Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Year End – Time to Spring Clean Your Finances

Published on: 20 Feb, 2013

Updated on: 20 Feb, 2013

Jon Hills, a tax partner at the Guildford office of PKF Accountants & business advisers, offers some financial advice to Surrey individuals ahead of the end of the 2012/13 tax year on 5 April: “With less than two months to go before the end of the tax year, now is the time to use up any remaining allowances and start preparing for some of the changes that will come into effect on 6 April.”

Here are some things you can check:

Pensions

The tax system incentivises the self-employed and employees to maximise their personal contributions to personal pension plans. The annual contribution limit for an individual (the total of personal contributions and those made by an employer) is the lower of 100% of net relevant earnings and £50,000. For personal contributions below this threshold, tax relief is available at the individual’s marginal rate of tax. With this in mind, the forthcoming reduction in the top rate of income tax to 45% may provide a reason for some individuals to bring forward their pension contributions to before 6 April.

ISAS and Junior ISAS

Now is also the time to use up any remaining ISA allowances to which you and your family are entitled. UK residents aged 18 or over can invest in one stocks and shares ISA and one cash ISA each year subject to the overall £11,280 limit for 2012/13. And parents who have used their own ISA limits can invest for a further £3,600 for children under the age of 18 through a junior ISA. Junior ISAs operate in a similar way as adult ISAs – income and capital gains generated will be tax-free.

…less than two months to go before the end of the tax year… Jon Hills, a tax partner at PKF

Capital Gains

Capital gains up to the £10,600 annual exemption can be realised tax free in the 2012/13 tax year, and any gains above this threshold are then taxed at either 18% or 28%, depending on the individual’s marginal rate of income tax. Unused exemptions cannot be carried forward into future tax years and are therefore effectively lost.

Tax Codes

HM Revenue & Customs (HMRC) has already started issuing tax coding notices for 2013/14 to employed individuals and those receiving occupational or personal pensions. It is important that these are checked carefully to ensure that the best possible estimate of the amount of tax due is deducted from your monthly income for 2013/14.

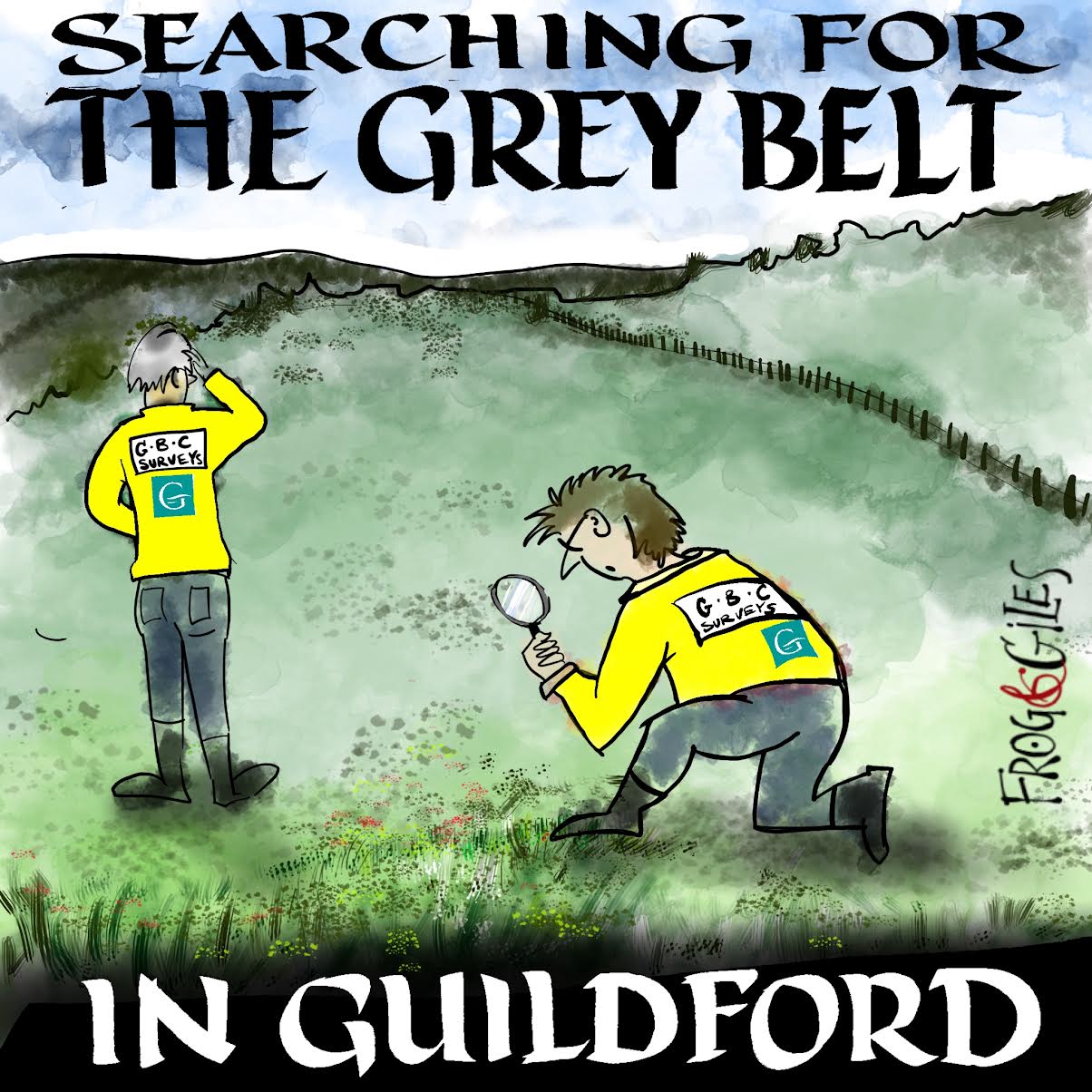

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

www.abbotshospital.org/news/">

Recent Articles

- Firework Fiesta: Guildford Lions Club Announces Extra Attractions

- Come and Meet the Flower Fairies at Watts Gallery

- Royal Mail Public Counter in Woodbridge Meadows to Close, Says Staff Member

- Latest Evidence in Sara Sharif Trial

- Letter: New Developments Should Benefit Local People

- Open Letter to Jeremy Hunt, MP: Ash’s Healthcare Concerns

- Opinion: The Future is Congested, the Future is Grey

- Full Match Report: City Go Out of FA Vase on Penalties

- Letter: Incinerating Unnecessary Packaging Causes Pollution

- Letter: Thank You, Royal Surrey

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments