Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Debenhams – Viability Assessments Are Misunderstood and Misapplied

Published on: 25 Nov, 2022

Updated on: 25 Nov, 2022

See: Single Vote Decides Debenhams Plan Following Wide-ranging Debate

If such large buildings are to replace Debenhams it is a tragedy that only 3 per cent of the flats will as is reported will be affordable.

The Planning Committee was told that the sales prices used in the viability study included a minimal premium for what is one of the best locations in the South East.

Also, according to the late papers provided, the value of the redundant department store had been under-assessed by £2.4 million.

No explanation was given for this last-minute change, but it would seem that a 30 per cent premium was added to the value of the redundant department store to induce the notional sale of this white elephant, which has to be strictly assessed on the basis that it can only be used for retail, and any prospect of an alternative use has to be disregarded when undertaking the viability assessment.

If this sounds bizarre it is merely what the government has legislated. These viability assessments are complex, subjective and somewhat surreal. They are also the reason that so little affordable housing is being produced nationally.

Additionally, in Guildford, with no explicit policy on building heights or density, we are often told that a development needs to be as big as is proposed on viability grounds. But these viability studies do not produce a definitive answer just a range of possibilities, so they are misunderstood and misapplied.

Many could argue that an owner of an obsolete department store, which could prove a liability incurring maintenance, security, insurance costs, and so on, would be keen to sell, without the need for any premium.

Instead, the rather subjective £2.4 million premium added to the land value is being used to justify an increase in the required revenue from the development, with no clear explanation provided as to why it has risen above that in the consultant’s submitted report posted on the GBC website.

As reported, GBC will put reviews in the section 106 agreement with the objective of getting further contributions to social housing if, once actual sales prices and building costs are known, the viability would have been higher than originally estimated.

This sounds great, but the precise terms of that review now need to be agreed. The council could end up with nothing even if viability improved significantly, or they could benefit substantially. With millions, and maybe tens of millions, of pounds at stake, it seems legitimate to ask whether the council might have found it easier to negotiate if consent had been deferred, rather than granted.

Just last week, GBC officers argued in the Guildford Local Plan Part Two Examination: Development Management Policies over a three-day period before a planning inspector, that they would get 100 per cent of any improvement. Developers at that enquiry (and not involved with Debenhams) argued that they should only pay 50 per cent.

Furthermore, could the fact that the initial viability study be negative, at the planning consent stage, justify a reduction in what is payable on review? I infer, following the last-minute change, that the latest viability study shows a deficit of £13.45 million, but that is not entirely clear to me and I doubt it was to the Planning Committee.

That’s not a real deficit of course because the developer is allowed 20 per cent profit before it is calculated. And that’s 20 per cent of proceeds not cost, which will be much lower. Most businesses operate on the basis of profit on cost, or in the investment world “IRR” (internal rate of return) or more meaningfully equity IRR.

Could the very generous profit provisions have anything to do with the extent to which the development industry lobbies the government, and the amount it contributes to the governing party’s coffers?

I would argue, that the past is the past and a review should simply reflect the circumstances when it is carried out. It will be very interesting to see what is ultimately agreed for the section 106.

Meanwhile, we look forward to the determination of the North Street Friary Quarter development scheme which is more than twice the size but, surprise, surprise, when I last looked offered no affordable housing and claimed a £60 million deficit.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

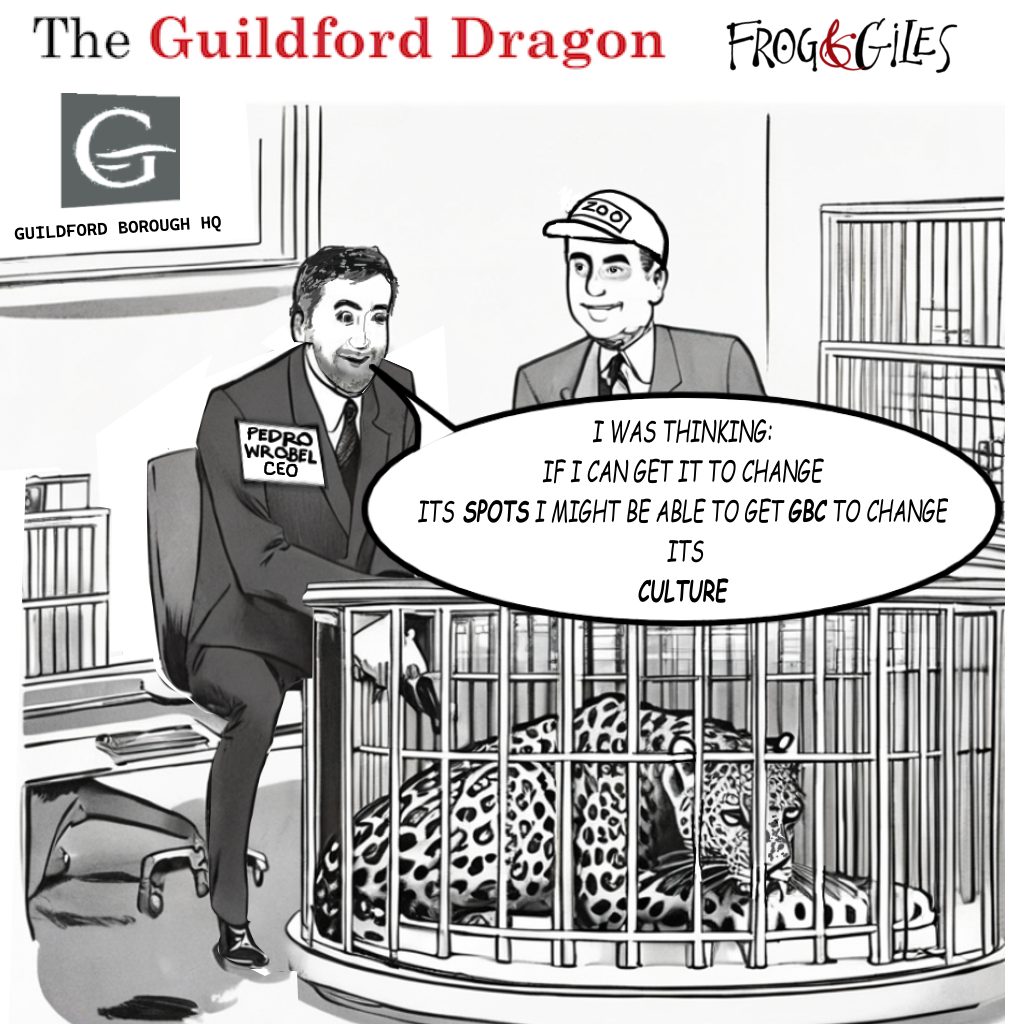

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments