Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Conservative Claims on Use of CIL Payments ‘Political Theatre’ Say Lib Dems

Published on: 29 May, 2025

Updated on: 29 May, 2025

Conservative councillors at Waverley Borough Council (WBC) are demanding answers from the council’s Liberal Democrat-led Executive over the use of the estimated £2.9 million of interest income generated from unspent Community Infrastructure Levy (CIL) and Section 106 (s106)

funds over the past five years.

CIL payments have become a contentious issue in Waverley, where some residents are facing demands for payment of tens or even hundreds of thousands of pounds because they were unaware of the need to complete the paperwork needed to claim an exemption.

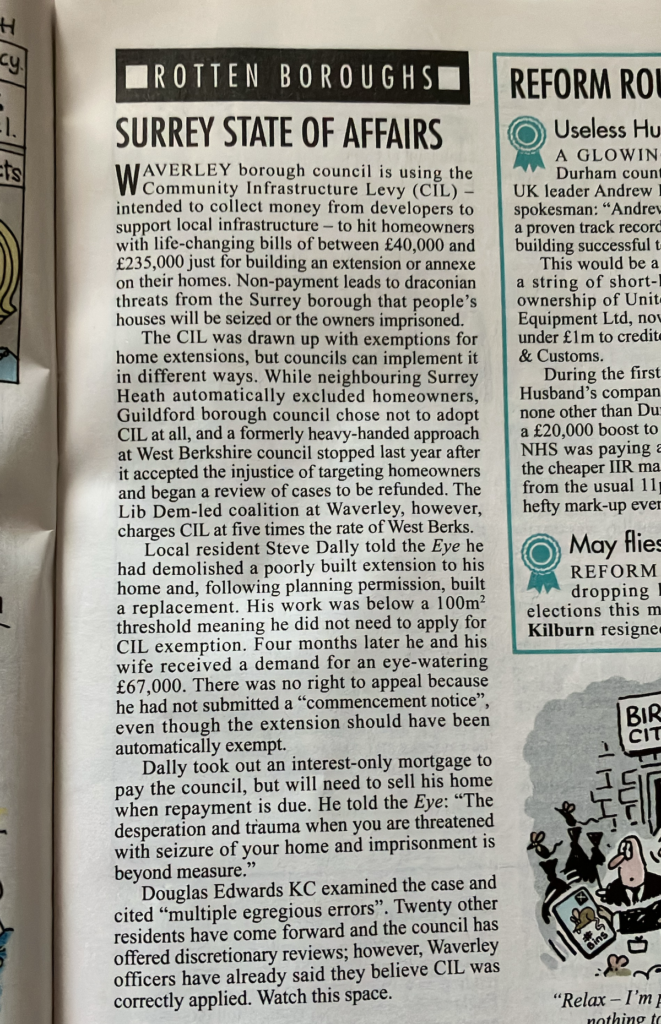

So far, over 20 homeowners across the borough have reported being aggressively pursued for high CIL levies, which they say should not have been charged, causing significant emotional and financial strain. The issue has been included as the lead story in this week’s Private Eye “Rotten Boroughs” column.

Sources within WBC have told The Guildford Dragon NEWS that the CIL payments issue was not well handled by some senior council officers, progress has been too slow and a resolution, with due reimbursement to those residents affected, has not been reached as quickly as expected by the WBC Executive. It is anticipated that any reimbursements might still take around two months.

Now Conservative councillors say WBC has confirmed that interest earned on infrastructure funds has been diverted into the council’s General Fund and not reserved for the infrastructure projects those funds were collected to support.

Cllr Jane Austin (Con, Bramley & Wonersh), leader of the opposition at WBC, said: “Interest earned on CIL and s106 funds has quietly become a hidden revenue stream for the council.

“In the year to March 2025, Waverley is projecting a surplus of £428,000 – but this includes over £1.36 million in estimated interest from CIL and s106 money. Without that, the council would be facing a deficit of more than £900,000. That’s a huge black hole.

“Meanwhile, £28 million sits in the council’s bank account, with over £10 million in unallocated CIL funds. Perhaps now we understand why. Residents want this money spent on infrastructure, not left to accumulate interest to support the council’s day-to-day operations.”

But the Lib Dems at WBC emphatically rejected the Conservative claims saying: “This is not fiscal responsibility – it’s political theatre. If the Conservatives truly cared about infrastructure, they would focus on fixing the broken systems they left behind, not peddling myths from the sidelines.”

Responding to the Tory claims as leader of WBC, Paul Follows said: “It is standard practice for Community Infrastructure Levy (CIL) and Section 106 (S106) funds to be allocated to specific infrastructure projects and held by the council until they need to be paid for.

“These projects typically require extensive planning and can take several months or even years to complete. For instance, Surrey County Council currently holds approximately £25 million in unspent S106 contributions from our borough.

“All funds held by the council are managed in accordance with our approved treasury management strategy. This ensures that they generate interest, in line with our statutory responsibility to secure best value for public money. Any interest earned is retained within the council’s General Fund and is reinvested into local services and the enhancement of public amenities.

“I’d like to thank Cllr Austin for helping to highlight the excellent work we’re doing in this area.”

In a separate statement, the Lib Dems criticised the Conservatives for being “misleading” adding that their claim “reveals a serious misunderstanding of the Community Infrastructure Levy (CIL) process and the scale of investment needed after years of their own neglect.

“To be clear: not a single penny of the original CIL or s106 contributions has been diverted. These funds are ring-fenced for major infrastructure – roads, healthcare, schools – projects that often require millions and take years to deliver. Interest earned in the interim is managed responsibly and in line with national guidance, a standard practice across councils.

“The real problem is that infrastructure delivery relies heavily on Surrey County Council and the NHS, both of which have repeatedly failed to submit the costed, deliverable proposals required to unlock funding. Waverley cannot allocate funds to projects that don’t exist.

“The Conservatives’ sudden concern over CIL disputes is disingenuous – they created this system. We are addressing legacy issues transparently and within the law.”

Responses to Conservative Claims on Use of CIL Payments ‘Political Theatre’ Say Lib Dems

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Guildford Plans Three-Day Celebration In a Festival of History And Culture

- Local Therapy Garden Supporting Mental Health Shortlisted for BBC Award

- Thousands of Year Six Pupils at Guildford Cathedral for a Special Send Off

- New Surrey Research to Find Solutions to Local Challenges

- Comment: What Are We To Make of the GBC Executive ‘Reshuffle’?

- Bensons for Beds Opens New Store on Guildford High Street

- ‘Politics Is Not Always a Kind Place’ Says Dismissed Lead Councillor

- Local MPs Vote in Favour of Assisted Dying

- Merger Between Reigate & Banstead and Crawley Councils Ruled Out

- Letter: It’s Almost Like We Have Been Abandoned By the Council

Recent Comments

- John Redpath on ‘Politics Is Not Always a Kind Place’ Says Dismissed Lead Councillor

- Jules Cranwell on ‘Politics Is Not Always a Kind Place’ Says Dismissed Lead Councillor

- Ben Paton on ‘Politics Is Not Always a Kind Place’ Says Dismissed Lead Councillor

- Angela Gunning on ‘Politics Is Not Always a Kind Place’ Says Dismissed Lead Councillor

- Nigel Keane on A281 At Shalford Has Now Reopened Following Repairs to Damaged Roof

- N Hatcher on New Electric Trains Now Arriving at Guildford – 100 Years After the First One Did

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Lauren Atkins

May 29, 2025 at 1:42 pm

Under the Community Infrastructure Levy Regulations 2010, local authorities are responsible for collecting and spending CIL in accordance with the purposes for which it was levied namely, funding infrastructure to support development in the area.

In addition to the principal amounts collected, CIL funds held over time may accrue interest through treasury management processes. The treatment of this interest is not explicitly detailed in the CIL Regulations, but CIPFA guidance provides clear expectations on how such interest should be applied.

CIPFA Guidance states the following principle: “Where interest is earned on monies received from planning obligations, this interest should be applied for the purpose for which the obligation is entered into.”

This principle has been consistently referenced in practitioner guidance relating to Section 106 and CIL accounting practices. It underscores the expectation that interest accrued is not treated as general income, but as part of the infrastructure funding obligation.

Implications for Local Authorities

The above statement establishes a standard that:

• Interest earned on CIL receipts should remain within the CIL fund;

• Such interest should be used only for the delivery of infrastructure, consistent with the principal CIL receipts;

• The diversion of CIL interest to the General Fund would be contrary to this guidance and could undermine transparency and public trust.

Examples of Good Practice

Some councils explicitly comply with this CIPFA principle:

• Babergh and Mid Suffolk District Councils state: “All interest accrued on CIL monies will be paid into the Strategic Infrastructure Fund pot.”

• Chichester District Council states in its s106 and CIL Protocol: “The interest will be ring-fenced for use with the associated s106 contribution and for infrastructure in general with respect to CIL.”

On 28 January 2025, the Waverley Full Council passed a motion resolving that householders previously subject to CIL liability should be able to request a discretionary review “in line with West Berkshire,” with a review period commencing 1 June 2025 to 31 May 2026. This resolution was passed by a democratic vote of elected representatives. Our [Conservative] group remain 100 per cent committed to ensure that democracy is upheld.

Lauren Atkins is a Conservative Waverley borough councillor for Bramley & Wonersh

Peter Martin

May 29, 2025 at 1:50 pm

It is shameful that more than 20 Waverley residents have been charged a [total of] £1 million for the Community Infrastructure Levy when they should not have been. It is even more shameful that the interest from this and all the other unspent CIL capital is being used to financially prop up a failing Waverley administration.

Peter Martin is a Conservative Waverley borough councillor for Holloway