Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Landlords of Student Lets Should Pay Council Tax

Published on: 3 Apr, 2013

Updated on: 3 Apr, 2013

Hon Alderman

Some people pay more council tax than others, but some pay no council tax at all.

Strange but true. It was as long ago as 2010 that there were 1300 properties which do not pay council tax or any kind of business tax at all.

These are homes in which it is claimed are let to students.

One might ask what constitutes a student?

I am not certain of a definitive answer to that question but I understand that they are not all at Surrey University.

Recently it was announced that homes left empty for only one month would be liable to pay council tax. This is perhaps a little hard on any person that has just bought a property which they need to refurbish.

Anyhow, the estimate is that this will cover about 460 such properties and raise some £677,000 in revenue for the Borough.

If the same measure was to be used on the 2010 figure of homes let to students this could raise some £2,700,000.

Students these days are under tremendous financial pressure and it would be unfair to load a council tax liability on to them now. However there are many landlords who regard this market almost like a business proposition and as such should they not pay a business tax?

The coalition government thinks not!

So ,it seems, all home owners are equal but some home owners are more equal that others.

Responses to Letter: Landlords of Student Lets Should Pay Council Tax

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

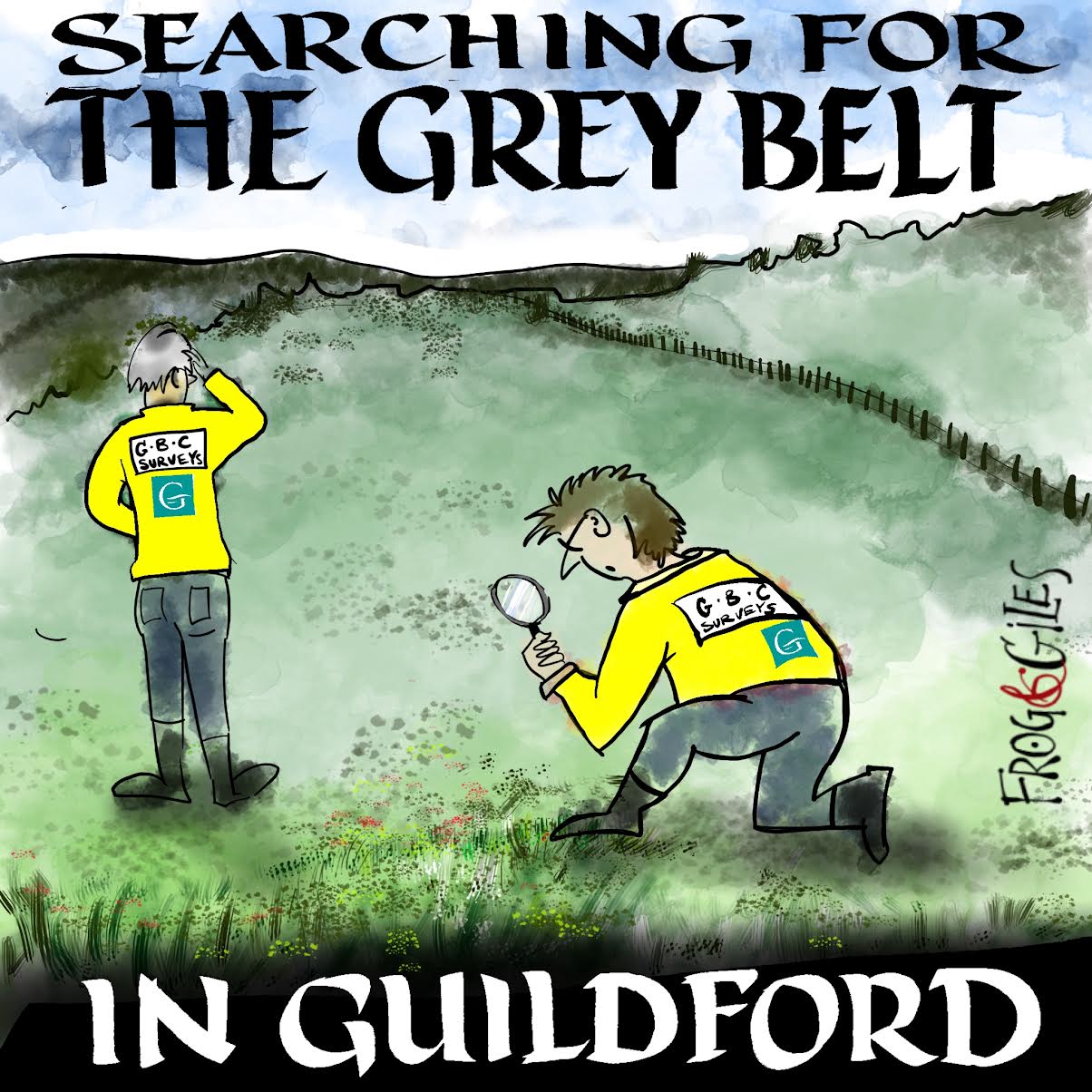

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

Recent Articles

- Highways Bulletin for November 25

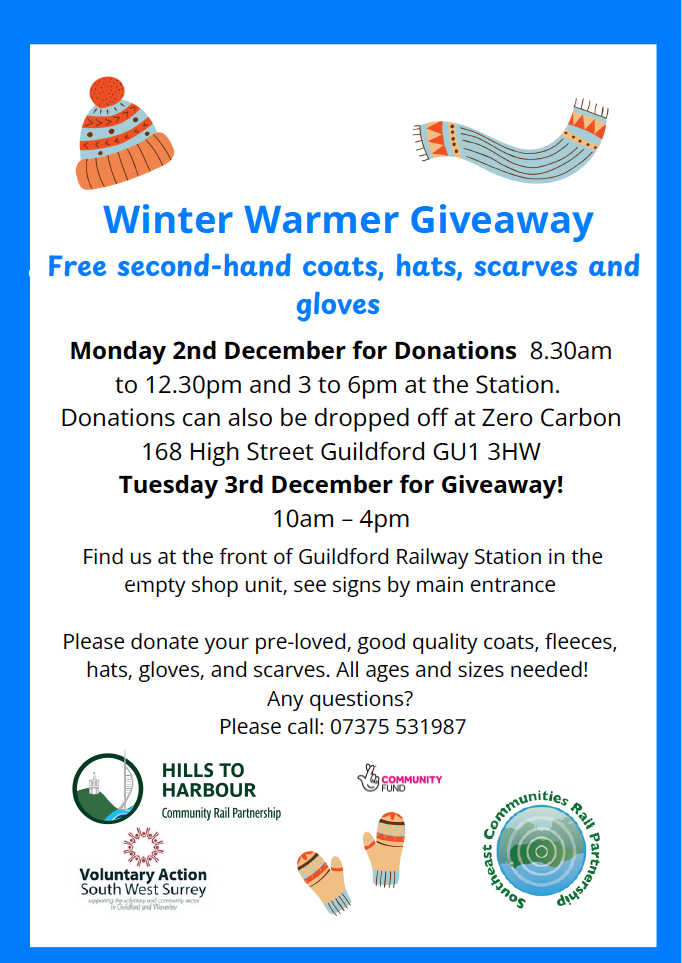

- Notice: Winter Warmer Giveaway

- Further Technical Fault

- Student Named Land Based and Horticulture Learner of the Year

- Artventure Studio Celebrates its 40th Anniversary

- Ash Level Crossing Will Close Before Opening of New Road Bridge

- Sara Sharif Trial Latest – ‘Fear and Violence Reigned’ in Sara’s Home

- Fire at Ash Manor School Tennis Centre Was ‘Accidental’

- Witness Appeal Following Collision on A3 Esher Bypass

- Parish Council and CPRE Pleased with MP’s Support for Call In of Solar Farm Decision

Recent Comments

- Roshan Bailey on Student Named Land Based and Horticulture Learner of the Year

- Frank Emery on Ash Level Crossing Will Close Before Opening of New Road Bridge

- Paul Robinson on Letter: The Active Travel Proposal Is the Safest Option for London Road

- Mike Smith on Photo Feature: Freiburg, Guildford’s Twin – Friends for 45 Years

- Derek Payne on SCC Cabinet’s Decision to Scrap London Road Scheme ‘Called-in’ by Select Committee

- John Perkins on Letter: LRAG Has Morphed from a Cross-community Group into a Pressure Group

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

C Stevens

April 5, 2013 at 12:50 pm

As well as the University there are the College of Law, the Guildford School of Acting, the Academy of Contemporary Music and Guildford College in Stoke Road. So, it would follow, there are, all in all, many students.

Council Tax is the responsibility of the occupier, save for those with an exemption, as is the case with students.

But why should there be an exemption? Some of the student houses are occupied by five or six people making a cost for each individual of £250 to £300 per year or £5 or £6 per week for a Band D house. That’s about the cost of a takeaway pizza.

And bear in mind that a house occupied by five or six adults creates a huge amount of rubbish, but the occupiers make no contribution to the cost of clearing it up.

So let’s not be too sympathetic because, frankly, we can’t afford to be!

Bernard Parke

April 5, 2013 at 4:44 pm

Perhaps we should also mention that many of these houses are known as “affordable Houses” for which there is a great demand by young would-be home owners.

If the government does not change this policy what is to stop the proposed new affordable houses being bought up by these entrepreneurs and, in doing so, taking them out of the reach of young families?

Alan Sutherland

April 7, 2013 at 1:24 pm

As spring follows winter, so to every year shall Bernard Parke once again complain about the student council tax exemption.

‘I am not certain of a definitive answer to that question but I understand that they are not all at Surrey University’

This might help http://bit.ly/17kGYrG

Secondly, as is pointed out every year, the council do not lose out on the council tax, they are reimbursed by central government, in the same way the BBC are reimbursed for the free TV license older citizens like Bernard enjoy in their nice warm houses funded with the winter fuel allowance.

Bernard Parke

April 7, 2013 at 9:51 pm

Alan Sutherland makes an interesting contribution to this subject.

No one is suggesting that students are all from the University of Surrey or that they should pay council tax. Students these days have tremendous pressures both financial and otherwise.

However, perhaps it would be fair also to state that to attend any form of advanced education would have been just a dream to their grandparents.

The fact is Council Tax is unjust. The financial band is too narrow whilst the other part of local government funding is on wider financial base. If some sections are to be financed in this way why not all of local government and do away with local taxation all together?

As for pensioners with their heating allowances and free television licences, everyone knows how this sector has to struggle to make ends meet. The ever increasing burden of council tax does not help them.

What these younger members of our society fail to realise that one day they will be in such a position of failing health and increasing taxes.

C Stevens

April 8, 2013 at 4:59 pm

Alan Sutherland makes a good point about central government re-imbursing councils for any loss due to the student exemption from Council Tax.

But since the money central government has to spend comes ultimately from the same source as the money local government has to spend, that is the tax-paying population, that population must be worse off than if the student exemption didn’t exist.

And I can’t think of any reason it should be.