Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: It’s Time To Abolish Council Tax For Ever

Published on: 29 Dec, 2015

Updated on: 29 Dec, 2015

From Alderman Bernard Parke

Council tax has been increased throughout the UK by almost 60% since 1996, according to a recent report by the Taxpayers’ Alliance.

I need not reiterate the fact that this is a regressive tax which effects those residents living in the so-called affordable housing sector, pensioners on fixed incomes, and low-wage earners.

I need not reiterate the fact that this is a regressive tax which effects those residents living in the so-called affordable housing sector, pensioners on fixed incomes, and low-wage earners.

Here in Guildford we are now advised that the number of landlords who let to students has risen to the staggering figure of nearly 1,500.

This is a trend which will increase every year.

Such lets, although placing a considerable burden on borough services, do not contribute to this cost as council tax is not levied on this sector.

Many such landlord enterprises could be described as commercial ventures.

Our local authority informs us that any loss of revenue is made up by the government. But when I have asked the council if this makes up the shortfall of revenue I have been told it is not possible for it to collate.

The situation has now worsened as the chancellor will allow local authorities to increase this tax by as much as a further 4% in 2016.

This levy is placed on a shrinking financial base. It would make more sense if local government was funded entirely by the broader government rate support grant, and so abolish this ill-conceived tax for ever.

Local authorities must appreciate that taxpayers cannot sustain these year-on-year rises.

No doubt a solution to this could be achieved by bringing down their spending patterns, by cutting back on costly schemes, selling off assets, and even using their cash reserves, but not by raising council tax yet again.

Is it too much to ask our elected representative to consider this and act accordingly?

I doubt it if they would consider this as solution, but we all live in hope.

Responses to Letter: It’s Time To Abolish Council Tax For Ever

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

Recent Articles

- Letter: All Three Major National Parties Are Relaxed About Green Belt Giveaways

- Updated: Ash Level Crossing Decision ‘Was Made Without Approval of Surrey Highways’

- Sara Sharif Trial Latest – ‘Fear and Violence Reigned’ in Sara’s Home

- Dragon Interview: Julia McShane leader of GBC’s Lib Dems

- Letter: Ash Bridge – We Need Accountability and Competence

- Letter: SCC’s Final Decision is Unlikely to Put an End to the Issue of the London Road Layout

- Only Cabinet Members Will Speak at SCC’s Meeting to Decide on London Road Scheme

- Highways Bulletin for November 25

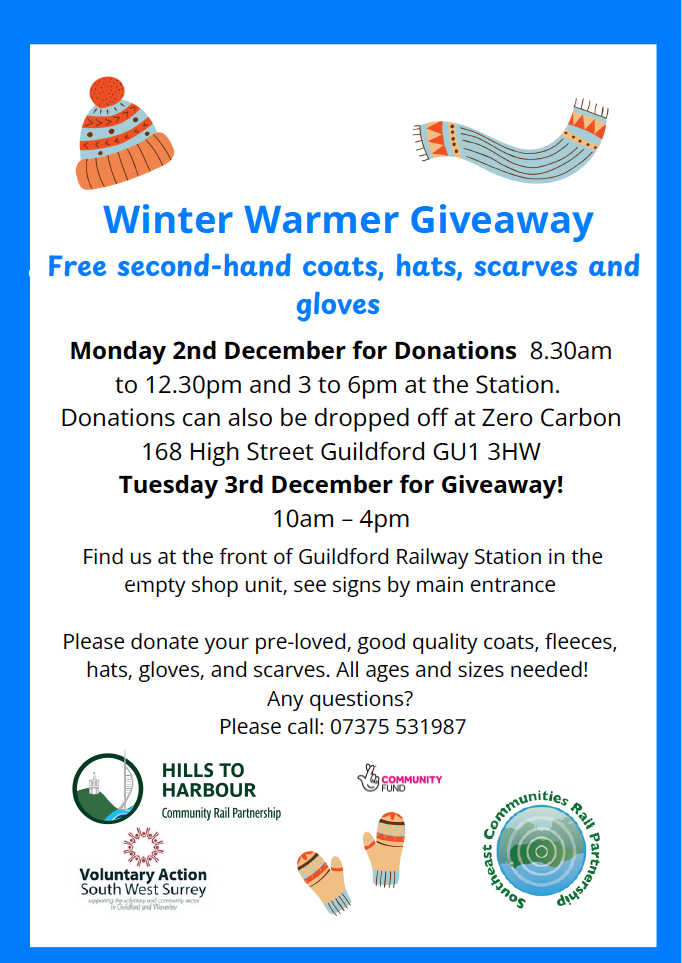

- Notice: Winter Warmer Giveaway

- Further Technical Fault

Recent Comments

- Jane Hughes on Sara Sharif Trial Latest – ‘Fear and Violence Reigned’ in Sara’s Home

- John Ferns on Ash Level Crossing Will Close Before Opening of New Road Bridge

- Olly Azad on Ash Level Crossing Will Close Before Opening of New Road Bridge

- Roshan Bailey on Student Named Land Based and Horticulture Learner of the Year

- Frank Emery on Ash Level Crossing Will Close Before Opening of New Road Bridge

- Paul Robinson on Letter: The Active Travel Proposal Is the Safest Option for London Road

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Stuart Barnes

December 29, 2015 at 9:32 am

I think that I am right in saying that the most significant growing cost is that of pensions to council workers.

The ever-increasing and unfair pension advantage that the public sector workers have over those working in the private sector is a scandal and it is time that something is done about it.

Jim Allen

December 29, 2015 at 9:34 am

Interesting concept. Perhaps local councils could start by becoming a ‘public service’ as opposed to a ‘commercial revenue generator’ – for their own ‘council schemes’.

Surely local councils like central government should take in and spend an equal amount – with a small pot for emergencies – like when the Wey floods.

Not take from the public as much as possible, as did Bracknell Council during the poll tax. And to quote the retiring council treasurer of the time; “We set it so high because we knew no one could refuse to pay.” That ‘high’ was four times the previous rates bill.

I have also failed to understand why if a commercial company can ‘do the job for £100’ the local council a ‘not for profit’ organisation cost £110. Surely, they should be able to do it for £90 – cost, less profit.

The UK’s finances are in a mess through PPFI and the insistence ‘the public person is a bottomless money pot’ (because the law says so).

We cannot keep expanding the money supply tree without it finally falling over due to the weight of debt hanging from it.

We need to re-assess how we treat money in the UK. Less that money is a ‘product’ in itself and more than money is a method of buying a product.

Jeff HIlls

December 29, 2015 at 12:46 pm

Why is it that certain councilors and county councillors in Guildford feel the need to withhold their addresses, do they fear the electorate that much?

Surely, if you hold a public post you should have nothing to hide from your electorate.

Gordon Bridger

December 29, 2015 at 6:37 pm

Come off it Bernard, as far as Guildford Council tax is concerned, its only 9% of the total council tax.

It works out at around £69 per resident, and £180 per household and well under 1% of average Guildford earnings.

The obsession which some have for cutting local Government defies reason. I would happily pay another £10 a year and even £50 more per year to maintain the Electric Theatre, the museum and even an orchestra.

And why this attack on students? They are our future, although of course more should be housed on campus.

If council tax has increased by 60% so what? It now provides a huge range of services social and leisure we could not previously afford.

While we need to avoid waste, I think there is much merit in the Council proving more and better services.

Few people appreciate how little our council costs us and when explained to them that the subsidy for the Electric Theatre is equivalent to them of two cups of coffee per year they wonder what the fuss is all about.

So do I.

David Smith

December 29, 2015 at 6:38 pm

On what authority does Mr Parke have the figure of 1,500?

Also what evidence is there to suggest this trend will increase (I am not disagreeing I am just questioning)?

With the government increasing tax on second properties, will we not see a decrease in investments of this kind?

Factor in a scarcity of stock and exceptionally high house prices into the mix and one will start to question whether these the ingredients make such a letting worthwhile?

Perhaps we should also consider purpose-built student accommodation and how it has increased in recent years in the from of Manor Park, the 141 bedroom scheme just built in Walnut Tree close and new applications such as a nine-bedroom scheme in Hayden Place.

I would have thought that schemes like these will erode the private sector supply. Surrey University has further permission to add even more student accommodation.

But forget about the supply of housing – has anyone noticed how many shops in Guildford are advertising for staff?

I always walk past them and think “what unemployment crisis?” Then I realise that permanent residents of Guildford will not take these jobs – either they cannot afford to live in the borough due to the low salaries the roles offer or they are over skilled.

Who on earth takes these roles then?

It’s our transient student population of course and this keeps our town vibrant. Indeed this is one of many benefits these students bring.

If council tax is a problem then people always have the option of downsizing or renting a room out – there are many elderly (empty nesters) who often occupy houses in the H band who are asset rich and cash poor and are often sitting on valuable assets which if sold could provide for a comfortable retirement.

Sally Parrott

December 29, 2015 at 9:50 pm

I’ve never understood why council tax bands stop at H. If a four-bedroom house in Surrey is band H, could not palaces, castles and multi-million pound homes pay proportionately more, ZZZ perhaps?

For those who can’t afford the sudden increase, this could accrue until the house is sold, when the debt and interest would be repaid.

I think the sums raised should be pooled (as some areas will have few valuable properties) and used to alleviate the heavy burden on the poorest.

Times are very hard for some – perhaps the richest should pay more?

Does everyone agree?

Bernard Parke

December 30, 2015 at 9:03 am

Gordon is right, the Guildford Boroiugh Council [percentage of the] tax is smaller that of the Surrey County Council, but of course does not effect the increase cost of the amount we pay.

No doubt you will remember only last year that their independent allowance review body resigned in protest as the councillors ignored their recommendation and voted for an even higher allowance in a time of austerity.

Students are subject to exploitation by many landlords.

Students are more sinned against than sinning.

The fact is that council tax affects more those of among us who are on the lower income scale.

The figure was actually 1,445.

It was given to me by GBC only last week.

Council tax in past years has been allowed to rise by two per cent on two per cent each year, but this year the government will allow a 4% increase.

As for the investment issue, only yesterday [December 29] the national press reported that wealthy buy-to-let landlords could receive further concessions on second homes.

May I thank all those who have contributed to this letter for this seems to have achieved my object of stimulating public debate.

Alan Hilliar

December 30, 2015 at 10:34 am

Barnard Parke is quite right to criticise the inequities of the present council tax system.

It’s been long established that it penalises older people on modest incomes who continue to live in the family house.

And the solution is local income tax, as the Liberal Democrats have argued for many years.

That would mean that people would pay for their local council services based on what they earn rather than the (quite arbitrary) basis of the size of the house in which they live.

Besides the obvious unfairness of the council tax (which the Conservatives introduced) why should we support the costs of two different methods of collecting tax?

However, I cannot see why Mr Parke should target students as an example of the unfairness of the council tax system.

Students are generally pretty hard up and couldn’t realistically contribute much (if anything) to the cost of local council services. So a local income tax wouldn’t affect them at all.

Besides which I would have thought that fact that we have large numbers of students in the University and local colleges contributes massively to the economic well being of the town.

So yes, of course let’s reform council tax and replace it with a fairer local income tax, but please let’s avoid any suggestion that the challenges we face in terms of local government finance are anything to do with students.

Let’s lay the blame for difficulties in funding local government at the door of the Conservative government, where it belongs, rather than distracting us from the real issue by attempting to blame our students.

Stuart Barnes

January 1, 2016 at 9:19 am

I think we know that the only fair way of paying for public services is something that used to be called the community charge.

Is anyone in favour of bringing that back?!

Dave Middleton

February 20, 2016 at 5:12 pm

As it happens, yes, I am in favour of an individual local council tax or community charge as it was called in its brief existence in the early 1990s. It has always struck me as being a much fairer means of raising local revenue.

At the moment, two adults living in a band C house (approximately £1,400 for 2016/2017 tax year) effectively pay £700 each in council tax. Four adults living in the same property would effectively only pay £350 each.

It’s even worse for a single occupant in such a property as, even after the single occupancy discount, that person is paying £1,050.

How can this be fair?

Philip Jones

February 19, 2016 at 5:54 pm

We have so many different taxes, we have car tax, income tax, council tax, purchase tax, inheritance tax, stamp duty, capital gains tax, etc.

The administration costs of these taxes is exhorbitant.

Take car tax for example, if that were removed, the Government could add say one penny to the cost of a litre of petrol and that would mean no more admin costs, no court cases for those who don’t pay it. No policing costs, no costs for computer programmes.

We could all save time so we don’t have to work out our tax band, the fuel you use the more you pay and overseas drivers would also pay the tax.

Car tax in it’s present form is ridiculous.

The same applies for council tax. We should all just pay more income tax and save all the costs in time and money to administer another outdated tax.

The number of taxes should reduced, and simplified for the benefit of all.

Bernard Parke

February 19, 2016 at 9:38 pm

Many car owners do not pay car tax now and do not contribute to road maintenance whilst other road users do.

Jules Cranwell

February 20, 2016 at 5:28 pm

Mea culpa on the road tax matter, as I run a 1963 Sunbeam, I bought aged 17.

It is exempt from road tax. However, I average 1,000 miles per year, and keep a whole industry in classic car insurance and support going, one of our most important industries and export markets.