Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Council Leader Outlines Main Budget Measures

Published on: 18 Feb, 2013

Updated on: 21 Feb, 2013

In the wake of last week’s council meeting, where the budget for 2013-14 was approved by 27 votes to 11, Cllr Stephen Mansbridge, (Con, Ash South & Tongham) Leader of Guildford Borough Council, explained the thinking behind the budget plans.

He said: “Despite ongoing financial pressures we want to create opportunities, encourage growth and provide choice for future generations.

“Through shrewd financial planning, and by improving the efficiency of our existing services, we delivered savings of £2.49 million in 2011-12 and £2.58 million in 2012-13. We plan further savings of £961,000 in 2013-2014, including exciting changes to our recycling service to help residents recycle more.”

We are working on an ambitious programme of service improvements and investment. Cllr Stephen Mansbridge

“We are working on an ambitious programme of service improvements and investment. Our plans include:

- increasing our support for Guildford Community Job Club and investing £80,000 into a local apprenticeship scheme

- further work on homelessness prevention and £7 million of improvements to existing Council homes

- investing in infrastructure research, including a strategic A3 corridor transport study, and Town Centre and approaches movement study

- supporting the Enterprise M3 Local Enterprise Partnership

- investing £10 million in new affordable homes over the next two years

- providing £40,000 for a new hardship fund to support those most affected by Council Tax Benefit changes

- improving our parks, car parks and crematorium

But a Lib Dem spokesperson said: “The proposals include a 1.99%* hike in council tax for residents in Guildford while at the same time the Conservative administration are cutting council tax benefits for the less well-off residents, increasing the cost of dial-a-ride and investing large amounts in consultants and temporary staff.

“The Liberal Democrat group voted against the budget, considering the proposals to have a negative impact on many residents of the which are unjustified and the current financial climate.

…we should not be increasing our council tax, keeping service cost increases to a minimum. Cllr Zoe Franklin

Justifying the 1.9% rise in the GBC portion of Council Tax the Conservative Council Leader Stephen Mansbridge said: “Changes to the way our government grant is distributed, and other funding reductions, mean that we must now increase our portion of the Council Tax by 1.9%.

“This is equivalent to an additional £2.74 a year, or less than six pence a week, for a band D property. This increase helps us to continue to deliver high quality services for our residents and reduce the risk of higher rises in the future.

“Our current band D Council Tax is five per cent lower than it would have been, thanks to the freeze in Council Tax during the last two years. A third year freeze in 2013-2014 would have a long-term impact on our income and the investment we could make in the borough.

“So this year we will keep to our policy of Council Tax rises below the rate of inflation. We must continue with our effective financial planning to make sure we achieve our aims for the benefit of everyone.

“We want to prepare positively for the future of our community and the local economy, to generate income and help support those in need. By continuing to transform the way we operate, and by using our assets more effectively, we will meet the financial challenges and provide a first class service to our customers.”

Deputy Liberal Democrat group leader, Cllr Zoe Franklin (Stoke) commented: “Budgets are a moral document that tell you about what and who are most important to a family, nation or in our case this council.

“In these difficult times we should be recognising the financial sacrifices being made by our residents. We be should be showing that we as a council are also tightening our belts and we should not be increasing our council tax, keeping service cost increases to a minimum.”

* 1.99% is the overall Council Tax rise agreed by Surrey County Council. The increase to the GBC element is 1.9%.

What do you think, was the council tax rise justified? Have your say. Use the ‘Leave a Reply’ feature below.

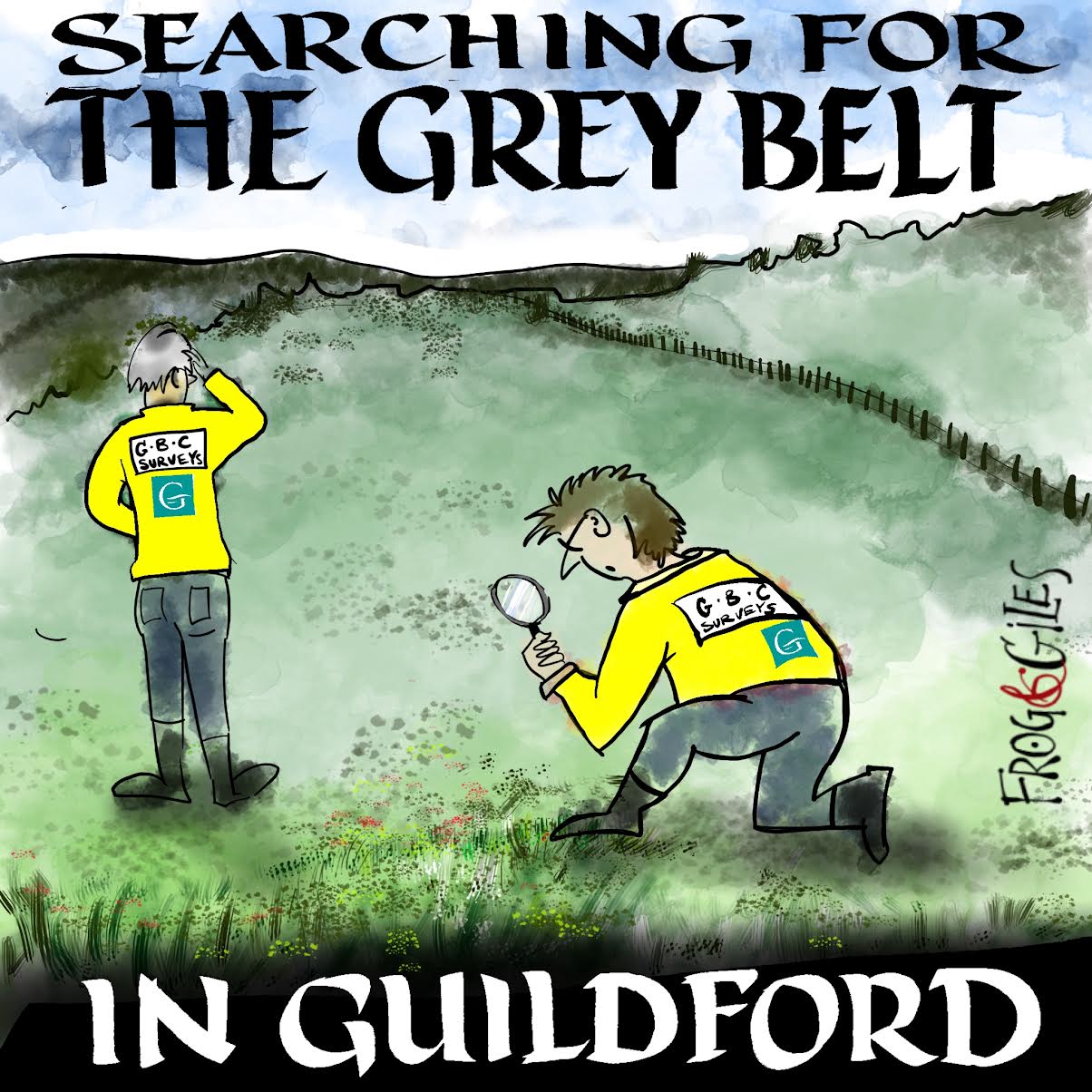

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Latest Evidence in Sara Sharif Trial

- Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Class A in Underwear Leads to Jail Sentence

- Historical Almshouse Charity Celebrates Guildford in Bloom Victory

- Notice: Shalford Renewable Showcase – November 16

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments