Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Property Speculators Inhibits Housing Affordability

Published on: 16 Apr, 2016

Updated on: 16 Apr, 2016

Overseas Buyers are forcing up house prices by a system know as “flipping”.

The system works by gambling on properties before they are built. Homes are bought off-plan by paying ten to fifteen per cent deposits, the remaining cost is not payable until the buildings are completed.

It is possible to make large profits by selling on these investments. An example given in a recent Times article is a £300,000 property secured with a £30,000 deposit. Once the value increases to £400,000 the right to buy is sold and a profit of £100,000 pocketed.

This process is quite common place in large city areas but there is evidence that outlying areas of London can now be effected.

Such a scheme certainly hinders many families achieving their ambitions of owning a home of their own.

Central government should act now to frustrate these buyers who have no intention of taking up residents in the UK.

Responses to Letter: Property Speculators Inhibits Housing Affordability

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

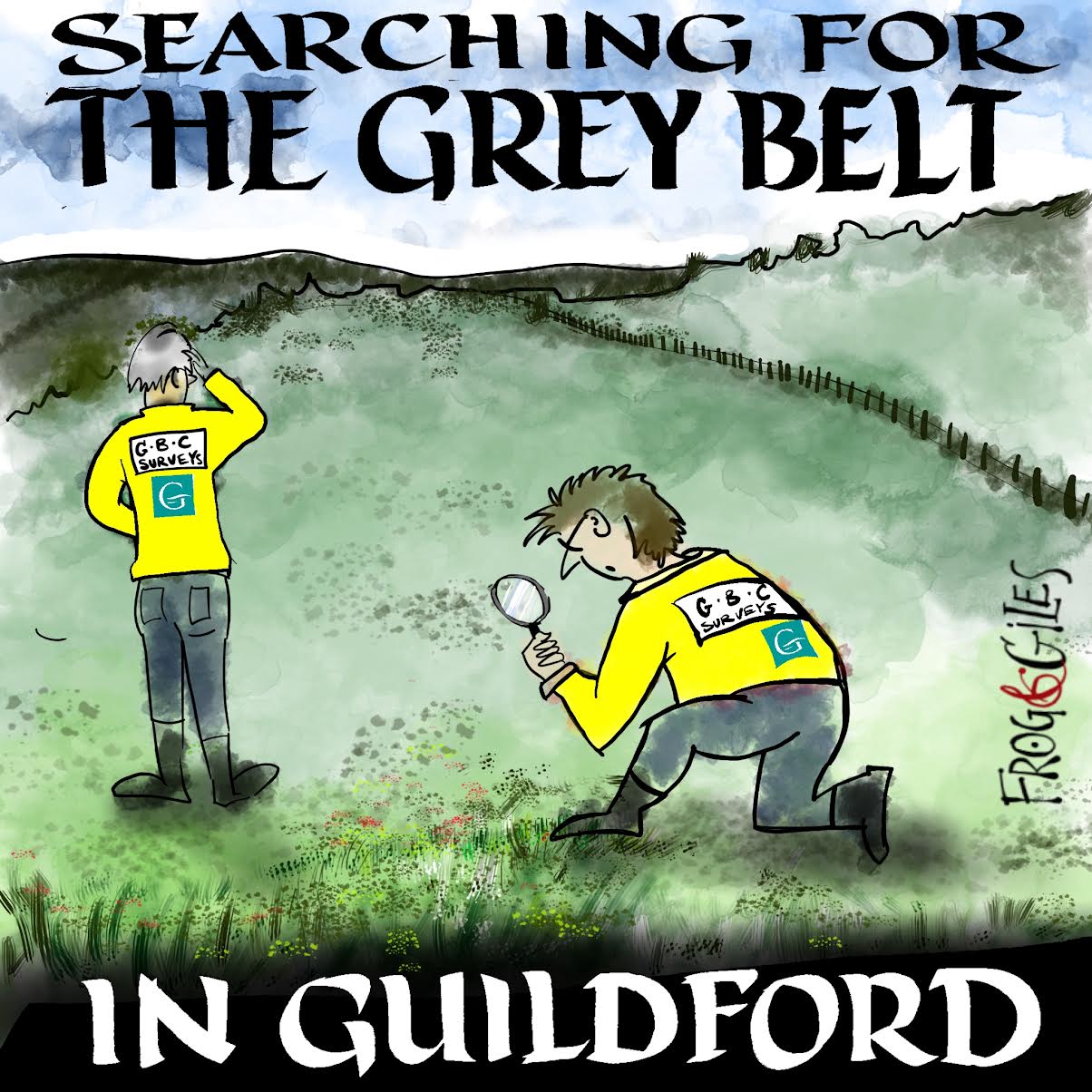

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Latest Evidence in Sara Sharif Trial

- Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Class A in Underwear Leads to Jail Sentence

- Historical Almshouse Charity Celebrates Guildford in Bloom Victory

- Notice: Shalford Renewable Showcase – November 16

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

Recent Comments

- Paul Spooner on Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Harry Eve on Opinion: The Future is Congested, the Future is Grey

- Nigel Keane on Letter: New Developments Should Benefit Local People

- Nathan Cassidy on Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- T Saunders on Opinion: The Future is Congested, the Future is Grey

- Jim Allen on Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Jules Cranwell

April 19, 2016 at 4:32 pm

The government could solve this at a stroke, by:

1. Imposing Capital Gains Tax on profits made by overseas investors from flipping.

2. Imposing a tax on properties owned, but left empty, by overseas investors.

Why don’t they?

I’ve read various reports that up to 80% of properties being bought in London off-plan go to overseas speculators. This now is apparently being exported to Guildford, as opportunities dry up in London.

GBC’s unchanged plan to concrete over the green belt will benefit these speculators most, to the detriment of Guildfordians most in need of housing.

John Perkins

April 20, 2016 at 9:18 am

I agree with Jules Cranwell. I’m not entirely sure how a tax on empty properties would work, but it’s probably worth pursuing.

Another factor is Stamp Duty, which can still be avoided by ‘foreign’ investors. The government says they will pay the surcharge if they “own another property anywhere else in the world”, but they don’t say how that can be established when the beneficial owners are not known. The tax should be mandatory.