Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Hint of Plan to Turn House of Fraser Store Into High Street Hotel

Published on: 7 Aug, 2020

Updated on: 7 Aug, 2020

A proposal to convert the upper floors of the House of Fraser department store on Guildford High Street to a hotel is being investigated by a mystery developer, a well-informed Guildford source has said.

Word is that Guildford Borough Council will soon be approached for pre-application consultation to explore what would be acceptable to the Planning Committee.

Cllr John Rigg (R4GV, Holy Trinity), lead for Regeneration, said he had heard nothing about the proposal but pointed out that there had been a shortage of hotel accommodation in Guildford.

Two of the practical considerations for an upper-floor hotel scheme would be parking and access to an upper floor lobby from street level. The ground floors would remain for retail use.

Mike Willoughby, of property agents Green & Partners who are advertising the major High Street site [insert image] along with nine other town centre commercial properties [insert link], said there had been”some interest” in the property but added: “I can’t really say anything. The council would need to be approached if a change of use was envisaged.”

Mike Willoughby, of property agents Green & Partners who are advertising the major High Street site [insert image] along with nine other town centre commercial properties [insert link], said there had been”some interest” in the property but added: “I can’t really say anything. The council would need to be approached if a change of use was envisaged.”

The whole property is still listed on their website as available to rent with a message, “Contact us for price”. The rateable value for the House of Fraser website is £1.8 million. but estimates of the business rates chargeable range from £330k to £900k. The rent is also likely to be within that wide range.

House of Fraser was bought by Mike Ashley’s Sports Direct for £90 million in August 2018, at the time considered a knock-down price. He invited bids to rent in February last year (2019).

Guildford already has 10 hotels in town with rates from around £55 currently, and 23 others within the borough or nearby. The town centre hotels include the traditional Angel, also on the High Street just yards away, also with no parking, and the modern Guildford Harbour Hotel at the top of the Upper High Street. Most appeared to have vacancies at the time of writing (evening August 6).

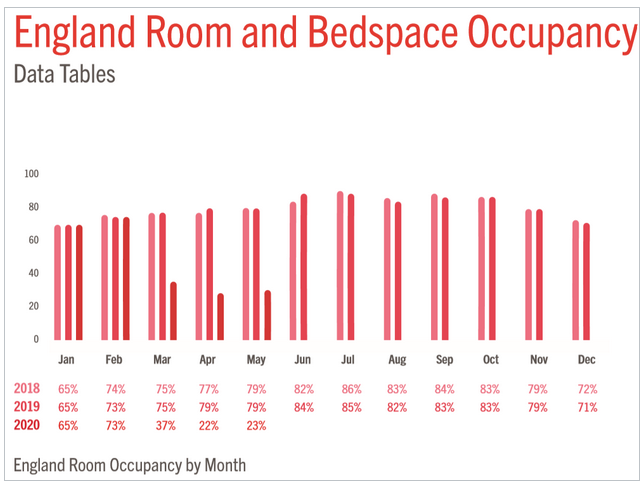

The hospitality industry has been hit hard by the pandemic and job losses are mounting. Occupancy rates across Britain have been much reduced, the VisitBritain website shows that in April and May they were only 22 or 23 per cent of normal levels.

But with interest rates so low investors might feel now is the time to take a gamble especially as there is so much uncertainty about future demand for retail premises.

An article published by property agents Knight Frank says: “The key … is the speed with which the markets recover after major events such as the economic downturns in 2001 and 2009. This provides us with confidence when forecasting the likely pattern of recovery this time around. While there are many unknowns, there is hope for a reasonably swift return to positive growth figures.

“The severity of the economic downturn will likely have a more lasting impact on the performance of the regional UK hotel market. Corporate budgets are likely to be squeezed, and the level of unemployment will dictate the disposable income available and therefore the propensity to spend on leisure-based experiences.”

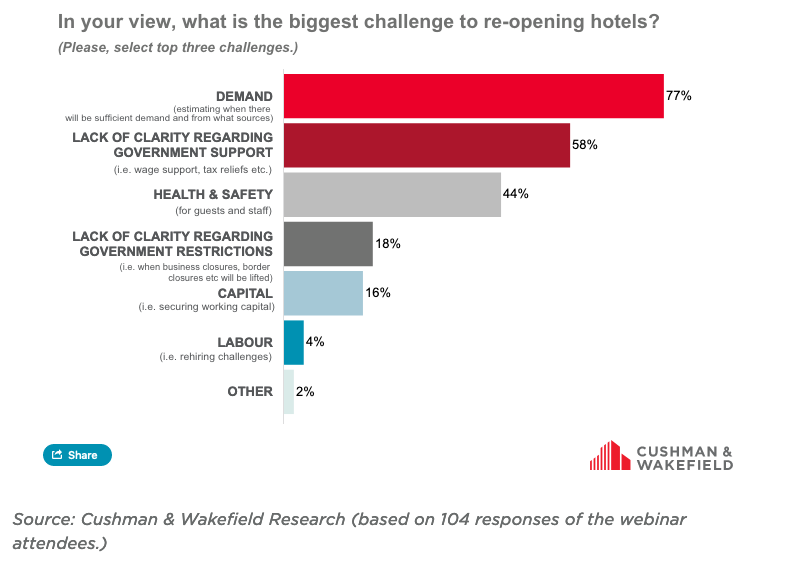

The hospitality and leisure industry contributes 5 per cent of national GDP and accounts for 10 per cent of employment in the country, according to UKHospitality. Uncertain demand was seen by those in the sector attending a webinar conference as the biggest challenge they faced.

Elsewhere in the town, property fund manager M&G Real Estate is still believed to be trying to sell its freehold of the riverside Debenhams site. A proposal that Berkeley Homes redevelop the site as housing is understood to have fallen through with the company preferring to concentrate on its involvement with the North Street redevelopment projects.

Elsewhere in the town, property fund manager M&G Real Estate is still believed to be trying to sell its freehold of the riverside Debenhams site. A proposal that Berkeley Homes redevelop the site as housing is understood to have fallen through with the company preferring to concentrate on its involvement with the North Street redevelopment projects.

On April 22, CoStar News reported Bourne Capital was in talks to buy the freehold interstate’s in the to-be-vacated Debenhams department store from M&G Real Estate for about £23 million.

Alastair Smith, of the Guildford Society, said: “Bourne Capital is an odd company owning an eclectic portfolio including Ronnie Scott’s. One of the directors is Sally Greene (married to the MD). She has a long track record in renovating theatres and is a big influencer in the performing arts etc. If they become owners, they might do something interesting.”

And in White Lyon Walk plans to modernise the arcade announced in September (2019) by Redevco which was reported to have purchased the centre for about £12 million seem to have been delayed by the pandemic.

Andrew Vaughan, Redevco’s CEO, said at the time of the purchase: “White Lion Walk is strategically located in the centre of Guildford and connects the town’s two main retail pitches, which means it benefits from a naturally high footfall of passing shoppers.

“Redevco plans to modernise the arcade, which is already well-positioned for redevelopment, to make it a more attractive shopping environment and create a more exciting tenant mix. This is in line with our strategy of investing only in areas where we can add value by creating good-quality retail space that serves the needs of the local community.”

See also: Ashley Puts Guildford’s Giant House Of Fraser Building Up For Let

Responses to Hint of Plan to Turn House of Fraser Store Into High Street Hotel

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Museum Shines a Light on Victorian Send, Ripley and Pyrford

- Guildford Festival Burst with Colour, Culture and Community Spirit

- Conservationists Celebrate Victory As Fast-food Plan At Nature Reserve Is Turned Down

- Incident in High Street – Man Found Unresponsive

- Letter: The Weyside Scheme Is Not Going To Be GBC’s Woking

- Guildford’s First “Bike Bus”

- Notice: Free Bandstand Concerts

- Councillors Hear How the Weyside Urban Village Project Became a Multi-million Risk

- NHS Surrey Issue Heatwave Advice Following Met Office Warning

- Guildford Charity’s Tribute To The Great Stevie Wonder

Recent Comments

- S Callanan on Letter: A Simple Footbridge Should Have Been Affordable to Keep Towpath Over Weir Open

- Helen Skinner on Guildford’s First “Bike Bus”

- Tony Harrison on Busy First Half of 2025 for Scouting in Guildford

- John Redpath on Letter: Front-line Police Officers Are Heroes But Admin and Comms Need Improvement

- Angela Richardson on Letter: A Simple Footbridge Should Have Been Affordable to Keep Towpath Over Weir Open

- Jim Allen on Letter: Front-line Police Officers Are Heroes But Admin and Comms Need Improvement

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Susan Kay-Attwood

August 7, 2020 at 12:57 pm

Seems a weird idea for House of Fraser.

Why do they want to develop White Lion Walk? Everyone loves the shops in there.

If they try and do what was done to The Friary Centre we’ll lose some more great shops.

Wayne Smith

August 9, 2020 at 9:13 am

House of Fraser has not appealed to customers for a long time. No investment, overpriced, old and outdated, poor web offer, poorly maintained shop.