Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Opinion: Have You Received Your Council Tax Bill? – Lessons from Austerity and Beyond

Published on: 6 Mar, 2024

Updated on: 7 Mar, 2024

By Bernard Quoroll

Former local authority CEO and former “independent person” at GBC

In this opinion piece, Bernard Quoroll uses his extensive experience to give an insight into the financial challenge faced by Guildford Borough Council and many others…

Like most of you, I have just received my new Council Tax bill.

The most immediately obvious thing is that it is some £20 per month higher than last year, when calculated over a ten-month period.

I now also know that while GBC escaped the necessity of issuing a Section 114 “bankruptcy” notice, it still had to take many of the short-term cost-cutting measures for the current year and beyond, that would have been required under Section 114. In that sense, it could be said to have escaped technical bankruptcy in name only.

I now also know that while GBC escaped the necessity of issuing a Section 114 “bankruptcy” notice, it still had to take many of the short-term cost-cutting measures for the current year and beyond, that would have been required under Section 114. In that sense, it could be said to have escaped technical bankruptcy in name only.

One of the recently issued council tax bills. Band E council tax has increased from £1,940 in 2015 to £2,787.

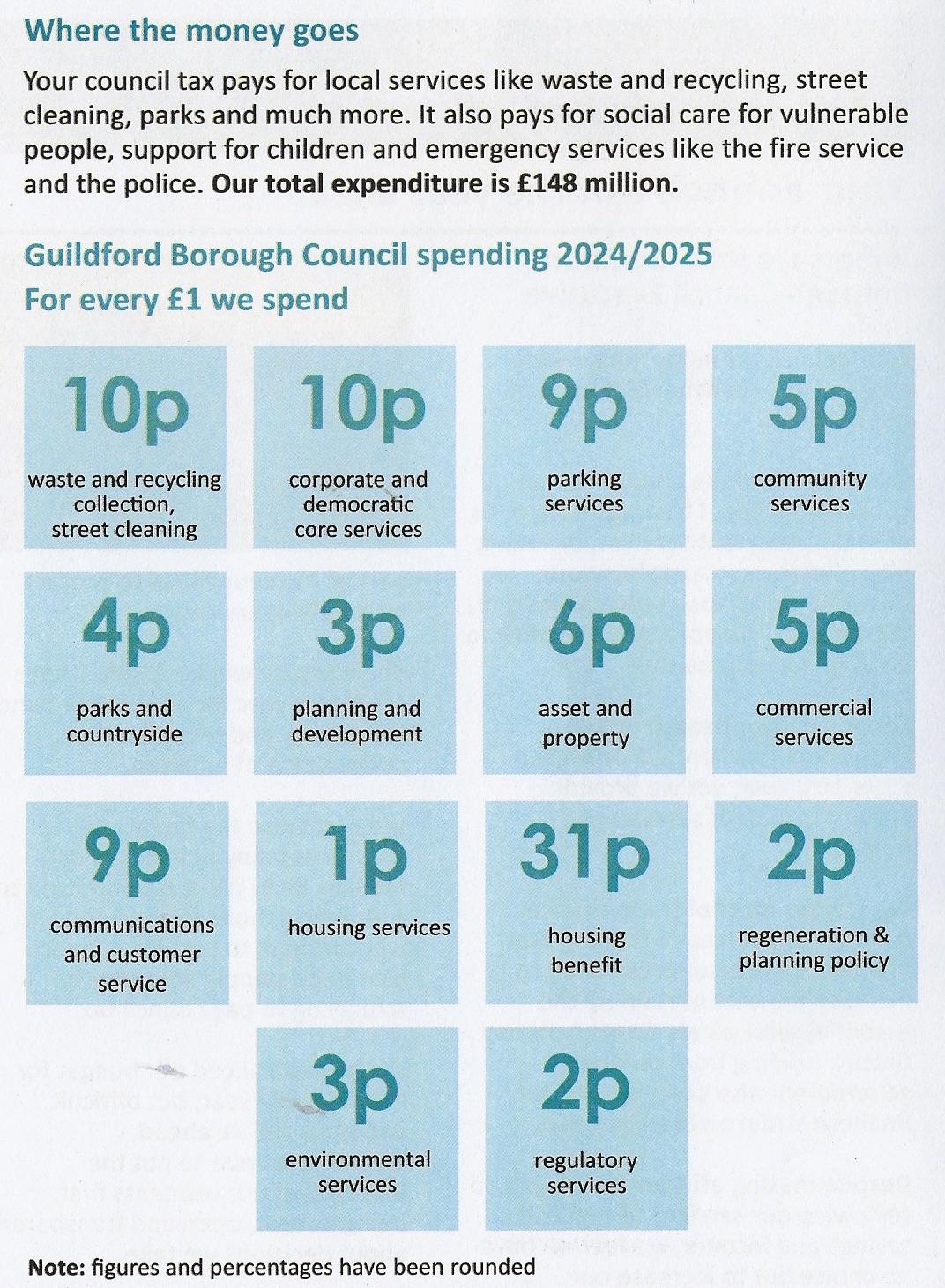

Whilst it is now clear that we are all paying GBC more money for less services, the extent of the reduction in those services is less clear. This is in part because not everybody in the community receives every service, so the pain of service reduction is less visible or felt less uniformly.

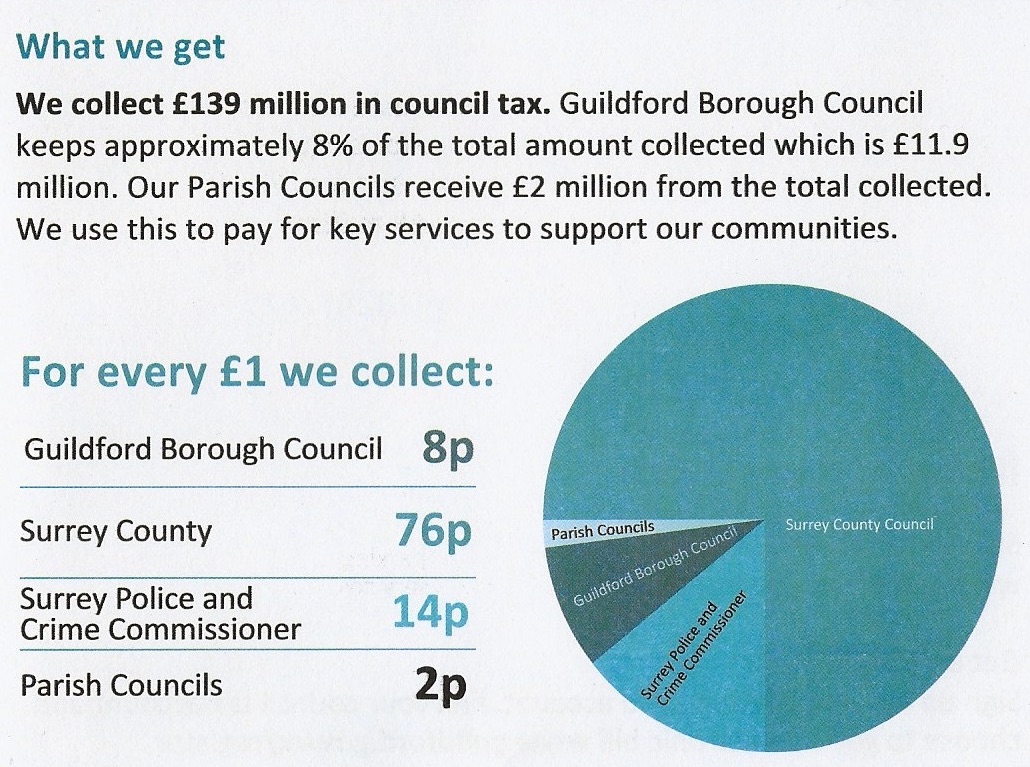

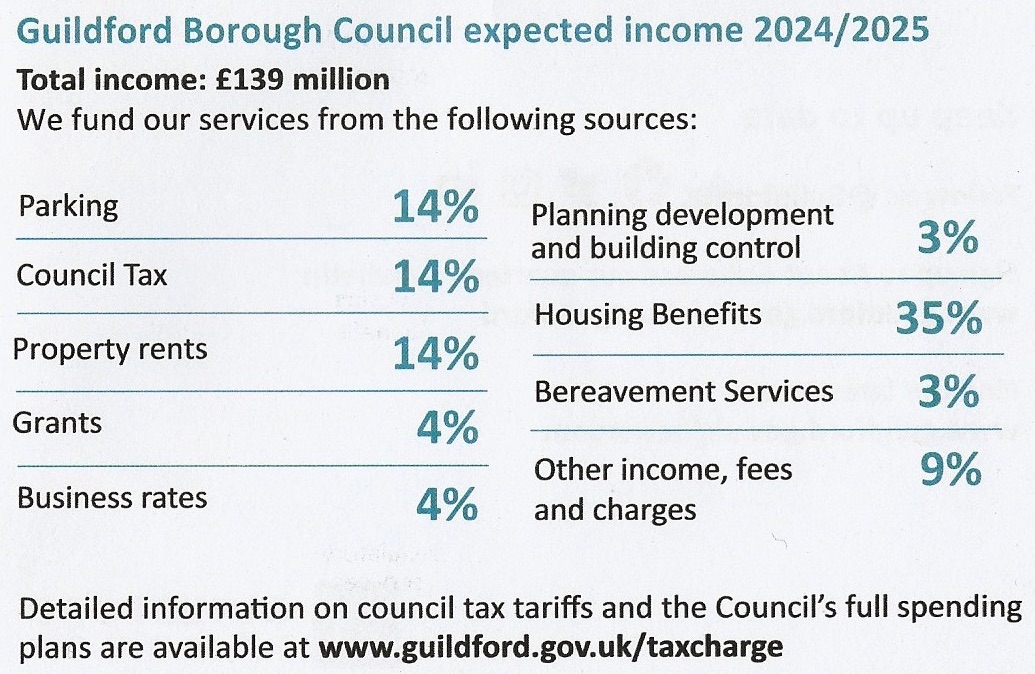

Reductions in service are also sometimes presented as efficiency measures when they are really cuts, for example in the frequency of waste collection, if that were proposed. And GBC’s 8 per cent share of the tax, is by far the smallest element of the combined costs of all the other local service providers, such as Surrey County Council and Surrey Police, which have their own explanations to offer for changes in their costs.

Reductions in service are also sometimes presented as efficiency measures when they are really cuts…”

GBC’s account of how they spend their budget. Taken from GBC leaflet. (Please note the original version of this article inadvertently included images from last year’s GBC Council Tax leaflet. We apologise for our error.)

But the effects of such heavy service reductions taken as a whole (and cumulatively since austerity began in around 2010) are no less real. Such direct and indirect service losses impact heavily on local resilience and wellbeing and in that sense affect us all in our interdependence but especially those who need them most.

They also fall hardest on so-called discretionary services, such as leisure, sport and grants to local theatres and greatly valued voluntary bodies like Citizens’ Advice. But even that is not the end of the story.

First, financial pressures will continue into and well beyond the 2024/5 financial year. There are no signs at all that those pressures are going away and if anything, they seem only likely to get worse.

Expect also to hear more and more tired assertions in the run-up to the next general election, about the need for local government to manage better, improve productivity, use consultants less etc.

Whilst those things are always true as managerial generalisations, (and perhaps especially so in Guildford which lately appears to have lost its way), such platitudes have always been the political stock of governments of all persuasions, when trying to convince voters that not one of the current problems is their fault.

How council tax, collected by GBC on behalf of all recipients, is distributed. Taken from GBC leaflet

The simple fact is that much of such savings potential has already been explored, or simply dwarfed by the scandalous extent to which central government has consciously starved local government of funds since at least 2010. So bad is it that it has been reported that half of all councils will face bankruptcy next year.

Second, our elected representatives need to satisfy themselves even more stringently and carefully that the rewriting of financial controls and the training of budget holders in GBC is going forward at pace and that timely monitoring of expenditure is being undertaken at both managerial and political levels.

failing to manage is managing to fail”

Neither senior officers nor elected members will be forgiven if found asleep at the wheel twice (or even a third time if current housing failures are added to the list).

Many councillors in my experience find this kind of stuff boring and quickly lose interest in the routine of monitoring financial matters in favour of “making a difference”. But “failing to manage is managing to fail”.

Put simply, a growing public awareness of the extent to which central government has deprived local government of funds since at least 2010 should not detract from local government’s continuing obligation to live within its means and manage its resources effectively. To put id mildly, GBC still has some way to go in demonstrating that it can manage its finances properly.

Thirdly, there are as yet hidden consequences from the actions about to be taken by councils (including Guildford) in selling off non-performing commercial assets to reduce the burden of their debts.

Revenue and capital budgets have traditionally been managed under different financial rules in local government and for good reasons. But after austerity began, central and local governments almost conspired to encourage local government to build up property investment portfolios whose income could be used to help offset reductions in central government funding. This was fuelled in part because councils can traditionally borrow money less expensively than the private sector.

Revenue and capital budgets have traditionally been managed under different financial rules in local government and for good reasons. But after austerity began, central and local governments almost conspired to encourage local government to build up property investment portfolios whose income could be used to help offset reductions in central government funding. This was fuelled in part because councils can traditionally borrow money less expensively than the private sector.

property investment is cyclical and risky”

It was a very bad idea for many reasons, even before austerity. Firstly, many councils were slow to understand that if you buy property for any purpose, you have to invest in its maintenance and renewal, (which itself costs additional monies), not just treat investment properties as cash cows.

If you don’t do that, the value of the asset diminishes when you come to sell. Secondly, local authorities are not skilled at making speculative investment decisions. They are supposed to be cautious when making decisions about spending public money and for good reason.

If you want to understand why, just look at Woking’s problems.

Third, property investment is cyclical and risky. Market values and interest rates can change fast and unpredictably. It is not a game for amateurs, however well-meaning. It is important because the capital numbers involved in many councils dwarf shortfalls in annual revenue. All this was entirely predictable but once the Audit Commission was abolished there was no independent organisation around ready to point this out.

Councils are now under pressure to return non-performing commercial assets to the marketplace so as to get them off their books. But each disposal needs to be considered in the light of their ongoing stewardship of the asset.

Was the asset bought at an overvalue: was its value properly maintained and enhanced during ownership; is the timing of disposal appropriate or is it likely to be a fire sale; is the disposal mechanism competitive or otherwise justifiable; does the council fully understand the potential for enhancement of value by further investment or land assembly and so on?

Only when those questions have been answered on a case-by-case basis will taxpayers and other scrutineers know whether their local council is acting prudently and learning lessons for the future.

Politically led councils will typically not want to do that but if not, lessons will not be learned and the property investment industry will have a field day at the expense of the public purse.

For the avoidance of doubt, I am not a member of any political party nor ever have been. My career was in Local government so I am, of course, not in that sense disinterested. I am writing because I think that it is important not to make avoidable cyclical mistakes.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments