Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Police Warning – Beware of Investment Fraud

Published on: 8 Jun, 2020

Updated on: 11 Jun, 2020

Surrey Police has issued a warning about investment fraud after a number of victims have lost money recently.

Surrey Police has issued a warning about investment fraud after a number of victims have lost money recently.

In May the force recorded six cases of investment fraud involving vulnerable victims, with total losses amounting to £365,150.

This crime typically involves a credible-sounding fraudster pretending to be from an investment company, offering victims opportunities to invest their money and potentially make impressive profits from doing so. The investment could be in shares or bonds, or precious goods such as gold, silver, diamonds, wine or art. Investment fraud can often happen over a long period of time.

People over 65 are frequent targets for investment fraudsters. Fraud is reported to cost UK firms and individuals £130 billion annually.

A police spokesperson gave an example of one case: “A couple in their 70s from Elmbridge were searching the internet for investments and a screen popped up asking for their details.

“Thinking it was legitimate, and their bank wanting to contact them about possible investment, they gave their details. They had transferred £70,000 before a further payment was blocked by their bank for being suspicious activity and the couple realised they had been victims of a crime.”

PC Bernadette Lawrie, Financial Abuse Safeguarding Officer for Surrey Police said: “We are seeing victims lose devastating sums of money to fraudsters and are urging people to be wary when contacted by someone claiming to be from an investment firm about their money. This contact is frequently via telephone but can also start through social media and while searching for investments online.

“Take your time making decisions and remember that if something sounds too good to be true then it probably is.”

The Financial Conduct Authority (FCA) warned earlier this year that legitimate investment firm BlackRock Advisors UK Ltd was being ‘cloned’ by fraudsters. This new tactic means fraudsters use the name, firm registration number (FRN) and address of firms and individuals authorised by the FCA to suggest they are genuine. They can also copy a firm’s own website.

PC Lawrie added: “If you are thinking of making an investment always check people are who they say they are. To make safe investments, take a look at the Financial Conduct Authority’s ScamSmart warning list.”

There is more information about Operation Signature, Surrey Police’s campaign to identify and protect vulnerable victims of fraud on the force’s website here. If you have been a victim of fraud please report it to Action Fraud online or by calling 101.

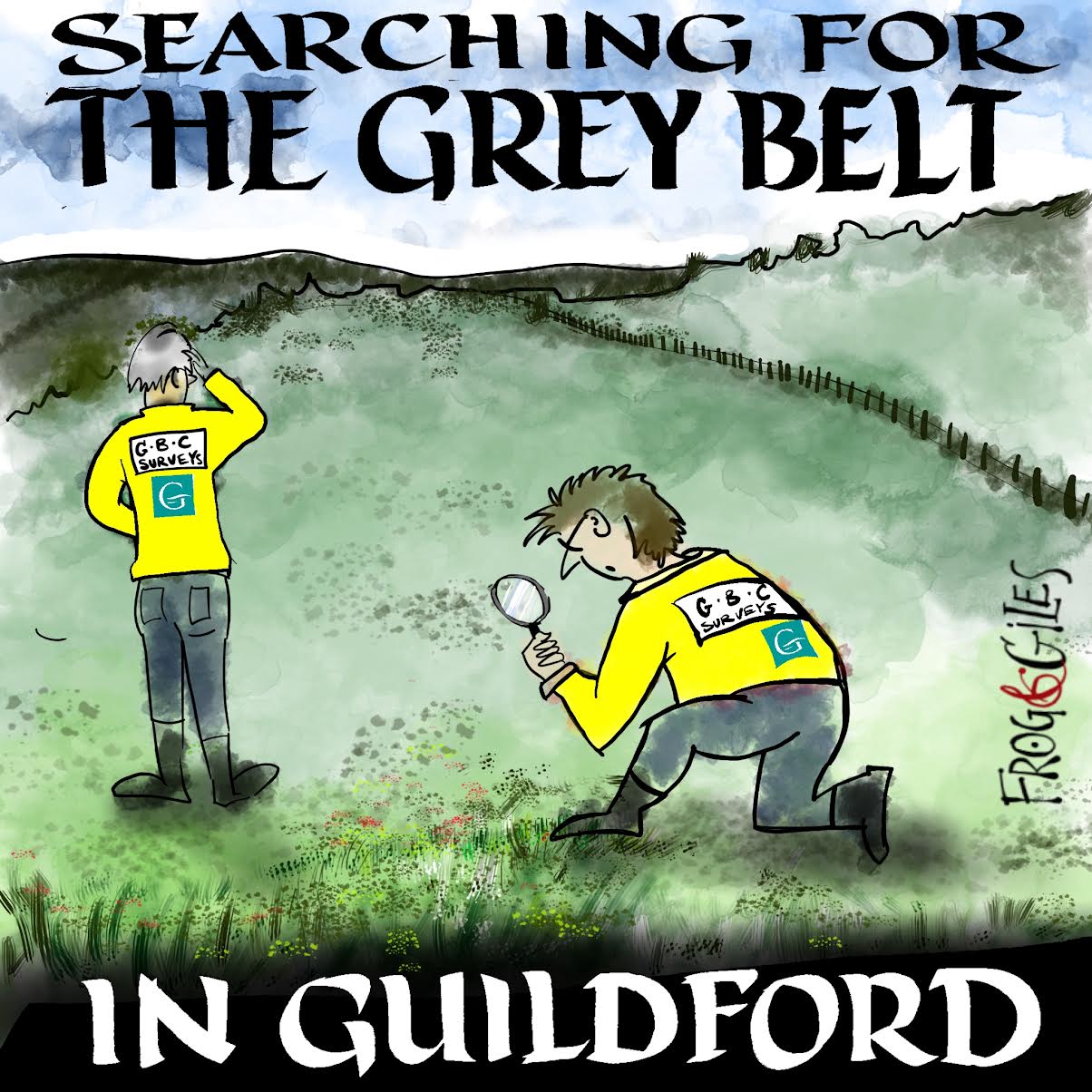

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Latest Evidence in Sara Sharif Trial

- Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Class A in Underwear Leads to Jail Sentence

- Historical Almshouse Charity Celebrates Guildford in Bloom Victory

- Notice: Shalford Renewable Showcase – November 16

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments