Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Alderman’s Views On Students And Council Tax ‘Nothing More Than Ill-informed Tosh’

Published on: 30 Apr, 2013

Updated on: 30 Apr, 2013

Hon Alderman Bernard Parke’s letter is utterly nonsensical.

First of all, the vast majority of students are studying full time and therefore do not have their own sources of income. Therefore they would be unable to pay council tax and would be able to apply for council tax benefit should they be made liable to pay it. So effectively they would still end up paying no council tax.

Of course, the difference would be that the ‘non payments’ would have to go through a complicated bureaucracy awarding them council tax benefit. The result would be that more would be spent on administration costs than would be gained in any new tax revenue.

Additionally, it’s not just students who have “two votes”. Anyone with an address in two different local government areas is entitled to vote in both places as they are subject to the decisions of the local government in both areas.

The University of Surrey, on the other hand, is the largest employer in Guildford and is essential to the local economy. Students also spend a considerable amount of money in local shops (who in turn pay business rates, which helps fund local services). Of course, many graduates do settle here after leaving university and then pay Council Tax once they are earning.

Mr Parke seems to hold a general and thinly veiled dislike and objection to the very existence of any students in Guildford. The only coherent point he makes is that many students live in run-down accommodation, mainly as a result of unscrupulous landlords.

Of course, if Guildford Borough Council were to do what the Liberal Democrats have been calling for for years, and establish a register of approved landlords for students, then that would very easily solve the problem.

All in all, Mr Parke’s letter comes across as nothing more than bitter and ill-informed tosh.

George Potter is the Liberal Democrat candidate for the Shalford division in the forthcoming County Council elections. To see all the candidates standing in Shalford please click here and scroll down.

Responses to Letter: Alderman’s Views On Students And Council Tax ‘Nothing More Than Ill-informed Tosh’

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

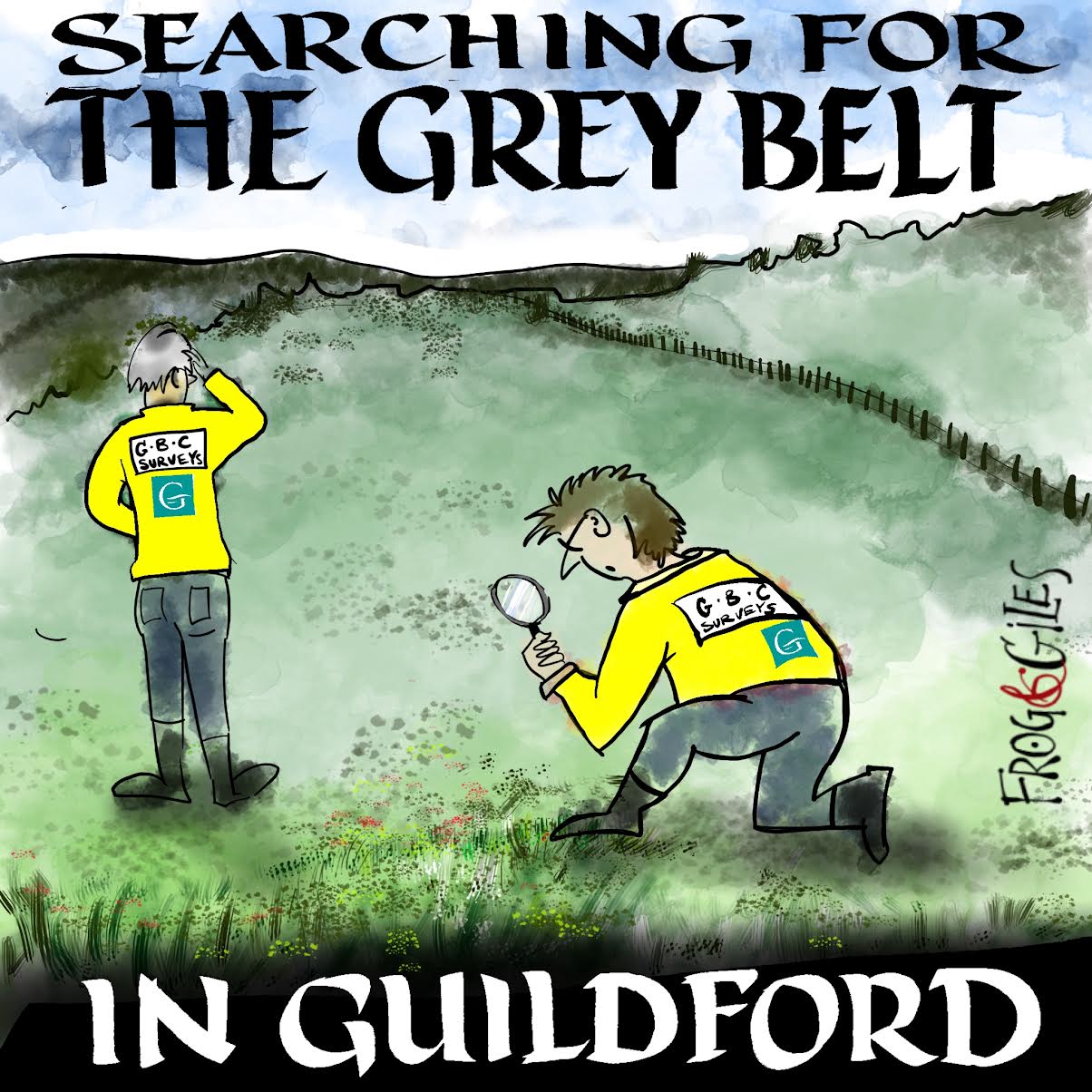

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Latest Evidence in Sara Sharif Trial

- Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Class A in Underwear Leads to Jail Sentence

- Historical Almshouse Charity Celebrates Guildford in Bloom Victory

- Notice: Shalford Renewable Showcase – November 16

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

Recent Comments

- Paul Spooner on Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Harry Eve on Opinion: The Future is Congested, the Future is Grey

- Nigel Keane on Letter: New Developments Should Benefit Local People

- Nathan Cassidy on Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- T Saunders on Opinion: The Future is Congested, the Future is Grey

- Jim Allen on Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

C Stevens

April 30, 2013 at 6:54 pm

Is Mr Potter right in what he says?

There’s a big difference between being exempt from council tax, as full-time students are, and claiming a benefit to assist in paying it, as people who are in receipt of income support or jobseekers allowance do. And full-time students won’t (generally speaking)be in receipt of either of these.

The idea of approved landlords for students is an interesting one, but isn’t that rather a matter for the educational institutions concerned? If it is a matter for the council, how does Mr Potter see it working?

I would never use the word “tosh” about another man’s view, but I’m just not sure that what Mr Potter says actually adds up.

George Potter

May 1, 2013 at 1:04 pm

In response to the comment from Mr C Stevens:

Local Council Tax Support, to give it it’s proper title, is deducted from the council tax bill by the local council before the bill is sent to the ratepayer. In that sense, it is not something claimed by, and paid directly to, an individual to assist with paying the council tax bill but a deduction from their council tax bill before they ever even see it.

The value of the deduction varies from council to council and unfortunately the bit of Guildford Borough Council’s website which specifies the value of the deduction in Guildford actually is appears to be currently broken. However, common practice is for those without any income or very low income (the situation that most students fall into) to receive a deduction somewhere between 90 and 100% of their council tax bill.

You would therefore be looking at council officials having to process and grant many more claims for Council Tax Support, with all the associated administrative costs, for the sake of maybe £2 or £3 a week extra from individual students, certainly a much smaller net source of revenue than originally suggested by Mr Parke.

Of course, students don’t actually claim JSA or ESA and so probably wouldn’t match the current criteria for Council Tax Support. However, given that the sole reason for existence of Council Tax Support is so that those unable to pay council tax do not have to, it would be incredibly inconsistent if any change to make students eligible for council tax would not be coupled with changes to also make them eligible to claim for Council Tax Support.

Regarding registered landlords, housing is a matter specifically for the council as it falls within their purview, rather than for the university. If local people are concerned about “twilight zones” of student accommodation then it is their democratically elected representatives who should attempt to do something about it. Educational institutions are generally considered responsible for the facilities and education they provide to their students, rather than being responsible for governing what happens off of its property.

Implementing registers of local landlords is obviously more complicated than can adequately be detailed here, however, several other towns in the country have successfully implemented such registers, to the benefit of responsible landlords and student and non-student tenants alike, so there seems no reason Guildford could not do the same if the borough council chose to do so.

C Stevens

May 1, 2013 at 6:46 pm

Interesting response from Mr Potter.

Gov.uk says full-time students are exempt from the tax. Follow the link:

https://www.gov.uk/council-tax/full-time-students

Inconsistency is the stuff of politics. Which party was it that having said they weren’t in favour of tuition fees then, rather inconsistently, supported their introduction?

And while it may be the council’s statutory responsibility to oversee housing, I’d be surprised if the local educational institutions didn’t maintain a register of landlords.

My view on students and council tax is that it would make very little difference to the overall and huge bill that students wind up paying these days while saving the poor benighted taxpayer a few bob.

Can I just add, if my suggestion isn’t acceptable, that I pay council tax but spend a lot of money in local businesses.

So can I be let off too?