Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford Businesses Reminded to Apply Now For Remaining £6.25 Million Grant Funding

Published on: 4 May, 2020

Updated on: 5 May, 2020

If you own a business in Guildford, you may qualify for a government grant to help you through the financial impact of the coronavirus. The borough council has already paid £15.75 million to 1,154 local businesses, and there is still £6.25 million available.

If you own a business in Guildford, you may qualify for a government grant to help you through the financial impact of the coronavirus. The borough council has already paid £15.75 million to 1,154 local businesses, and there is still £6.25 million available.

Small Business Minister Paul Scully said: “Small business owners up and down the country are facing challenges on a scale never seen before and the financial support package we have put in place reflects that.

See also: How Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

“I urge any business that believes it is eligible, but has yet to be contacted by their local authority, to make themselves known to them through the council’s website.”

Joss Bigmore (R4GV, Christchurch), GBC lead for Finance and Assets, Customer Services, said: “We are trying all avenues to contact local businesses to make sure they don’t miss out on the help they are entitled to. Our officers are visiting premises as well as contacting businesses by phone and email.

“We thank everyone who has waited patiently for us to process their request and to apologise for any delays. Government guidance has evolved since the grants were first announced and we have received an exceptional number of enquiries in recent weeks.

“ To qualify for a grant your business must be the ratepayer of the property concerned and be eligible for either the expanded retail discount or a small business rate relief reduction on March 11. The rateable value of the property must be less than £51,000, the property must not be used for personal use or car parking, and your business must not have been insolvent on March 11.

To be eligible for the expanded retail discount the premises should be occupied and wholly or mainly being used: a. As shops, restaurants, cafes, drinking establishments, cinemas and live music venues; b. For assembly and leisure; or c. As hotels, guest and boarding premises and self-catering accommodation.

Cllr Bigmore added: “We understand that a lot of businesses are facing extreme financial difficulties, but unfortunately we can provide grants only in accordance with the government’s guidance. We have been discussing examples of where businesses were not eligible for the scheme but were still facing extreme financial difficulties with the Government.

“We were pleased to see a new discretionary fund announced on Saturday. This additional fund is aimed at small businesses with ongoing fixed property-related costs, and under 50 employees that are able to demonstrate they have seen a significant drop in income due to Coronavirus restriction measures.

“The council is still awaiting further information on the discretionary scheme but we understand that we will be able to support businesses in shared spaces, regular market traders, small charity properties that would meet the criteria for Small Business Rates Relief, and bed and breakfasts that pay council tax rather than business rates.

“We also understand that local authorities will be able to make payments to other businesses based on local economic need. Over the coming days, we will assess the further guidance due from government and make a further announcement concerning the discretionary fund.

“If your business does not qualify for grant funding, the Government has also launched a new business loan scheme – you can check your eligibility online on the gov.uk website at www.gov.uk/business-coronavirus-support-finder.”

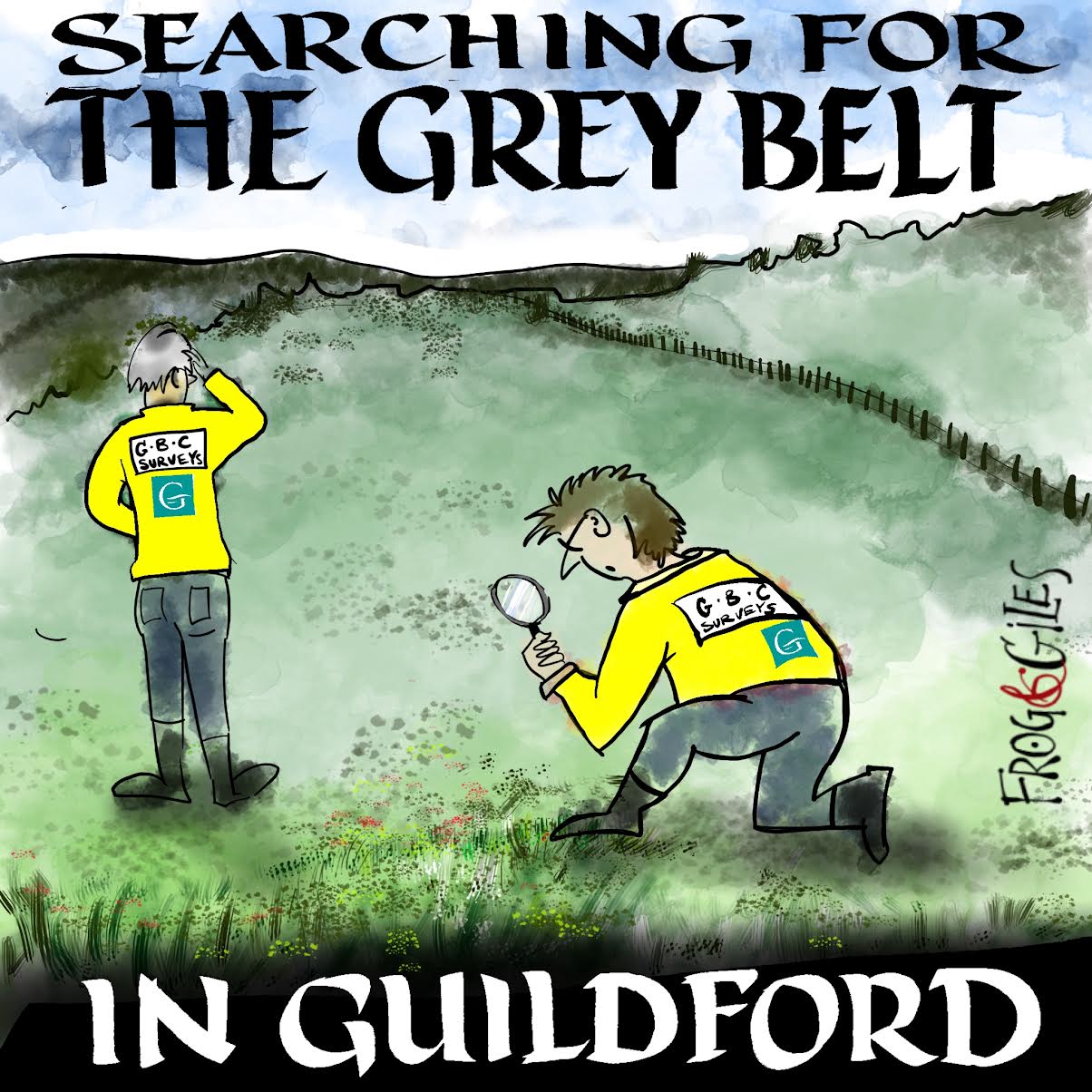

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Latest Evidence in Sara Sharif Trial

- Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Class A in Underwear Leads to Jail Sentence

- Historical Almshouse Charity Celebrates Guildford in Bloom Victory

- Notice: Shalford Renewable Showcase – November 16

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments