Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Comment: County Council Considers Future of Devalued Property Investments in Secret

Published on: 19 Feb, 2022

Updated on: 22 Feb, 2022

By Martin Giles

The public was excluded from a Surrey County Council meeting this week (February 15) where the subject of its investment in the Debenhams building in Winchester High Street was due to be further discussed.

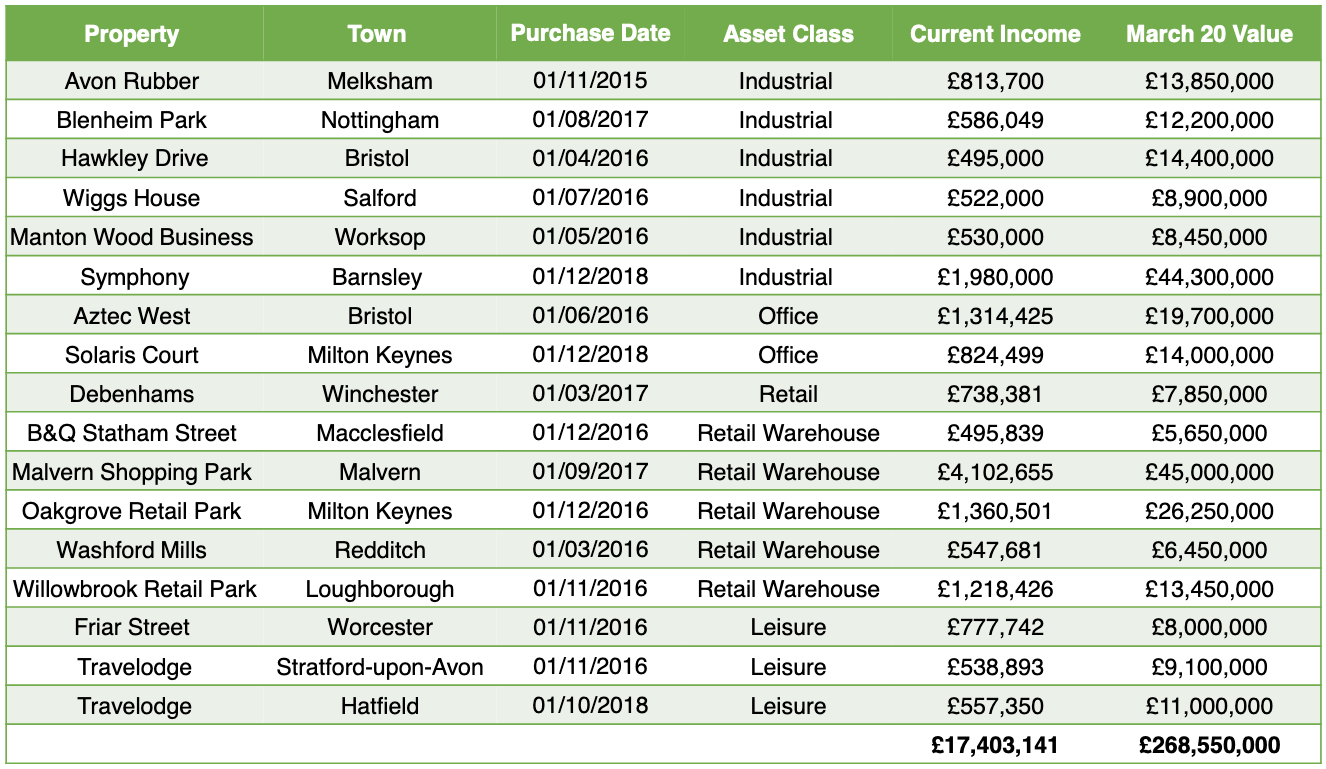

The latest published accounts relating to Halsey Garton Property Investments Ltd, an investment company set up by SCC, were expected to be reported and the ensuing discussion was expected to be commercially sensitive.

In 2017 SCC bought Debenhams in Winchester for £15.8 million and in March 2021 it was worth £6.25 million. In addition, with Debenhams in administration, no rental income is currently being received.

Combined with what, some say, was another ill-judged purchase of Malvern Retail Park [near Worcester] in 2017 – now worth less than half its value – and the fact that the council’s debt repayment strategy was deemed “imprudent” by its auditors in January 2021, more bad news was assumed to be on its way.

It may be that the building is worth even less now than it was in March 21. Perhaps now that Debenhams have moved out it’s clear that it needs significant renovation and additional investment to make it saleable again, even at a loss.

With the decline in the market for retail properties buildings such as old department stores, the Winchester High Street property needs to be made more desirable so that new uses can become more obvious in an attempt to attract new lessors or purchasers. But some might feel that the cost of the work required would be throwing more good money, possibly several hundreds of thousand pounds, after bad.

Critics of the council’s investment policy say that even in 2017, when the future of the retail sector was already being questioned because of the burgeoning online shopping phenomenon, the risk assessment of investments was not prudent, considering public money was at stake.

Many local authorities have increased their commercial property portfolios over the last decade hoping the derived income would make up for the loss of government grants. But as all investors are warned values can go down as well as up and local authorities throughout the UK are now seeing their investments devalued with the consequent impact on their already wrung out finances.

SCC’s “Investment Strategy” was approved by its Cabinet in 2013 to “Enhance the council’s financial resilience in the longer term”. It was intended to “deliver an ongoing income stream generated from a diversified and balanced portfolio of investments”.

In 2017 the strategy was reviewed by the SCC Cabinet who re-confirmed the ambition to continue to grow the portfolio.

In 2019 with book values of its investments falling, another review decided investments should be held at existing levels noting “SCC book value has no impact on revenue returns”.

Responses to Comment: County Council Considers Future of Devalued Property Investments in Secret

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Recent Comments

- Ian Macpherson on Updated: Main Guildford to Godalming Road Closed Until August 1

- Sara Tokunaga on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Michael Courtnage on Daily Mail Online Reports Guildford Has Highest-paid Council Officer

- Alan Judge on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- John Perkins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- S Collins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Ben Paton

February 19, 2022 at 3:29 pm

Under the last Conservative administrations, Guildford Borough Council had the inspired idea of using its powers to borrow cheap from HM Treasury and use the proceeds to invest in retail property.

Susan Parker of the Guildford Greenbelt Group was a lone voice at the council warning of the dangers. Have Guildford’s investments in retail property done any better than SCC’s?

GBC should report back to the electorate and hold those responsible for the loss of public money to account.

Editor’s response: A list of GBC’s property investments since 2011 has been requested.

Valerie Thompson

February 21, 2022 at 3:57 pm

Another example of GBC’s failed “openness and honesty” policy.

I thought they had promised to change with the demise of the Conservative majority.

joss bigmore

February 21, 2022 at 7:09 pm

This article is about SCC not GBC

Claire Morris

February 22, 2022 at 6:43 am

Perhaps Valerie Thompson should read the article properly as if she did she would realise it relates to Surrey County Council not Guildford Borough Council.