Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Council Assures Help For Tenants, The Homeless And Businesses

Published on: 22 Mar, 2020

Updated on: 25 Mar, 2020

Guildford Borough Council has announced it will “fully help and support residents through this difficult time”.

And adds: “We are fully aware some people have been directly affected by the Coronavirus (COVID-19) and have lost income as a result. If you have lost your job or had your hours reduced, you might be entitled to help from the government.”

And adds: “We are fully aware some people have been directly affected by the Coronavirus (COVID-19) and have lost income as a result. If you have lost your job or had your hours reduced, you might be entitled to help from the government.”

In a statement, Cllr Angela Goodwin, lead councillor for housing, homelessness, access and disability said: “We know many of you are worried how this challenging time will affect your income and even if you will be able to pay your rent.

“We have help and support in place for council housing tenants and can also advise on support for those in private rented accommodation. We also continue to work closely with partners to support people who are homeless or rough sleeping in our borough.”

The council also notes that additional income-related benefits that have been made available for those who are self-isolating or ill as a result of COVID-19 can also apply for Statutory Sick Pay (SSP) or Employment Support Allowance (ESA). Further advice regarding this can be found on www.gov.uk.

If you have lost your job, you will need to make a claim for either: Universal Credit (if unemployed and/or need assistance with your Housing Costs) www.gov.uk/apply-universal-credit. Statutory Sick pay (if signed off work and your employer does not pay sick pay). Employment Support Allowance (if you are suffering from a long-term illness).

If you do not have online access, phone 0800 328 5644 for any new claims. If you have an existing Universal Credit claim, then you will need to update your journal.

If you are a Guildford Borough Council housing tenant, contact 01483 505050 and ask to speak your rents officer. If you state the area you live, an officer will be able to give you support and advice on your specific situation. You can also email to: rent@guildford.gov.uk

For its council housing tenants, GBC will be suspending evictions until further notice and suspending court action until further notice.

For help with council tax residents need to complete a separate application which can be completed online at www.guildford.gov.uk/localcounciltaxsupport

If you are currently of pension age then the application process is via Guildford Borough Council at www.guildford.gov.uk/benefits

The council is continuing to work closely with partners to support people who are homeless or rough sleeping in the borough of Guildford.

The council is encouraging people to report any concerns they may have about rough sleepers. Contact the HOST team directly on 01483 302495. Website: GuildfordHost@riverside.org.uk

Report via Streetlink, the national rough sleeper reporting line: www.streetlink.org.uk (you can also download an app) or phone 0300 500 0914.

If the person needs urgent medical attention please dial 999 for an ambulance.

GBC will continue to offer emergency assistance and advice to anyone rough sleeping in Guildford. Homelessness assessments will generally be undertaken by telephone.

For details visit the council’s housing page www.guildford.gov.uk/housing or phone 01483 444244.

For genuine emergency homelessness outside of office hours, phone 01483 505050, when further information will be given about contacting the council’s out-of-hours service supplier.

Regarding help for businesses, GBC has said: “The government has announced a range of help for businesses to be delivered by us as a council to help support businesses affected by the Coronavirus (COVID-19).”

Cllr Joss Bigmore, lead councillor for finance and assets and customer services said: “We recognise that this unprecedented situation has a major impact on the many local businesses who make up our thriving local economy.

“We need to pull together as a community, now more than ever and will do all we can to support you through these tough times.

“A range of business support is available including a business rate holiday, rate discounts for retail, leisure and hospitality and grants for businesses.

“We also have advice on our website for food businesses who would like to offer takeaway or delivery options during this exceptional time and we will continue to share advice and updates on all of our services on our social media accounts, using the hashtag #isupportguildford.”

The council has announced:

Applications for rate discount (holiday). Where it can, the council will apply any rate discount (holiday) to your account without application.

The council says it may not be able to issue revised bills or state aid letters immediately. Instead it says it will publish a list of property references on its website.

Businesses can its find property reference on its rate demand – on the right, third line down. This will enable the council to get the information to businesses quickly, while protecting data.

The council’s advice is if a business is already in receipt of retail discount – do not cancel your direct debit as this creates additional work for council staff.

The council says it expects to recalculate bills during the coming week (starting Monday, March 23), and will not claim the April direct debit.

With regard to rate discounts for businesses in the retail, leisure and hospitality sector, the retail discount definition has been expanded.

The rateable value limit of £51,000 has been removed, however, state aid still applies.

The council states, properties must be occupied and wholly or mainly used. a. As shops, restaurants, cafes, drinking establishments, cinemas or live music venues. b. For assembly and leisure. c. As hotels, guest houses and boarding premises and self-catering accommodation.

More details can be found in the government guidance at https://www.gov.uk/government/publications/business-rates-retail-discount-guidance.

The council says discount will end either when the occupation of the property changes or March 31, 2021, whichever is first.

If a business qualifies for a retail discount and has already made a payment, email BRates@guildford.gov.uk, putting REFUND and the payer reference and property reference in the subject line. Provide the council with bank details (name, sort code, account) so that it can arrange a refund.

The pub discount has increased from £1,000 to £5,000. The council states it is waiting for further government guidance, but is expected to increase relief for all current recipients as the same criteria apply, this coming week.

For rate holiday for non local authority childcare providers, the council says: “We currently have no information on this. Once we have guidance we will try to amend all the accounts that we think meet the criteria.”

Regarding grants for ratepayers, the council has said: “We understand that the following grants will be available, however we are awaiting guidance and expect to receive it during the week of March 23. We expect to pay grants in April once we have received the funding for distribution.”

The council adds that the indication is that the following grants will be available:

£10,000 grants for ratepayers in receipt of Small Business Rate Relief and Rural Rate Relief, where the rateable value is £15,000 or less and the property is not used for personal use.

If you think you may qualify you can email BRates@guildford.gov.uk, putting SBR GRANT and your payer reference and property reference in the subject line.

The council adds: “Provide us with your bank details (name, sort code, account). As we do not have the final guidance we cannot guarantee a payment, and we may not respond until April, but this will help us prepare.”

Payments from a Retail, Hospitality and Leisure Business Grants Fund for those who qualified for the Retail Discount on March 11, 2020. The council says grants will be £10,000 where the rateable value is £15,000 or less, grants of £25,000 where the rateable value is £15,001 to less than £51,000.

If you think you may qualify email BRates@guildford.gov.uk, putting GRANTS FUND and your payer reference and property reference in the subject line. Provide ther council with your bank details (name, sort code, account). As it does not have the council says it cannot guarantee a payment, and may not respond until April, but this will help it prepare.

Finally, the council states: “We will deal with other difficulties experienced by ratepayers on a case-by-case basis as the impact is not uniform.

For advice email BRates@guildford.gov.uk, putting DIFFICULTIES and your payer reference in the subject line. The council reminds people: “Please explain your specific difficulties, and we will get back to you as soon as possible.”

Responses to Council Assures Help For Tenants, The Homeless And Businesses

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

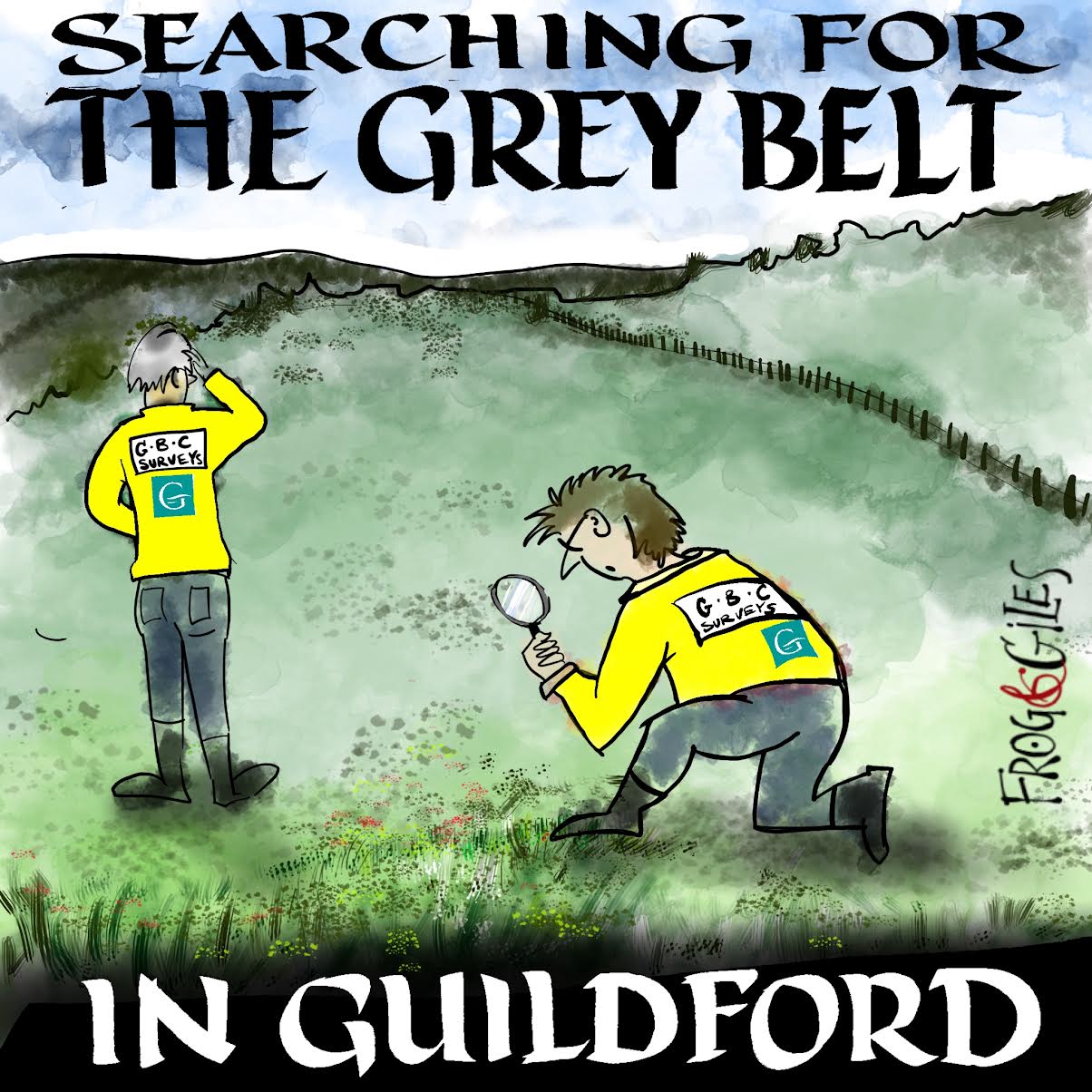

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Latest Evidence in Sara Sharif Trial

- Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Class A in Underwear Leads to Jail Sentence

- Historical Almshouse Charity Celebrates Guildford in Bloom Victory

- Notice: Shalford Renewable Showcase – November 16

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

Recent Comments

- Paul Spooner on Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Harry Eve on Opinion: The Future is Congested, the Future is Grey

- Nigel Keane on Letter: New Developments Should Benefit Local People

- Nathan Cassidy on Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- T Saunders on Opinion: The Future is Congested, the Future is Grey

- Jim Allen on Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Jim Allen

March 22, 2020 at 10:53 am

I believe this covers most eventualities.

I would like to thank Cllr Angela Goodwin and her team for their work making sure this has been produced by the council officers before the fact, not after.

Kathleen Parrish

March 22, 2020 at 5:00 pm

The best thing Guildford Borough Council could have done is to clean the communal corridors of their properties. I have been struggling to get them to do this for several years and all I can say is, not only does dirt cause illnesses but ants also love dirt. I have received excuse after excuse.

No way should tenants have to clean communal areas as it does not work as some refuse to clean and some not well enough and all get older and unable to clean up after others. In the midst of this death-causing virus the communal corridor is filthy.