Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Property Speculators Inhibits Housing Affordability

Published on: 16 Apr, 2016

Updated on: 16 Apr, 2016

Overseas Buyers are forcing up house prices by a system know as “flipping”.

The system works by gambling on properties before they are built. Homes are bought off-plan by paying ten to fifteen per cent deposits, the remaining cost is not payable until the buildings are completed.

It is possible to make large profits by selling on these investments. An example given in a recent Times article is a £300,000 property secured with a £30,000 deposit. Once the value increases to £400,000 the right to buy is sold and a profit of £100,000 pocketed.

This process is quite common place in large city areas but there is evidence that outlying areas of London can now be effected.

Such a scheme certainly hinders many families achieving their ambitions of owning a home of their own.

Central government should act now to frustrate these buyers who have no intention of taking up residents in the UK.

Responses to Letter: Property Speculators Inhibits Housing Affordability

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

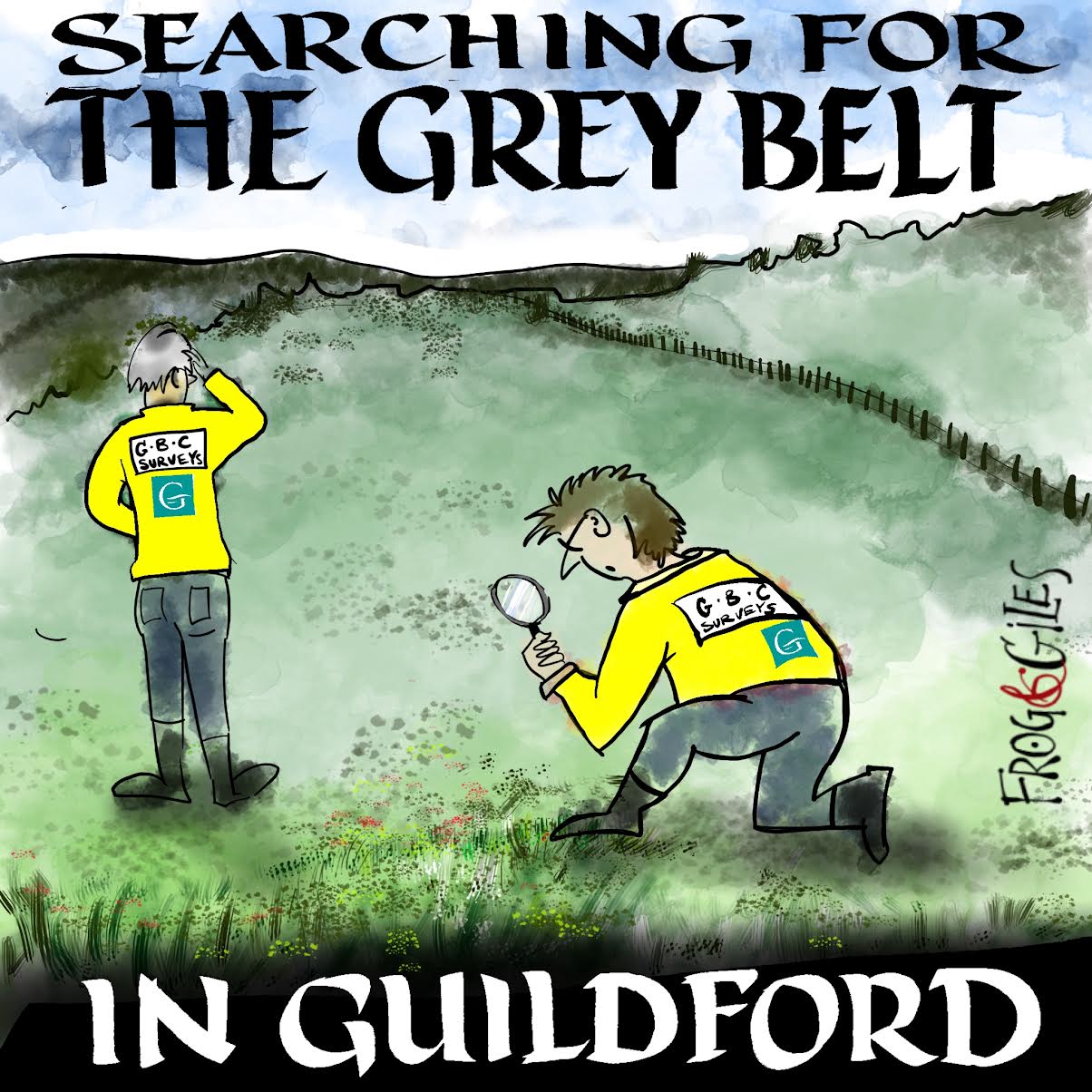

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

Recent Articles

- Postcode Lottery Police Funding – It ‘Cannot Be Fair’ Says Police Commissioner

- Heartbreak for City Again as Two Extra-time Goals Snatch Victory

- Letter: All Three Major National Parties Are Relaxed About Green Belt Giveaways

- Updated: Ash Level Crossing Decision ‘Was Made Without Approval of Surrey Highways’

- Sara Sharif Trial Latest – ‘Fear and Violence Reigned’ in Sara’s Home

- Dragon Interview: Julia McShane leader of GBC’s Lib Dems

- Letter: Ash Bridge – We Need Accountability and Competence

- Letter: SCC’s Final Decision is Unlikely to Put an End to the Issue of the London Road Layout

- Only Cabinet Members Will Speak at SCC’s Meeting to Decide on London Road Scheme

- Highways Bulletin for November 25

Recent Comments

- Jane Hughes on Sara Sharif Trial Latest – ‘Fear and Violence Reigned’ in Sara’s Home

- John Ferns on Ash Level Crossing Will Close Before Opening of New Road Bridge

- Olly Azad on Ash Level Crossing Will Close Before Opening of New Road Bridge

- Roshan Bailey on Student Named Land Based and Horticulture Learner of the Year

- Frank Emery on Ash Level Crossing Will Close Before Opening of New Road Bridge

- Paul Robinson on Letter: The Active Travel Proposal Is the Safest Option for London Road

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Jules Cranwell

April 19, 2016 at 4:32 pm

The government could solve this at a stroke, by:

1. Imposing Capital Gains Tax on profits made by overseas investors from flipping.

2. Imposing a tax on properties owned, but left empty, by overseas investors.

Why don’t they?

I’ve read various reports that up to 80% of properties being bought in London off-plan go to overseas speculators. This now is apparently being exported to Guildford, as opportunities dry up in London.

GBC’s unchanged plan to concrete over the green belt will benefit these speculators most, to the detriment of Guildfordians most in need of housing.

John Perkins

April 20, 2016 at 9:18 am

I agree with Jules Cranwell. I’m not entirely sure how a tax on empty properties would work, but it’s probably worth pursuing.

Another factor is Stamp Duty, which can still be avoided by ‘foreign’ investors. The government says they will pay the surcharge if they “own another property anywhere else in the world”, but they don’t say how that can be established when the beneficial owners are not known. The tax should be mandatory.