Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Council Tax Rise – Time To Rethink It All

Published on: 8 Feb, 2016

Updated on: 8 Feb, 2016

From Alderman Bernard Parke

In previous years the chancellor has decreed that the council tax levy should not increase by more than 2%.

However, this year that levy is to be nearly twice that amount, approaching the 4% figure.

However, this year that levy is to be nearly twice that amount, approaching the 4% figure.

Local government is financed both by the broader based revenue support grant and the local council tax.

The latter is based on an ever-decreasing financial base, and in Guildford we have nearly 1,500 homes on which no council tax is payable at all, and many such properties draw heavily on borough services.

Council tax rises of this magnitude hit young people, many seeking the dream of owning a home of their own.

In addition to this burden, they are facing ever increasing rent rises making it virtually impossible for them to place a deposit on even the so-called affordable properties.

Pensioners, and those on low incomes also find this iniquitous tax a burden on even the most modest lifestyles.

This year the revenue support grant is to be reduced so triggering this unwanted increase.

The question must be asked why?

Council tax is in great need of being revisited, for it hits the less fortunate in our society, all local services should be based on the larger financial base – the Government’s revenue support grant.

Responses to Letter: Council Tax Rise – Time To Rethink It All

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

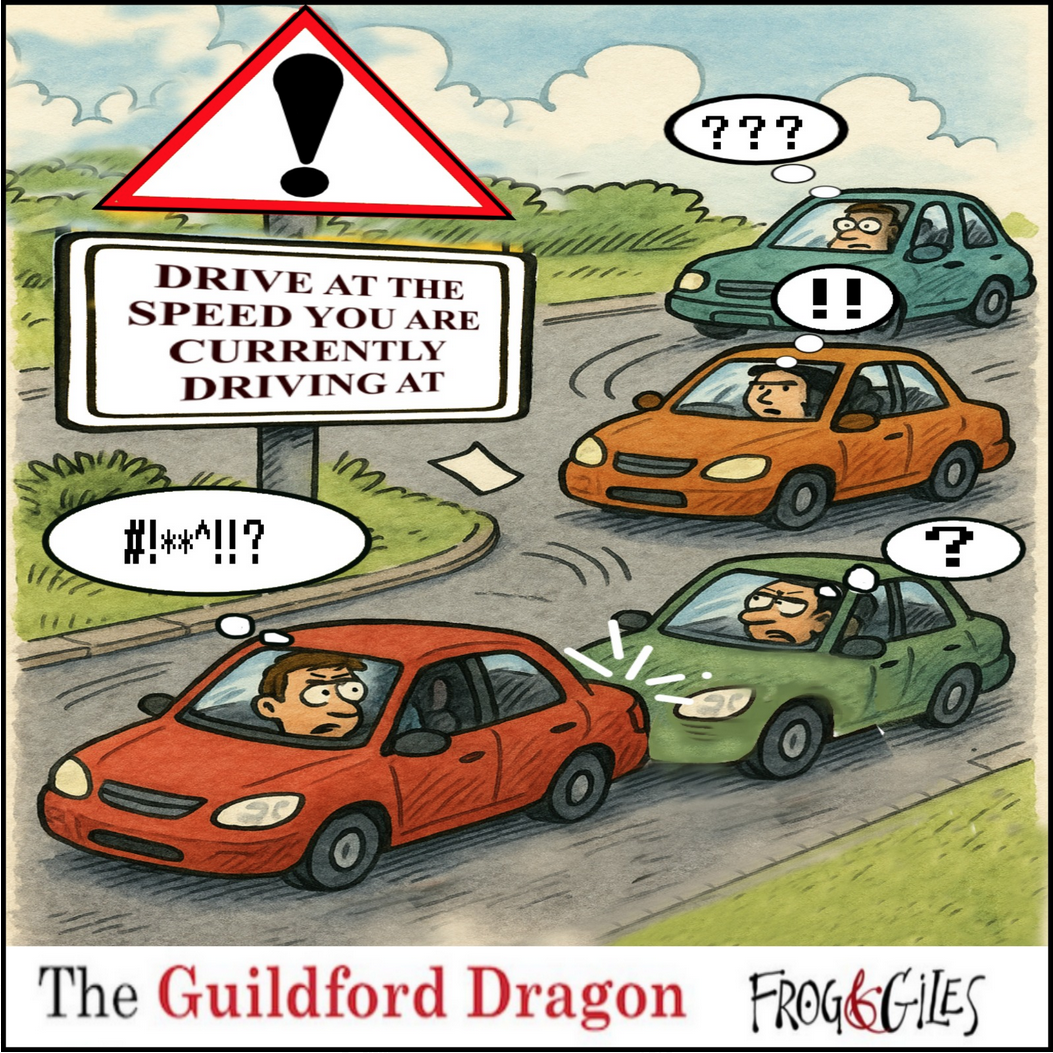

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Flashback: There Are Lessons To Learn from the Juneja Case – The Council Must Admit It

- GBC’s Plan For a Thriving Guildford ‘Is Our Promise to Residents’ Says Council Leader

- Highways Bulletin: Campaign for Better Transport

- Check on Forgetful Neighbours During Hot Weather Urges Alzheimer’s Society

- Guildford Museum Works to Encourage Interest in Town’s History

- Missing 15-year-old Girl Located

- What Ash Wants – Village’s Neighbourhood Plan Goes Out for Consultation

- St Nicolas’ Infant School Celebrates ‘Good’ Ofsted Rating

- Former Guildford Policeman Admits Misconduct In Public Office

- Letter: Nothing Prepared Me for the Scene of Destruction

Recent Comments

- John Lomas on Letter: Recreational Rowing Might Be the Answer

- Amanda Moss on A281 Closure – Additional Works To Take Advantage of Road Closure

- Jack Sparrow on Royal Surrey Patients Complain Changes Won’t Fix Underlying Parking Problem

- Paddy McMullan on Memories Of Queen Elizabeth Barracks And The Women’s Royal Army Corps

- Fiona Yeomans on St Nicolas’ Infant School Celebrates ‘Good’ Ofsted Rating

- Sally Grove on What Ash Wants – Village’s Neighbourhood Plan Goes Out for Consultation

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Jules Cranwell

February 9, 2016 at 9:14 am

Unfortunately, GBC needs more and more of our money.

Vanity projects, such as the £3.5 million upgrade of the council offices, and the huge increase in ‘allowances’ the Executive has just voted for themselves do not come cheap.

Alice Forbes

February 10, 2016 at 12:01 am

In reply to Jules Cranwell:

The upgrade is not a vanity project, but is needed to make the building fully accessible for both officers and visitors who have mobility and other difficulties.

Jules Cranwell

February 14, 2016 at 8:27 am

In reply to Alice Forbes:

That may have been the excuse, but do we know how much of the budget was for mobility?

No, because we’ve not been given the breakdown.

I suspect it was less that the cost of replacing the perfectly adequate furnishings in the council chamber.

Jim Allen

February 14, 2016 at 5:35 pm

If we are paying £3 million plus then I expect the workmanship to match the invoice.

The shoddy workmanship within the council chamber would make a blind man weep without even seeing it.

The workmanship in the ceiling circle is below ‘first year apprentice reject work’.

Quality control is to say the least missing from this section of the project.

As for its design, I personally preferred the old chamber, far smarter.

Apparently it was only short of a hearing loop and possibly a lift, but I could be wrong.

Roll away ‘councillor work stations’ – who has heard of such a thing in a real council chamber? Or is it clear away for duel use, party, anyone?

Dave Middleton

February 9, 2016 at 3:06 pm

The problem with basing the bulk of local authority funding on government grants, is that local authorities are then beholden to central government for funds and likely to become even more subservient to central government and by extension, which ever political party is in power at the time.

Not a good situation.

Bernard Parke

February 10, 2016 at 6:34 am

Is this not better than allowing local authorities embarking on costly and trivial schemes as we have recently witnessed?

Laura McEvoy

February 10, 2016 at 11:49 am

I agree with Dave Middleton above.

Local services should be funded locally so that councils remain as independent as possible and answer only to local residents.

However, council tax is a broad brush with modest properties in Guildford near the top bands.

I’d like to at the very least see the thresholds on the bands changed so that the burden is spread more evenly based on property value.

Ultimately a land value tax collected locally would be a much better tool than council tax and business rates.

Eddie Ward

February 13, 2016 at 9:58 pm

In reply to Laura McEvoy’s point about a local land tax.

If a land tax was introduced nationally, and the proceeds distributed fairly, there would, be little need for many of the taxes we pay today.

The main reason for this is that no-one can hide the land that they own.

It is already on the Land Registry, so offshore accounts would be a thing of the past.

Well, we can but dream.

Bernard Parke

February 14, 2016 at 9:47 am

The situation has not help GBC by the Chancellor cutting the central government grant and encouraging authorities to raise more funds locally.

I have in my possession an election newsletter which states: “Guildford Conservatives have delivered 12 years of frozen or low council tax increases”.

Now after the election this would seems to be changing.

Adrian Atkinson

February 15, 2016 at 10:07 am

In respons to Mr Parke:

The very same Conservative newsletter will state their declaration to protect the green belt I’m sure.

According to recent comments about the amount of green belt being proposed to be released in the next draft local plan and my back of a fag packet calculations at 15 houses per hectare means some 10,800 houses heading for the green belt currently near you.

Remember all those pre-election green belt pledges.