Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: A Massive House Building Programme Is Fraught With Danger

Published on: 4 May, 2015

Updated on: 4 May, 2015

From Roland McKinney

In his article “Affordable Housing Is Vital To Maintain Our Prosperity,” Gordon Bridger reiterates his belief that land costs are two thirds of the price of a house.

In his article “Affordable Housing Is Vital To Maintain Our Prosperity,” Gordon Bridger reiterates his belief that land costs are two thirds of the price of a house.

I have no idea where this comes from, but it is incorrect.

Lets take as an example a company that operates in London and the South East, including within this borough, Berkeley Homes, and use their 2014 accounts to illustrate how incorrect his belief is.

According to these accounts, in 2014, they sold 3,742 dwellings, at an average price per dwelling of £423,000. Read the accounts and you fill find that the average plot cost at April 2014 was £72,000, up from £62,000 in 2013. So the plot cost averaged 17% of the average selling price. Less than one fifth of the cost of the homes they sold in the financial year to April 2014.

So land is two thirds of the cost of a house as Mr Bridger puts forward? No not even close.

Pre-tax profit for the year was £380 million, equivalent to an average profit per dwelling sold of £101,550. In other words profits were substantially more than plot prices. If you do the maths you will find that the average pre-tax margin was 31.6% on the total cost of the average dwelling. A very profitable business.

As for the housing crisis – consider this. This is a crisis created by various government policies. This is complex, but policies which contribute to the crisis include immigration, an open housing market, housing benefit, tax credits, taxation, amongst others.

Now think about just a few of these.

Migration Watch have estimated that about 40% of demand for housing comes from net immigration into the UK, much of which is into London and the South East. Another estimate which considers the impact of children of new immigrants indicates that 60% of housing demand comes from recently arrived migrants.

Any government could change the open door policy to one of controlled immigration, inside or outside of the EU.

Then there is the policy of allowing overseas buyers free access to the UK housing market (and to land – green belt plots are for sale overseas).

Our example, Berkeley Homes, have sales offices overseas. Many overseas buyers leave their property empty – buy to leave. Again, this is a policy that could be changed, for example, to the Australian approach which severely limits overseas buyers and does not tolerate buy to leave.

And beyond government policies – market forces may decide that British economic prospects are poor, resulting in the pound weakening appreciably, which would lead to many overseas buyers trying to sell, to get their money out. This would collapse the housing market in London and would spread to the South East, so in this entirely plausible scenario we would have an entirely different housing crisis, similar to that experienced in Spain and Ireland.

Then consider buy to let – in this financial year more than £10 billion will be paid in housing benefits to private landlords. Any government can change this, and make buy to let much less attractive, for example, by ending tax deduction on mortgage interest.

I could go on, but in the interests in brevity, will not do so. Embarking on a huge house building programme, as advocated by Gordon Bridger and many others, is a policy fraught with danger, especially when the proponents of the policy have little or no idea of why there is a housing crisis, or even of the real costs of providing housing.

Responses to Letter: A Massive House Building Programme Is Fraught With Danger

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.Recent Articles

- Letter: Compton Residents Are Angry and Upset Over Tree Felling

- County Council’s ‘Devolution’ Solution ‘Will Doom’ West Surrey To Fail

- Dragon Review: Handbagged – Yvonne Arnaud Theatre

- How VE Day Was Celebrated 80 Years Ago in Guildford

- Dragon Interview: Sir Jeremy Hunt MP on His Knighthood and Some Local Issues

- Guildford Has a New Mayor with Rock Star Quality

- Ash Street Co-op Still Suffering Fallout From Cyber Attack

- Guildford’s Job Centre Among 238 Hit By Data Breaches, Say Experts

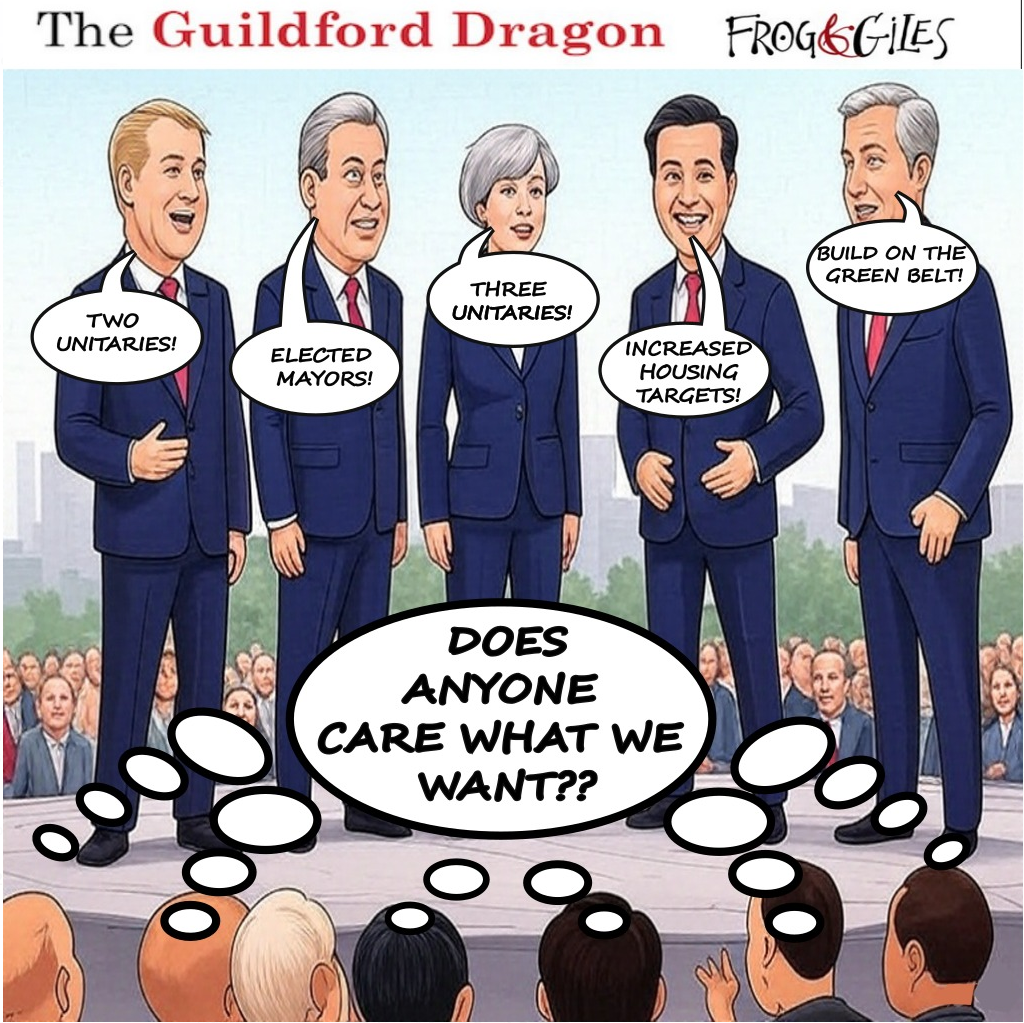

- Surrey’s Boroughs and Districts To Submit Their Three-Unitary Council Plan

- Letter: House of Fraser’s Closure Was the Last Straw

Recent Comments

- Rachel Buckett on Memories Of Queen Elizabeth Barracks And The Women’s Royal Army Corps

- Brian Creese on Guildford Has a New Mayor with Rock Star Quality

- Richard Sherlock on Guildford Has a New Mayor with Rock Star Quality

- Angela Gunning on Letters, Comments, Complaints Policy and Privacy Statement

- Peter Mills on Trans Protest on Guildford High Street

- Arthur Pint on Police Investigate Paint Attack at Guildford Business Park

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Harry Eve

May 4, 2015 at 2:30 pm

The Australians seem to be good at everything. Why have we fallen behind on producing common sense policies. The next thing we know is that they will be running our political parties. It isn’t cricket.

Once again Roland has put the spotlight on certain aspects of the housing issue that the developers would rather we did not know about.

I was going to say developers and their politician friends but its quite possible that the party leaders are too busy discussing who to go into coalition with than to think too deeply about the consequences of their policies.

Peter Acherley

May 4, 2015 at 8:20 pm

I’m not sure Berkeley Homes is a good example. They build high density apartment schemes in London often on sites which have major prep costs including contamination, demolition and remedial works.

You only have to look at the line into Waterloo to see their schemes hugging the rail line and the group have just completed on the gas holder site in Battersea, next to Battersea power station. The cost of removal of these holders will be significant and likely to result in a lower land purchase price.

In Surrey the company have done very little. Have a look at their Grove Road and Dagden Road scenes in Guildford to get a true picture.

There are a lot of people on here who have absolutely no idea!

Roland McKinney

May 5, 2015 at 4:04 pm

Not sure in what respect Peter Acherley thinks Berkeley Homes is not a good example – but assuming it is cost of sites, I’ll continue with some more information about Berkeley Homes, this time from their 2013 financial report.

In it it was reported they spent £315 million during that year buying new sites, mostly in London, including the former News International site in Wapping, for £150 million, definitely a brownfield site.

Berkeley Homes estimate that these sites would yield about 3,000 plots, so the average cost was £105,000 per plot. So brownfield sites are not low cost as suggested by Peter Acherley. This is not surprising – only about 20% of brownfield sites are so heavily contaminated that they need extensive remediation.

But consider too that Berkeley Homes have a current planning application to build 295 dwellings in Effingham, mostly on green belt land. The reported price for the purchase of Effingham Lodge Farm was £2 million, or less than £6,800 per plot.

Berkeley Homes have already built one development in Effingham, so perhaps they are more active in Surrey that Peter believes. Their financial report showed five active sites in Surrey.

But I do agree with one comment from Peter “…a lot of people on here have absolutely no idea.” If he were to back up his assertions with some data, maybe I’d think differently.

John Robson

May 5, 2015 at 8:50 am

Fag packet maths:

15,000 houses x £100,000 average profit (given that this is Guildford’s green belt, this is a Conservative number, Conservative being the operative word, in my view.

The sum equals £1,500,000,000 or £1.5 billion.

Now I finally understand what our gr££n belt is worth, this is an astronomical number for Guildford Borough Council’s (GBC) strategic developer chums and still GBC will only compel them to provide 40% affordable housing if it’s “economically viable”. The offshore accounts, bonuses and pension pots will be bulging.

So something doesn’t add up and it won’t be the profit column on the balance sheet, but one thing is for sure I now finally understand politics.

Roland McKinney

May 5, 2015 at 10:12 am

In response to John Robson –

It’s even worse (or better, depending on where you are in the housing chain) than that.

If they have bought land at agricultural prices they will make an additional killing on the land too. It’s why there are so many builders and developers on the Sunday Times rich list. They get on the rich list whilst young people struggle to buy and, of course, the builders and their chums blame it on the green belt. Sadly, many young people fall for the lie.

Dominique Kelly

May 5, 2015 at 10:13 am

And “affordable” is only 80% of the market rate which is still sky high for the country as a whole or key workers.

Bernard Parke

May 5, 2015 at 2:08 pm

Dominique Kelly’s comment is indeed very true.

This word “affordable” is just a ploy to build in sensitive areas such as the green belt.