ‘prudent’ Guildford Conservatives who boasted about their careful financial management in their election literature for so many years?

The Dragon is doing a splendid job bringing this to Public attention. But please Sir, may we have more?!

If Woking Council had been more transparent it probably would not have ended up in its present mess.

Editor’s response: Thank you for your comment, these are pertinent questions. Unfortunately, there is always a judgement that has to be made as to how much detail to report and, of course, a limited time period within which to get the story written, edited, laid out, and published. In this case, I did add to the story filed by the local democracy reporter, as I considered Dragon readers would want more detail, but because of other unavoidable commitments, I failed to add a link to the webcast. Apologies. That has now been corrected and a link to the report also added.

Within the report, there is (at 7.12) a table 9the accuracy of the table has been challenged) breaking down the £300 million debt, well most of it. Major projects such as Walnut Bridge, Weyside Urban Village and Ash Road Bridge are components.

We will continue to report on this story and I will try and get answers to your other questions too.

One point regarding GBC assets, my understanding is that GBC has no property assets outside the borough as the result of a specific policy decision.

Ian Osgood

July 27, 2023 at 12:00 pm

When councillor Richard Lucas comments that if section 114 comes into play it would make the council useless. I would contend that they have already achieved this benchmark.

No doubt a few more golden termination packages will be paid for ultimately by the council taxpayers.