Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: This Is the Way the New Homes Bonus Is Calculated

Published on: 24 Oct, 2017

Updated on: 24 Oct, 2017

Conservative borough councillor for Shalford and lead councillor for finance

I write following recent comments made [by Peter Shaw in his letter: We Should All Discuss And Consider Local Political Issues] in relation to the New Homes Bonus (NHB).

Firstly, the “New Homes Bonus Calculator” is freely available on DCLG’s [Department for Communities & Local Government] website so anyone is able to look at its calculation should they be interested in doing so.

The New Homes Bonus grant is calculated on the following basis:

- The number of additional properties added to the housing stock each year based on data submitted by authorities on their council tax base forms (ie, it is based on physical properties once built and brought into residential use)

- The number of properties added in each council tax band is converted to a “Band D equivalent” number of properties

- The number of empty homes that have been brought back into use during the year is added into the calculation and converted to a Band D equivalent

- The % increase in Band D equivalent number of properties is then compared to a national ‘deadweight percentage’ and the number of Band D equivalent properties added to the housing stock above the ‘deadweight’ is used as the number of units in the calculation of the grant award for that year

- The Band D equivalent number of units is then multiplied by the national average Band D council tax (£1,529.56 for the most recent year) to get the New Homes Bonus annual award to each local authority for that particular year

- In two-tier areas, such as Surrey, 80% of the NHB is awarded to the district/ borough councils and the other 20% to the county council.

- In addition to the basic award, the council receives an additional bonus of £350 per unit for every affordable property

The annual award was previously paid for six years, however, this reduced to five years in 2017-18 and it will reduce to four years in 2018-19.

The grant for 2017-18 was based on additions to the council tax system between October 2015 and October 2016. This calculation resulted in an annual NHB award of £329,625 for 216 additions above the ‘deadweight’ and £18,550 additional affordable homes bonus.

When the split between the county and the borough is taken into account is means the annual bonus award for 2017-18 was £278,540 which equates to an average of £1,290 (ie £278,540/216) per additional property per annum.

The payment for 2017-18 will be payable for five years, therefore, equating to an average of £6,450 NHB award per property over the five year period. The total grant awarded to the council for 2017-18 also included the legacy payments for the previous financial years.

The annual bonus award for future properties will reduce as the number of years NHB is paid for reduces. The government have set a national cap on NHB grant of £900 million and have stated that they will continue to change the scheme each year to fit within the national cap.

The government is currently consulting on proposals to reduce the grant for authorities based on the number of successful appeals determined by the planning inspectorate as a percentage of the total number of planning applications determined.

New Homes Bonus is top-sliced from the main government revenue support grant (RSG), so it is not new funding – it is existing funding just distributed in a different way to the RSG.

Any forecasts of the grant income much beyond one year, and certainly beyond 2020, are bound to be wrong due to:

- The need for DCLG to keep within the national cap

- The fair funding review of local government finance changing the way local government is financed from 2020

- Government changes post 2020-election

The council’s future budget forecasts do not, therefore, rely on any increase in NHB income to set a balanced budget.

The council approved a New Homes Bonus policy at the budget council meeting in February 2016.

Responses to Letter: This Is the Way the New Homes Bonus Is Calculated

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

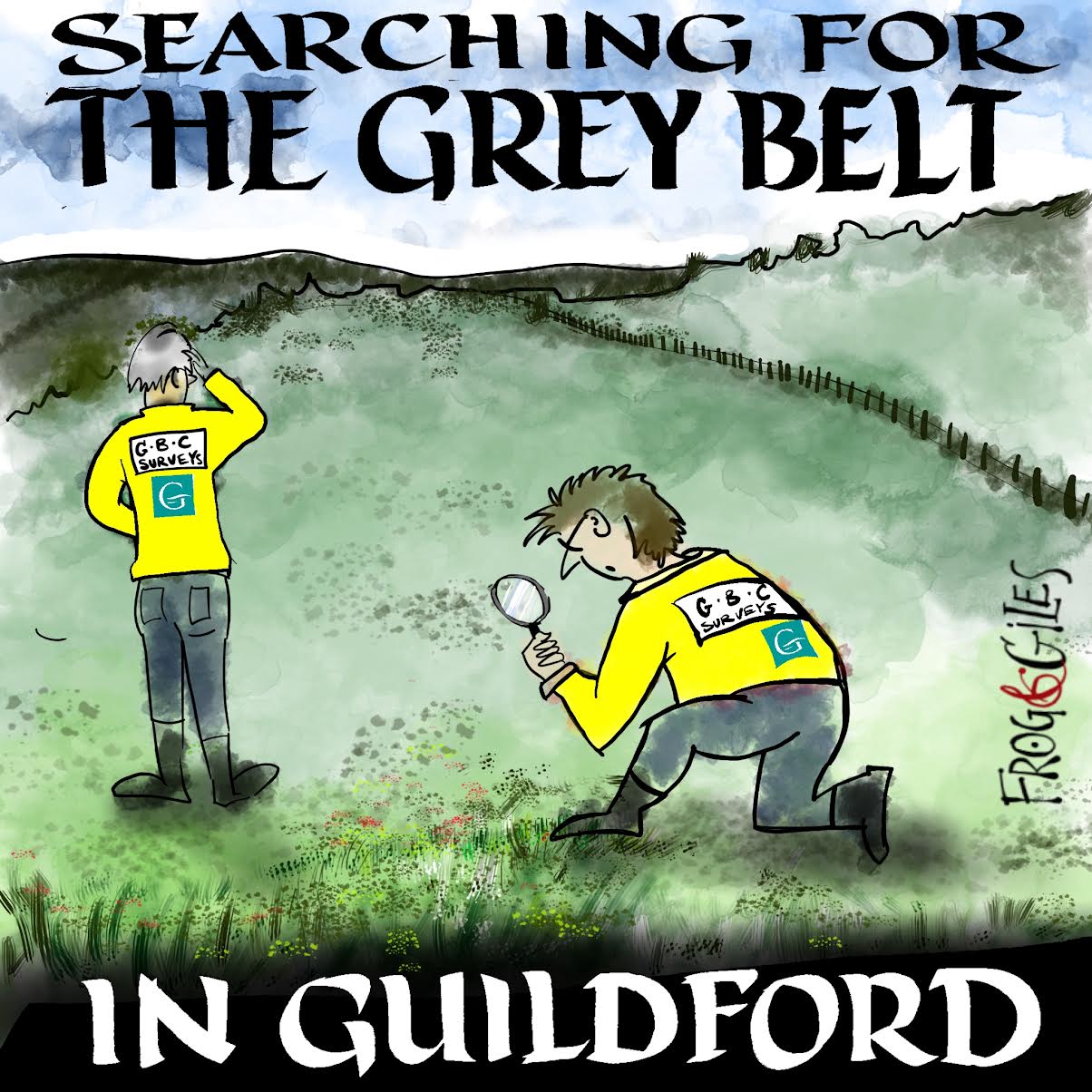

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Latest Evidence in Sara Sharif Trial

- Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Class A in Underwear Leads to Jail Sentence

- Historical Almshouse Charity Celebrates Guildford in Bloom Victory

- Notice: Shalford Renewable Showcase – November 16

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

Recent Comments

- Paul Spooner on Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Harry Eve on Opinion: The Future is Congested, the Future is Grey

- Nigel Keane on Letter: New Developments Should Benefit Local People

- Nathan Cassidy on Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- T Saunders on Opinion: The Future is Congested, the Future is Grey

- Jim Allen on Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Peter Shaw

October 25, 2017 at 9:03 pm

I would like to thank Cllr Illman for this detailed response.

However, the total income from the NHB scheme that Guildford received was estimated to be £2,362,055 for 2016/17 (as per the NHB Calculator and council meeting documents (New Homes Bonus and Parish Allocation Policy 2016-17 Financial Year)). I appreciate that the figure may be slightly different due to using forecast data in some of the calculations but the ballpark figure of around £2 million is about right. A similar amount will be expected in the near future and when/if the Local Plan is adopted this would significantly rise (as the unconstrained OAN will be used as the yearly housing target).

This will raise the annual new homes per year target from 322 to 654, doubling the current target. A reasonable assumption would be that the total annual income from the NHB would also gradually double to around £4 million per year during the plan period. So assuming no changes in this policy, GBC would receive around £70m in funding, give or take a few million.

The money might still come from the RSG but at least now this helps to explain why GBC Executive are so focused on building houses, it has to meet council expenditures. At least £1 million each year is required to support council services, with the rest being used on other projects.