Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

£10m Owed to Guildford Borough Council By In-Trouble Thurrock

Published on: 28 Sep, 2022

Updated on: 28 Sep, 2022

By Emily Coady-Stemp

local democracy reporter

Three Surrey councils are owed a total of £30 million by a council which has seen the government intervene in its borrowing problems.

The government announced this month that after “serious concerns about the financial management” at Thurrock Council, a unitary authority, Essex County Council would be brought in to take control.

The government announced this month that after “serious concerns about the financial management” at Thurrock Council, a unitary authority, Essex County Council would be brought in to take control.

The Bureau of Investigative Journalism revealed a total of £138 million of public money was unaccounted for, with questions raised over the Essex council’s borrowing and investment in 53 solar farms.

Three Surrey councils have loaned money to Thurrock Council, with Waverley, Spelthorne and Guildford borough councils each having invested £10 million in the troubled council.

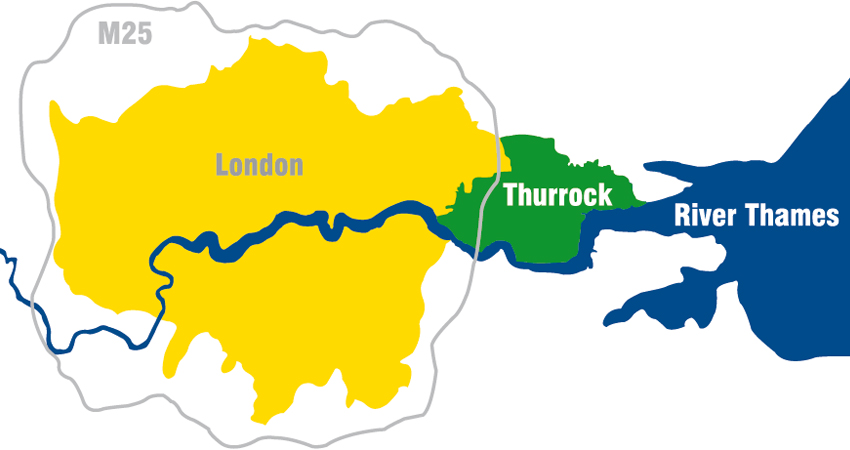

Thurrock lies to the east of London. Although historically part of Essex, it is now a unitary authoriyty.

A GBC spokesperson said lending between local authorities was a “common practice” and that the risk rating of the debt had not changed since the government’s intervention.

Spelthorne and Guildford are both due to have the debt repaid in 2023, with Waverley’s money due to be paid back in January and March 2024, because it is two separate loans of £5 million.

Essex County Council will take full control of Thurrock’s finances and has powers to see if there are failures elsewhere to mitigate any further risk to services.

Guildford’s lead councillor for finance Cllr Tim Anderson (R4GV, Clandon & Horsley) said the borough council had invested £10 million with Thurrock Council from March 2022 until March 2023, at a rate of 1.35 per cent.

He confirmed the council had also loaned more than £40 million to eight other local authorities, including £10 million to the London Borough of Croydon, which issued a section 114 notice, effectively declaring itself bankrupt, in November 2020.

The other loans are £5 million to Birmingham County Council, Derbyshire County Council, Somerset West & Taunton, Gravesham Borough Council, Mid Suffolk District Council and Cherwell District Council, and £2 million to South Somerset District Council.

Cllr Anderson said: “A council has never defaulted on a local authority investment.

“Councils are required, by law, to produce a balanced budget, and if they can’t their chief finance officer may, as a last resort, have to issue a Section 114 notice.

“The notice suspends all new expenditure with the exception of statutory services including schools, adult care and safeguarding until the council agrees a robust recovery plan.

“If a revised balanced budget cannot be approved, then external auditors and central government may decide to intervene and impose an action plan to resolve the financial issue.”

Spelthorne confirmed two loans of £5m each are due for repayment in January 2023.

A spokesperson said no further loans had been issued and the agreed terms and conditions and risk assessment still applied.

They added: “It is important to note that government will underwrite ability of councils to meet their liabilities and there is no indication to show a different approach is being taken now, therefore, the monies will be repaid.

“In terms of low levels of credit risk councils rank only after sovereign governments.”

Waverley Borough Council did not wish to comment further, but a spokesperson confirmed two loans had been made to Thurrock Council of £5 million each, one with a maturity date of March 2024 and the other of January 2024.

Then local government secretary Greg Clark MP said in a statement on September 2: “Given the serious financial situation at Thurrock Council and its potential impact on local services, I believe it is necessary for government to intervene.

“I strongly believe that when a council gets into difficulties its local government neighbours should be the preferred source of help in turning it around.

“I know that Essex County Council possesses the expertise and ability to help its local government neighbour. Working together, I believe the councils can deliver the improvements local people expect and deserve.”

Surrey County Council and the remaining districts and boroughs confirmed they did not have any outstanding lending with Thurrock Council.

Responses to £10m Owed to Guildford Borough Council By In-Trouble Thurrock

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Recent Comments

- Ian Macpherson on Updated: Main Guildford to Godalming Road Closed Until August 1

- Sara Tokunaga on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Michael Courtnage on Daily Mail Online Reports Guildford Has Highest-paid Council Officer

- Alan Judge on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- John Perkins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- S Collins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Keith Francis

September 29, 2022 at 12:39 pm

This is interesting as Spelthorne’s property investments haven’t put it in a good place.

Surrey County Council also has some poor property investments, including the Debenham’s store in Winchester.

When will the next SCC investment board meeting be held and the accounts of its two companies published?