Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford Officers Find £10m Accounting Error

Published on: 13 Jul, 2023

Updated on: 16 Jul, 2023

local democracy reporter

Guildford’s financial worries have been laid bare as officers outline the steps needed to give the council a “fighting chance” of staying afloat.

The rising cost of projects including the Ash Road Bridge and the Weyside Urban Village, as well as a £10.2 million accounting error linked to a covid grant, have contributed to the council’s officers warning the authority may end up on the same path as neighbouring Woking which effectively declared bankruptcy.

Councillors will look at a new budget for the current year over the coming weeks as the council seeks to address its £300m of borrowing and an £18.3 million projected deficit over three years.

Officers said they were “gravely concerned” about the council’s financial position over the next two to four years.

Reports show that a balanced budget, which councils are required to produce each year, can be achieved in 2023/24 and possibly in the next financial year, with the use of the council’s reserves to bridge the shortfall and the sale of council-owned assets.

Officers said: “There is only a possible two-year window to work on the implementation of strategic recovery plans.

“However, in the added context of historical and continuing funding reductions from government, time is not a luxury the council has.”

A revised budget for 2023/24 will be brought to a meeting of the corporate governance and standards committee on Tuesday (July 18) before being discussed by the council’s executive on Thursday (July 20) and at full council on July 25.

Officers said it was not necessary to issue a section 114 notice, effectively stopping all non-essential spending, but that the possibility of doing so, and following in the footsteps of Woking, could still be brought to a full council meeting in October.

The 11 districts and borough councils across Surrey, and the county council, have a total debt of £5.5 billion, of which £1.9 billion is to be found in Woking.

The officer report said: “It may be argued that many councils will be in a comparable situation in the coming years; however, it is the view of the S151 officer and the corporate management board that Guildford Borough Council’s position is at a higher and more urgent level of risk than most councils of a comparable size and scale.”

Officers said this was because of various factors including increasing demand for services, the state of the UK economy over the last year (with high inflation and rising interest rates), and reductions in government funding over many years.

In Guildford, the challenge is “greater and more urgent than most councils” because along with these factors there was also “a legacy of ambitious decisions to support infrastructure and regeneration” leading to the £300 million debt, expected to rise further.

Where did the problems come from?

Officers set out that a £10.2 million accounting error had been discovered at the council, where a Covid-related grant which was due to be repaid to the government had been incorrectly included in earmarked reserves.

Along with other issues, this led to a net £16 million reduction from the reported £32 million available to support the council’s medium-term financial plan deficit, and reduced the council’s capacity to respond to the financial pressures, the report said.

Along with this, the interim section 151 officer at the council, responsible for the council’s finances, identified a £1.9m payroll error in the 2022-23 budget.

Projects like the Ash Road Bridge, with a cost that has now risen to £44.5 million, and the Weyside Urban Village, with a projected deficit of £50m have both “experienced significant scope creep and cost pressures over years” which means the debt on them will be “considerably higher” than first thought.

While the council’s “Future Guildford” programme, which was supposed to reduce costs at the council by cutting staff, has led to small teams and a lack of clarity on roles, meaning “significant workarounds, silo management and disruption to productivity which has driven up costs”.

In the finance team, some staff were moved over to other teams, and vacant roles not filled, meaning other departments were using IT systems via self-service, including for finance work.

The report said: “Budgets were rolled forward based upon the new operating model costed by the project team without reference to the finance team.

“Core technical financial controls such as bank and income-related reconciliations are being performed by non-accountants without specialist finance oversight in the new model.”

What can the council do now?

A dedicated financial task force will be put in place at the authority, with plans for more interim staff estimated to cost around £2 million, which officers said needed to be seen in the context of reducing debt at the council and in the hope of avoiding a section 114.

The report said: “This ‘invest to save’ funding is required to enable the council to realise the targets for balancing the budget over the three-year period.”

Measures brought in immediately will include no new spending without explicit approval, temporary measures to stop all non-essential spending and no hiring staff or renewing of contracts without approval from the council’s corporate management board.

Officers said in the report: “The budget situation will require a meaningful change programme to be rolled out.

“It is imperative commitment and priority is given to setting and achieving net cost reductions at pace.

“This is to give the council a fighting chance to remain solvent in the coming years.”

While councils may use their reserves, effectively their savings, to balance their budgets, the budget brought to councillors in February this year predicted a £32 million reserves pot for March 2024, which is now projected to be £8.5 million, as long as there is no deficit in 2023-24 and no added cost pressures.

The council also said its collaboration project with Waverley Borough Council, where staff sharing has been brought in, has already saved more than £800,000 across the partnership in the costs of senior management.

What are the risks?

The predicted £18.3 million deficit over a three-year period is equivalent to 145 per cent of the council’s net budget.

Officers said being able to deliver the savings to address the deficit was a “significant risk”.

They said: “This will fundamentally change the services the council delivers and will require political will and a step change in activity to reconfigure services accordingly.”

While the report also outlined the biggest risks to the revenue budget, or the money the council spends on day-to-day costs, were the performance of its commercial investment estate and parking income.

As well as this, the council, like many others, still has accounts waiting to be signed off by auditors.

The report shows that the 2020-21 accounts have not yet been signed off, or those afterwards, meaning three sets of annual accounts are open, which officers said was a “risk to the council’s awareness of its financial baseline.”

Responses to Guildford Officers Find £10m Accounting Error

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

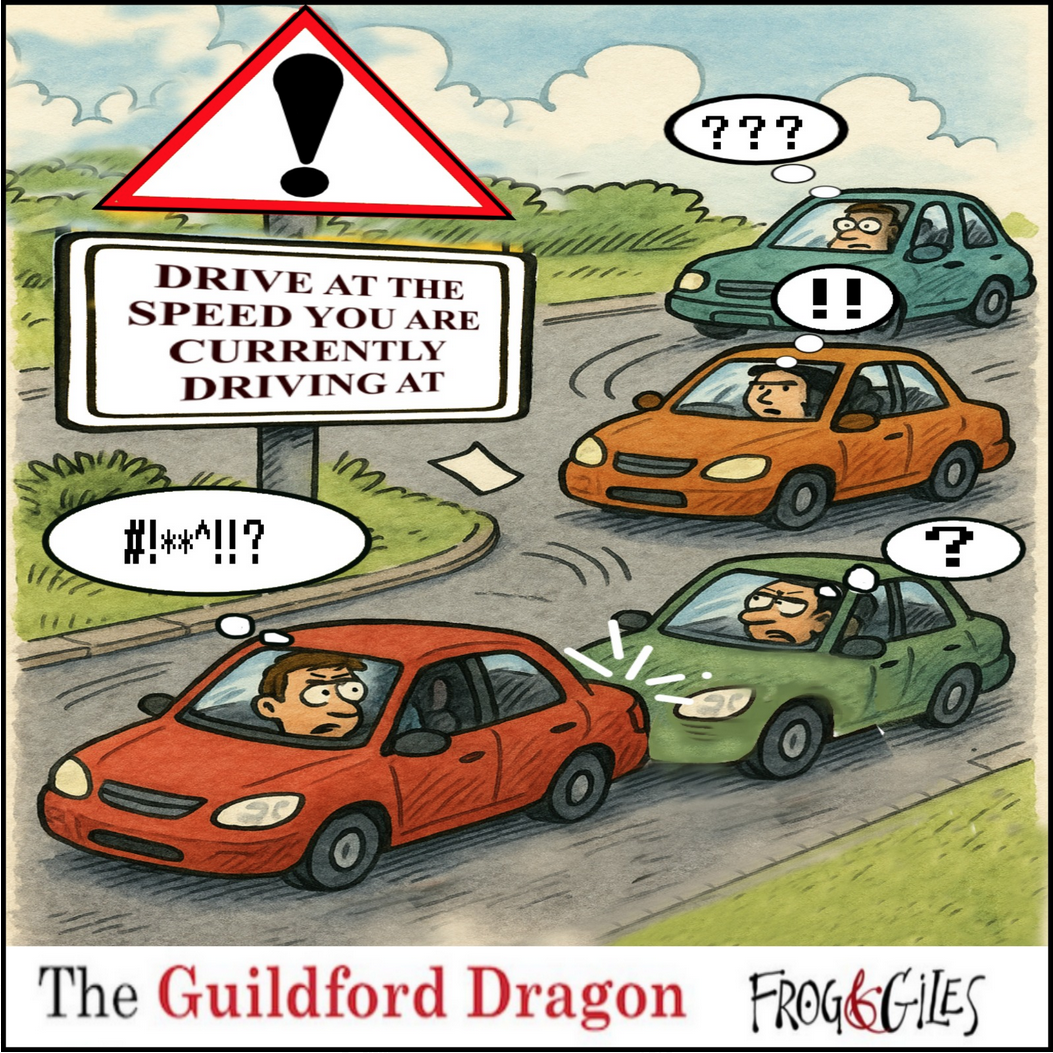

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Crop Fire Destroys Wheat Field on the Slopes of the Hog’s Back Near Guildford

- Thames Water Announce Hosepipe Ban – But Not for Guildford

- Letter: Normandy Proposal Needs A Proper Services Audit

- Notice: Free Bereavement Support Programme

- Normandy Housing Plan Reignites Concerns Over ‘Damage To Our Community’

- Letter: The Class of 1955 Meets 70 Years On.

- Highways Bulletin: Reimagining Parking with Green Design

- Opinion: Never Have We Needed the Benefits of the Natural World More

- SCC Calls on the Government To Protect the Environment

- Two-Week Road Closure on Portsmouth Road for Gas Network Upgrade

Recent Comments

- Richard Cooke on Letter: Snail-paced Progress for Full Weir Repair

- Bethan Moore on Guildford’s First “Bike Bus”

- Andy Friend-Smith on Guildford’s First “Bike Bus”

- Peter Mills on Guildford’s First “Bike Bus”

- Des Flanders on Making History As Pewley School’s Class of ’54 Hold Their Final Reunion

- Margaret Rotherham on Guildford Festival Burst with Colour, Culture and Community Spirit

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Jim Allen

July 13, 2023 at 11:54 pm

Time a competent accountancy team are found!

Serious acceptance that some projects forced on the new council by past councils 2 elections previous are cancelled before a pide comitment trebbles the debt!

Time for hard decisions !

Good money after bad is never a good idea!

Selina Hatcher

July 14, 2023 at 11:27 am

Can’t they sell off Bright Hill and Guildford Park Avenue site to generate some capital? Bright Hill hasbeen blocked off for months.

Jeremy Holt

July 14, 2023 at 5:29 pm

This is an extraordinary article.

Who was the “section 151 officer”?

Would this be the same person who was responsible for the accounting errors?

The extracts from the report seem to suggest that all the problems had nothing to do with the officers and we should admire their diligence in highlighting the problems in the report.

It must be difficult for the councillors not to be able to rely on information from the officers who seem to accept no responsibility for the problems.

Jeremy Holt

July 15, 2023 at 5:02 pm

Guildford Park Avenue is not owned by GBC.

I think Selina must be referring to Guildford Park Road car park.