Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Comment: What Next for the House of Fraser Store?

Published on: 9 Aug, 2023

Updated on: 11 Aug, 2023

It’s hard to believe now but not that many years ago there was still talk of John Lewis opening a new “anchor store” in North Street, while Debenhams and House of Fraser were going concerns.

See: Closing Down Signs Suddenly Appear at House of Fraser – Store to Close in September

Today it is clear that, in common with many other towns, Guildford cannot even support one single department store.

It should be no great surprise. Many of us simply go online when we want to buy something (see cartoon right). Shoppers will do what they find most convenient and cost-effective.

It should be no great surprise. Many of us simply go online when we want to buy something (see cartoon right). Shoppers will do what they find most convenient and cost-effective.

Ask yourself when you last went to the High Street and what for? More to the point, when did you last buy something in the House of Fraser?

So what next for the store? Even those of us who rarely shopped there might not like to see its demise. The department store has been there either as Harvey’s, Army & Navy or House of Fraser all our lives, a familiar and reliable landmark, it seemed.

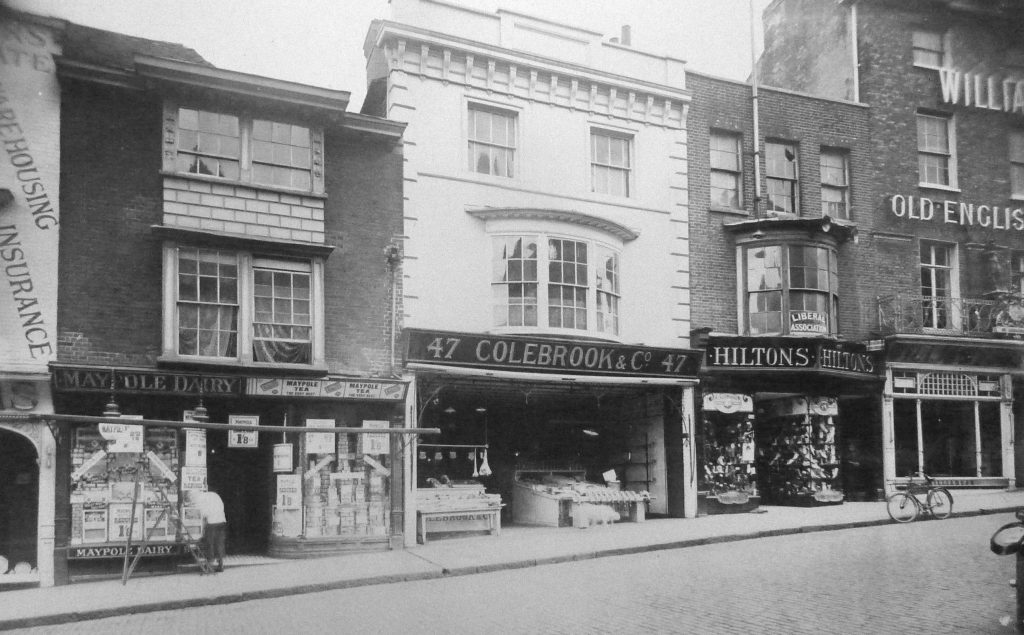

Before the current store existed – the outline of House of Fraser can be discerned in this early 20th-century photograph. Colebrook’s the butchers (founded in 1827) and boot makers and retailers Hilton’s and Williamson’s, the furniture retailer to the right all became part of Harvey’s in the 1950s, then Army & Navy and then House of Fraser. What next?

But being a landmark does not pay the bills and if income is insufficient to pay the rent and rates, as well as all the other overheads, a business cannot survive.

Exactly what triggered the decision to close down at the end of September is not known. Rumours of break clauses in the lease remain just that and House of Fraser has declined to comment.

Another rumour is that Fenwicks, who recently announced they’d be closing their flagship store in Bond Street, is expected to take on the store and some of the staff who, by all accounts, were given little notice of the closure announcement.

Fenwicks has also failed to respond to our request to comment.

We do know from documents on public record that Canada Life purchased the freehold in 2009 for £31 million and that the whole property is leased to House of Fraser (Stores) Ltd until July 2039.

It seems most unlikely that Fenwicks would want to take on the whole 17,581 square metres of floor space, nor pay the current annual rent of £2.7 million and rates of £910,000 (tellingly revalued down from £1.7 million this year, which says a lot about the store’s profitability), although those in the know tell us that is “fairly low cost” for Guildford High Street.

Canada Life bought the property in March 2009 for £31 million. What its role might be in the House of Fraser closure is unknown, the leasing structure might be multi-layered. According to its website they have a fund size £258.8 million invested in 29 UK properties. [see:https://www.

Canada Life bought the property in March 2009 for £31 million. What its role might be in the House of Fraser closure is unknown, the leasing structure might be multi-layered. According to its website they have a fund size £258.8 million invested in 29 UK properties. [see:https://www.

There has been speculation for some time the store had become unviable in its present form leading to speculation that while the ground floor could be retained as retail the upper floors could be converted to residential or perhaps a hotel.

Time will tell. The main hope must be that Guildford is not left with a large decaying and empty store in its prime location, which surely would be bad for our town.

Perhaps the government should introduce some swingeing penalty taxes on retail premises left empty? That might encourage landlords to reduce rents making them affordable for entrepreneurs with fresh ideas.

Responses to Comment: What Next for the House of Fraser Store?

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.Recent Articles

- Mr Carpenter’s Byfleet Seedling and Other Varieties of Apples

- Guildford MP Visits Local Satellite Firm During 40th Anniversary Year

- Letter: Only a Town Council Will Give Us to the Option to Choose on Some Local Services

- Comment: Parish Councils – Who Cares?

- Update: North Street Re-opened

- Letter: Parish and Town Councils Will Become More Essential Than Ever

- Plans for Several Railway Repair Projects Over August Bank Holiday

- Letter: We Should Thank Parish Councillors

- Notice: Guildford Area u3a Group Enrolment Day, Tuesday, August 12

- DNA Test Breakthrough Led Police To Solve £35,000 Bramley Burglary

Recent Comments

- Jan Messinger on Letter: Only a Town Council Will Give Us to the Option to Choose on Some Local Services

- Jan Messinger on Comment: Parish Councils – Who Cares?

- Fiona White on Letter: What Do Parish Councils Do?

- Jim Allen on Letter: What Do Parish Councils Do?

- Nigel Mitchell on Letter: We Should Thank Parish Councillors

- Jan Messinger on Letter: We Should Thank Parish Councillors

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Anna Windebank

August 29, 2023 at 12:53 pm

I do hope that Fenwick takes it on with some radical and imaginative ideas, to pump some new blood into the idea of The Department Store.

I have loved them since I was a child and am gutted that we are losing our own.

I remember Harveys of Camberley used to have fashion shows with live models in the cafe, when I was a kid; they were extremely popular. Why not some equivalent blue-sky thinking in 2023?

Jane Mercer

October 1, 2023 at 9:00 am

A John Lewis department store in the centre of Guildford would be just what the High Street needs. One of there stores would be fantastic in Guildford.

Ben Paton

October 1, 2023 at 9:52 pm

Department stores have been going the way of the Dinosaurs for decades – extinct.

The figures in the article show the impossible economics they are up against.

The article states that:

1) Canada Life paid some £31 million for the store

2) the store has some 17,600 square metres of space.

That gives a capital cost for a square metre of nearly £1,800.

To make a nominal return of 10 per cent on that area would require a net profit after tax of £180 per square metre. (A real 10 per cent return after inflation would require a much higher net profit.)

It is very hard, perhaps impossible, to see how that can be done given that the cost of a virtual square metre on the internet is much lower and a search engine will drive “footfall” to a virtual square metre more cost effectively than the falling “footfall ‘magnetism'” of bricks and mortar High Streets.

Guildford High Street has not been a sufficiently attractive shopping destination for decades. This further illustrates the insanity of Woking Borough Council when it borrowed a billion (or billions) to invest in bricks and mortar retail space in Woking. It also explains why the Guildford Local Plan’s intention for North Street to be a “retail led” development was nonsense from the start – just like the rest of the Local Plan.

The build cost of a residential square metre in England is £2-3,000. So Canada Life’s only alternative use that may recoup its investment will be conversion of most of the space to residential use.