Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

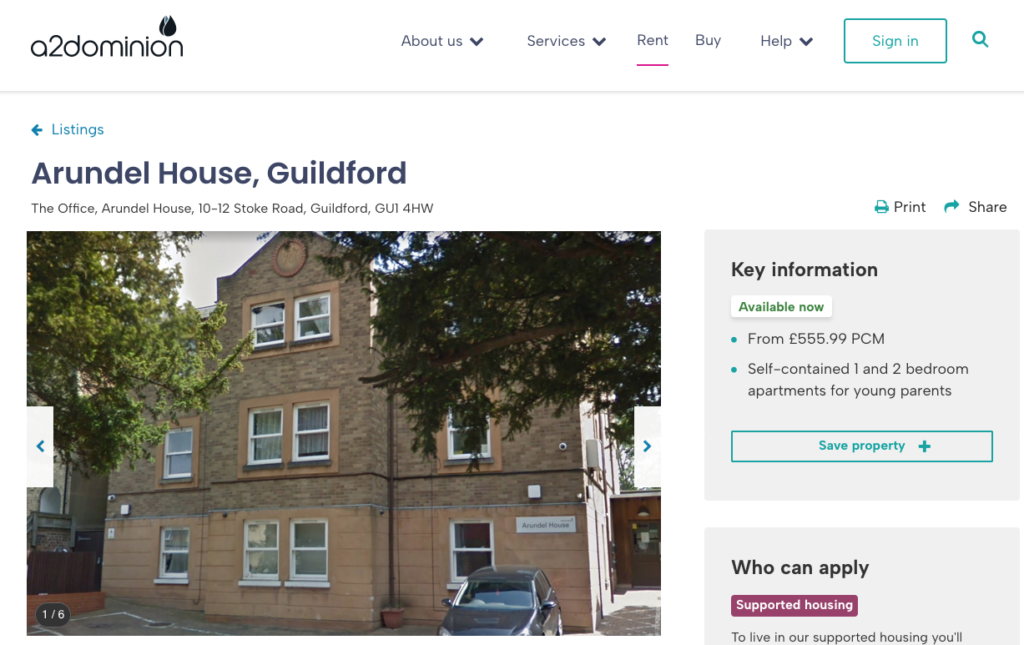

Regulator Downgrades Social Housing Landlord

Published on: 4 Jan, 2024

Updated on: 5 Jan, 2024

By Chris Caulfield

local democracy reporter

Problems with repairs, service charges, complaints, damp and mould, contributed to one of Surrey’s largest social housing landlords being downgraded by regulators for failing its tenants.

The Regulator of Social Housing (RSH) found that issues at A2Dominion had “crystalised over a breadth of areas” which “resulted in poor outcomes for its tenants”.

The report, published on Wednesday, January 3, said A2Dominion, which has properties in Guildford, had been working to make improvements but had not yet been able to deliver the changes required.

This led to poor quality data, poor reporting, and the board not having effective oversight.

Harold Brown, senior assistant director for investigations and enforcement at RSH, said: “We found significant issues with A2Dominion’s data and its business planning, risk and control framework, leading to a failure by the provider to manage key risks effectively.

“A2Dominion is working with us to address these issues and we will continue to monitor the provider as it works to return to compliance.”

The group owns and manages more than 38,000 homes across 79 local authority areas in London, the South East and Wiltshire.

The majority of its housing stock is for general needs. It also has significant levels of shared ownership housing as well as supported or sheltered accommodation.

A2Dominion, as a charitable housing association, must meet certain regulatory standards.

Its new board took over in September 2022 and referred itself to RSH following concerns over the quality of some services, as well as its financial position.

A2Dominion was then under review for three months while it was investigated for potential non-compliance.

In a letter to stakeholders, CEO Ian Wardle said: “We know that outcomes for some customers have been poor.

“Earlier this year, we issued an apology to customers who had been adversely affected. While we have made some improvements, work is still underway to fully resolve issues with repairs, service charges, complaints, damp and mould, latent defects and the roles and responsibilities of managing agents.

“We also know that our services aren’t as responsive as they could be. In some of these areas, we aren’t always delivering the high standards we set ourselves and customers expect.”

The regulator downgraded A2Dominion from G1, which means a provider meets governance requirements, to G3 where there are issues of serious regulatory concern which the provider is working to improve. Its financial position is unchanged.

The new grading does not affect services and it will continue to deliver its day-to-day operations as normal.

Mr Wardle said: “Over the past few months, we’ve been in positive and constructive discussions with the regulator following our self-referrals.

“We’ve welcomed the opportunity to identify further steps that we can take to make improvements for our customers and the communities we serve.

“The regulator has confirmed that it has assurance that we have an adequately funded business plan in the short term, sufficient security in place, and is forecast to continue to meet its financial covenants.

“Since I joined in September 2022, working with the then recently appointed new chair, we have appointed many new board members, and have made changes to our management team. All our colleagues are passionate about what we do.

“However, in far too many instances, colleagues haven’t had the resources and processes to fully deliver outstanding customer service. It is my job to fix this, and we’ve made improvements throughout 2023, with more planned in 2024.

“At the same time historic decisions on development schemes, tougher trading conditions and rising costs have affected our finances, but we will weather the storm.

“We’ve already made a number of significant improvements in relation to customer complaints and have prioritised our commitment to social housing as the core of our business, including our exit from care services and fine-tuning our development strategy so we can focus on getting things right first time for our customers.

“We also remain financially strong, with an A credit rating from Fitch, £3.6 billion of assets, and over £300 million of undrawn available facilities.

“I look forward to continuing to work closely with the regulator following their decision, and will collaborate on the steps we need to take to return to our previous rating.”

If you live in an A2Dominion home and wish to discuss your situation, please contact chris.caulfield@reachplc.com

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Latest Evidence in Sara Sharif Trial

- Ash’s New Road Bridge Is Named – and November 23rd Is Opening Day

- Class A in Underwear Leads to Jail Sentence

- Historical Almshouse Charity Celebrates Guildford in Bloom Victory

- Notice: Shalford Renewable Showcase – November 16

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Updated: Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments