Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Council Tax Calculations

Published on: 14 Mar, 2024

Updated on: 15 Mar, 2024

In response to: Have You Received Your Council Tax Bill? – Lessons from Austerity and Beyond

Thank you, Bernard Quoroll, for his thoughtful piece. It is helpful to have such clear thinking in a time of heated political obfuscation.

Can I just point out a couple of mathematical errors on my council tax bill which I suspect are present on everyone else’s bills as well.

There is an analysis of the breakdown of the increases across four groups which appears to show an impossible result – the total increase is 4.7 per cent, and yet none of the constituent elements is increasing by more than 4.2 per cent!

A careful comparison with last year’s bill shows that the Surrey County Council increase is actually 3.43 per cent and so should be shown as 3.4 per cent on the bill, and more significantly the Surrey County Council adult social care precept is actually increasing by 15.37 per cent (not 2.0 per cent as shown – I suspect that someone rounded 1.53 up to 2.0 not noticing the position of the decimal point).

It doesn’t help the political fog in which we live when basic mathematical facts are not checked properly before such documents are sent out.

A SCC spokesperson responded:

On council tax we follow the legislation available here: The Council Tax (Demand Notices and Reduction Schemes) (England) (Amendment) Regulations 2022 (legislation.gov.uk)

Everyone wants to do the increase by dividing this year’s council tax by last year’s – hence the [Mr Hughes’] comment that our ASC precept has increased by 15 per cent.

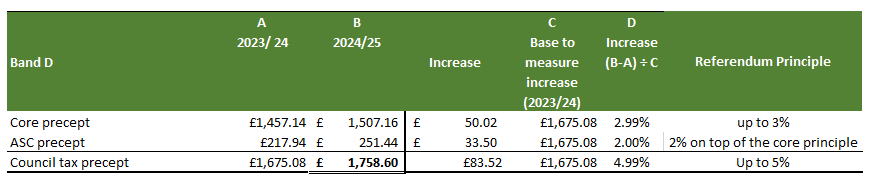

But the legislation requires that we use the total council tax from the prior year as the base (the table below shows it hopefully more clearly).

It is essentially a calculation, where the increase in precept between the 2 years is then divided by the total council tax base from the prior year. (B-A) / C

The Council Tax increase

We are required to show the 2 x SCC increases separately on the bills.

In determining the increase residents might use various methods of calculation – we follow the legislation (at the above link) on how to calculate this. The correct method is as follows:

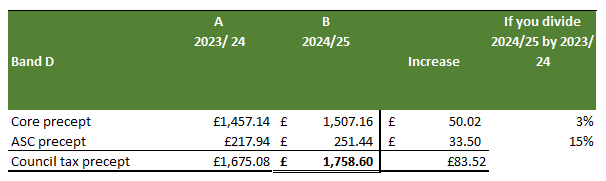

Calculate the increase on the prior year for the two elements, then divide that by the total base from the prior year 50.02 / 1,675.08 = 2.99% (see below)… An incorrect method of calculation would be to take the 2 elements and divide the 2024/25 value by the year before (2023/24) value. Such as like this:

An incorrect method of calculation would be to take the 2 elements and divide the 2024/25 value by the year before (2023/24) value. Such as like this:

Responses to Letter: Council Tax Calculations

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.Recent Articles

- New Parish Councillor Says Funds from Developers Must Benefit the Local Community

- Tests at Paddling Pool Showed Water Was Too Alkaline, Says GBC

- Letter: Our Residents Want CIL Money Properly Used for Infrastructure Without Delay

- Charity’s New Programme Meets Needs of SEND Children Without School Places

- Pasta Evangelists to Open First Restaurant Outside London – Right Here in Guildford

- Police Seek Witnesses to Park Barn Assault

- Notice: Rosamund Community Garden

- Village School Set to Close Due to Falling Birth Rate

- Letter: Waverley’s Management of CIL Money Is Morally Questionable

- Dragon Interview: MP Hopes Thames Water Fine Will Be ‘Final Nail in Its Coffin’

Recent Comments

- Patrick Bray on Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

- Mark Percival on Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

- George Potter on Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

- Helena Townsend on Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

- Peter Martin on Conservative Claims on Use of CIL Payments ‘Political Theatre’ Say Lib Dems

- Lauren Atkins on Conservative Claims on Use of CIL Payments ‘Political Theatre’ Say Lib Dems

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Martin Elliott

March 14, 2024 at 4:51 pm

Basically SCC and HMG are being disingenuous in presenting the ASC precept, as they have been every year since it started. It’s a ring-fenced uplift on the normal County Council Tax.

What they quote is the percentage for this year’s allocation.

However it stays in force for another four years, so the actual total revenue is more than a 10 per cent addition of the County Council Tax.

It would be a lot more honest to admit this and absorb this “extra” into the normal ASC already in the budget, and just “ring-fence” in the budget protocol.

A lot more honest than an invoice that says 2 per cent and then presents a sum of more than 10 per cent.

Graham Hughes

March 14, 2024 at 5:22 pm

Well, this is a most interesting revelation for which I thank the SCC spokesperson. I always suspected that the law was an ass and now we have the proof!

It seems to me that the presentation of these figures on the printed council tax bills is designed to deceive and I am confident that any school pupil presenting percentages in this way in a GCSE exam would score no marks.

Maybe it would help if a sub-total could be included in the bill presentation just below the two SCC items showing the combined total of the SCC and SCC adult social care precept (£1,758.60 in the above example) and the combined increase of 5 per cent beside it.

Normally, it would be mathematically incorrect to add the two percentage elements to get the overall increase but if this is how the law decrees the calculation must be done then we need the extra row in the table to understand it.

Lottie Harding

March 14, 2024 at 7:58 pm

The regulations are crazy and result in a high volume of calls and complaints to every council in the country every year to complain about the fact the percentage increase in the adult social care precept is wrong.

Many council staff get fed up with the sarcastic comments they receive about being idiots and unable to calculate a basic percentage that a 10 year old could calculate. If DLUHC took the calls and the stick, maybe they’d change the regulations?

J Holt

March 15, 2024 at 10:10 am

It seems to me that the two calculation examples at the end of the article have been swapped.

At the moment the examples do not agree with the text.

This is most confusing.

It would be good if this could be corrected (if it is in fact wrong).

Editor’s response: You are quite right, I apologise for the error. Thank you for pointing it out.