Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Thank You For the Post-Brexit Trade Debate

Published on: 9 Jan, 2017

Updated on: 9 Jan, 2017

I would like to thank all of the contributors to my opinion piece, on Guildford business, for their comments. Guildfordians are clearly lively debaters.

It is clear from the contributions that everybody, Brexiteer or not, shows signs of being in favour of free and unfettered trade between countries. The Brexiteers say we should concentrate on trade outside the EU. Those who favour the EU say we should concentrate on trade everywhere in the world, including in the EU.

Supporters of the EU are proud that our country contributed to the establishment of the most sophisticated free trade area in the world. It is just as easy to do business between Guildford and Paris as it is with Woking, and we love it. No more frustration such as when we do business with the USA, for example. Our Single Market provides the gold standard for unfettered trade. Nowhere else in the world does this exist.

Brexiteers, on the other hand, say we can forget about free trade with the EU because any resulting drop-off will be compensated by increases from free trade deals that will be struck with countries like Burundi, China, Bangladesh, Nepal, once we are unshackled from the EU. The world is huge outside of Europe and we need to chase it more.

The point of my opinion piece was that we, and all our European friends, are already prioritising the development of trade outside of Europe. I wanted to highlight, in my opinion piece, that leaving the EU will make no difference. It’s gonna happen anyway.

I noted in my piece that we two Guildfordians were in excellent company while doing business in Guangzhou with a further 20 or so fellow Europeans.

Our fear, as supporters of the EU, is that an organisation whose ethos is free trade, will negotiate far better than the UK ever could if we were to go-it-alone. The EU has greater negotiating weight because of significant economic superiority by sheer size of its aggregated economies. It also has the experience and know-how because free trade is what it is all about. It exists for this.

Any school student of economics can tell us that, as indeed all financial analysts of the world are telling us. That’s why since the referendum our currency has collapsed. That’s why we have had to increase quantitative easing. That’s why we have had to reduce interest rates further. That is why the Government has had to cancel its programme to eradicate the deficit by 2020. That is why economic activity is already beginning to stutter.

The tea leaves don’t make for good reading and we haven’t even Brexited. So maybe don’t change those Euros, Dollars or Thai Baht back into Sterling just yet.

Responses to Letter: Thank You For the Post-Brexit Trade Debate

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

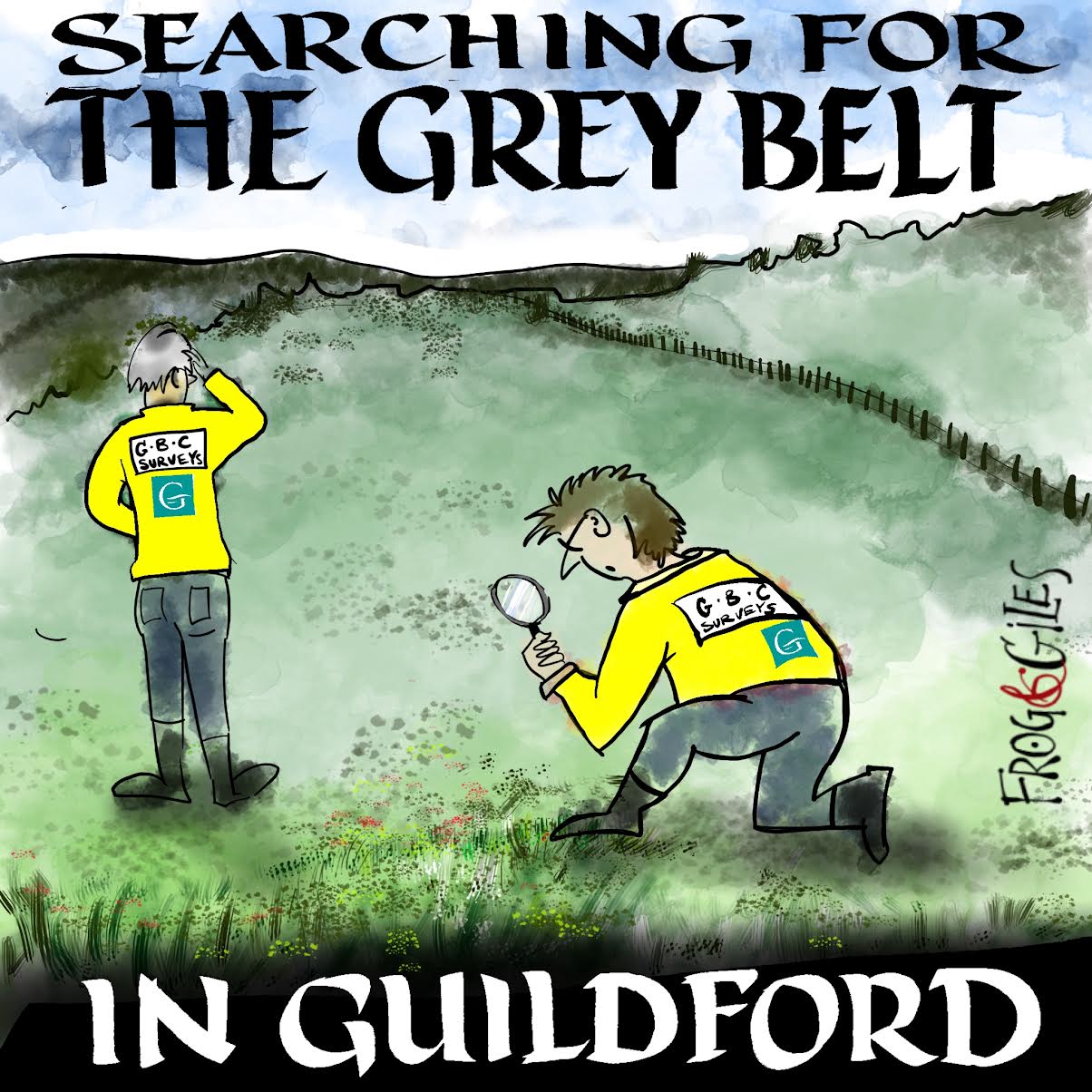

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

Recent Articles

- Column: Guildford’s MP Writes – Championing the Needs of Guildford and Our Villages

- City Win at Last With Three Penalties in Cup Tie

- Letter: Development of Gosden Hill Could Be an Opportunity for Improvement

- Sara Sharif Trial Latest – Defence Says Sara’s Uncle ‘Facing Murder Count on Absolutely Nothing’

- Ash Level Crossing Row: GBC Rejects Cabinet Member’s Statement As ‘Factually Incorrect’

- Letter: What Will Be Done for Burpham Residents Now?

- Updated: County Council Cabinet Confirms Its Decision on London Road Scheme

- Postcode Lottery Police Funding – It ‘Cannot Be Fair’ Says Police Commissioner

- Heartbreak for City Again as Two Extra-time Goals Snatch Victory

- Letter: All Three Major National Parties Are Relaxed About Green Belt Giveaways

Recent Comments

- Warren Gill on Ash Level Crossing Row: GBC Rejects Cabinet Member’s Statement As ‘Factually Incorrect’

- Olly Azad on Heartbreak for City Again as Two Extra-time Goals Snatch Victory

- Brian Holt on Heartbreak for City Again as Two Extra-time Goals Snatch Victory

- Helen Skinner on Updated: County Council Cabinet Confirms Its Decision on London Road Scheme

- John Oliver on Updated: County Council Cabinet Confirms Its Decision on London Road Scheme

- John Ferns on Ash Level Crossing Row: GBC Rejects Cabinet Member’s Statement As ‘Factually Incorrect’

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Mary Bedforth

January 9, 2017 at 12:23 pm

I am sure the Greeks, Italians and Spanish people are happy with how things turned out for them.

The EU is collapsing and so is the Eurozone. Thank goodness we did not get sucked in to it.

jim Allen

January 9, 2017 at 1:00 pm

Clearly Mr Pillenger likes good debate but I can’t help but miss what point he makes about finance.

Surely if there is more ‘loan’ than ‘money’ then the loan can never be paid back. If no one has accounted for that money then no one knows how much it actually cost.

Claiming that some other nationality can negotiate better then the British is rather anti-British.

The negotiation in my mind is clearly based on the principle “you need what I have – how much are you going to pay?”

Ken Clark made the comment on January 8 tht the EU has 500 million potential customers. I doubt there is anyone in the world (save China) could produce enough product to satisfy such a need, and then once produced would only need to replace what is broken. So dead-end trade.

Surely we should be looking at the specialised market places of 100 countries rather than the bulk supply to 26.

I believe we will survive both as a country and as a financial entity. We need to stop this quantitative easing in its current format, and instead write off the debt and interest payments of everyone in the UK. It would probably cost less in the long term. We could then start afresh with rational lending and rational charges.

Supporting a system which has not been audited for 18 years in my small world is irrational.

Robert Park

January 9, 2017 at 9:54 pm

Large majorities in Greece, Spain and Italy still support remaining in the EU, despite their various economic difficulties. In fact, polling evidence suggests that now the full impact of Brexit is becoming obvious, a majority in the UK also supports remaining.

The EU is not collapsing and nor is the Eurozone. It is true that growth has been disappointing. That is not due to European integration as such but because the European Central Bank has imposed inappropriate public deficit targets in a similar way to those which have caused such damage in the UK. This can be addressed by more expansionary and more co-ordinated fiscal policies.

If people with the attitudes of Mary Bedforth have their way, we shall be back to the narrow nationalistic “beggar my neighbour” economics of the 1930s, with huge damage to the whole continent and the wider world.

C Stevens

January 11, 2017 at 4:20 pm

Can we have chapter and verse on the “polling evidence” to include date(s) of poll(s), size of sample(s), geographical area(s) and percentage results, please?

Stuart Barnes

January 10, 2017 at 9:20 am

Talk about hitting a dead horse!

It is over – we are going to leave the single market and all the negative things attached to it. The people have decided that control of our borders, our laws, our sovereignty and our country is more important.

Interestingly the latest opinion poll confirms a majority in favour of taking back control of our immigration policy over access to the single market. Even the hapless Jeremy Corbyn is now very reluctantly, and not very convincingly, agreeing that we must control immigration.

The simple point is that if we remain in the single market we will continue effectively to be part of the EU basket case but with even less control than we have now.

Harry Eve

January 10, 2017 at 2:16 pm

Surely you have to flog a dead horse – not just hit it? The UK (and Europe) needs people who know what they are doing.

Stuart Barnes

January 10, 2017 at 7:12 pm

You are correct of course! Sorry for my wrong quote. I will try to do better in future.

Fortunately my mistake will not affect the facts or the argument.