Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Letter: Is Genesis Care the Right Kind of a New Beginning?

Published on: 18 Jan, 2022

Updated on: 18 Jan, 2022

former GP

The proposed new Cancer Care centre to be commissioned by the RSCH has been, up until now, discussed mainly in terms of the planning application to create a new multi-storey hospital car park. There was no suggestion that an NHS site was being handed over to a private hospital, although that is routine in today’s world of public/private partnerships.

It’s just one more example of the fire-sale of valuable, publicly owned NHS land that’s been accelerating over the last 25 years.

Vicky Mumford, assistant director of nursing cancer for the RSCH, was fulsome in her praise of Genesis Care, the company that will provide the new hospital, explaining that the new centre was of “paramount” importance in attracting “the right people” to work in Guildford, and offer “the best treatment”.

She views the importance of the partnership with Genesis in this way: “This is a wonderful, unique opportunity for us to partner with another organisation to provide both NHS and private healthcare with equipment that gives that opportunity for world-class outcomes. Cancer patients deserve the opportunity to have ease of access to their treatment. They deserve the best treatment.”

A glance at Wikipedia’s entry on Genesis Care will give you an inkling of possibly why the company might help attract the “right people” to work in Guildford – its doctors and managers have “a substantial stake in the business” (it doesn’t say whether the nurses, cleaners and technicians do).

The company is Australian in origin, and has gradually expanded globally, and in 2016 a majority share-holding (56%) was bought for A$1.6 billion (£800 million) by a consortium of China Resources – a vast Chinese state-owned corporation (2019 revenue $91 billion) and Macquarie Capital – an Australian global financial services corporation managing A$373 (£185) billion of assets.

Macquarie is most notable here in the UK for its involvement in UK water companies. Its controversial stewardship of Thames Water ended in 2017, having sold the company loaded with an extra £2 billion debt; but in August 2021 it bought a controlling stake in Southern Water, which in July had been fined £90 million for pumping raw sewage into the sea from the Kent and Hampshire coast. The nature of the People’s Republic of China, of course, needs no further elaboration.

We don’t know what the business plan of the RSCH’s Genesis Care cancer centre is, but Vicky Mumford says it will treat a mixture of NHS and private patients. Like most of the UK’s curious archipelago of little private hospitals, who seem somehow to evade the prevailing NHS model of hospital closure and centralisation, it seems likely a regular income stream of NHS funds (aka taxpayers’ money) will be not only important for its profitability, but essential for its viability.

Profitability is the keyword here because limited liability companies have a primary duty to secure as good a profit level as they can for their shareholders – it’s the bottom line that counts. The problem for the NHS, as more services are handed over to such companies, is its purpose begins to change from one of public service to one of servicing corporate business interests.

In three months, the new Surrey Heartland Integrated Care Board will assume responsibility for pretty much the whole of the NHS budget for Surrey. It will have the difficult task of divvying up what will almost certainly be a very tight budget among all the competing health providers in Surrey – GPs, hospitals, community services, mental health services etc.

Everyone will want a big a piece of the pie as possible. But with that enormous corporate power behind it, somehow I think Genesis Care won’t be kept waiting for their slice.

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Revealed Survey Shows SCC’s Preferred Two-unitary Option Has Least Public Support

- Highways Bulletin: Junction 10 Closures and Making Strides for Walk to School Week

- New River Boats for Surrey Care Trust

- Body Found in Woodland Believed To Be Missing 69-year-old

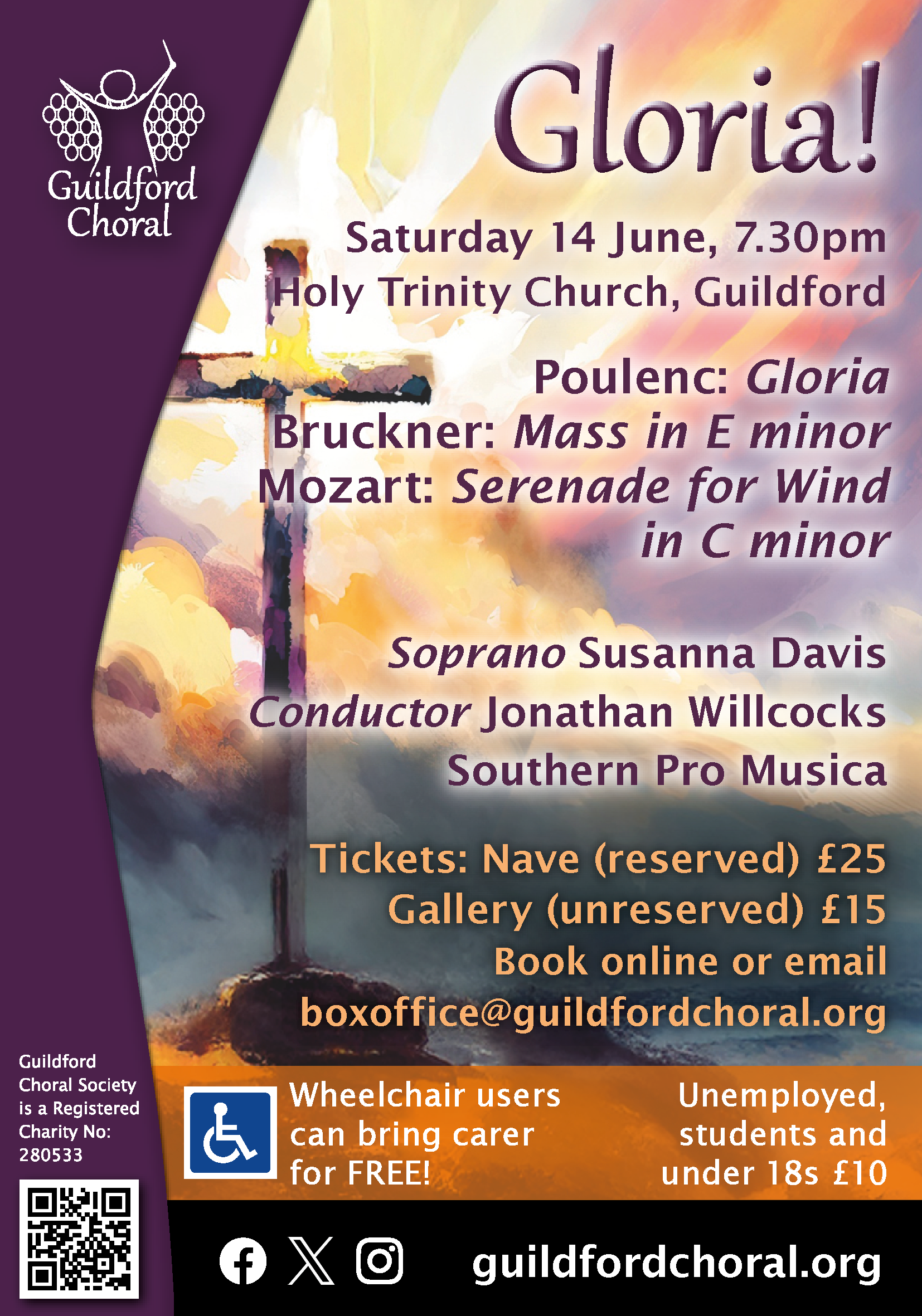

- Guildford Choral Promises a Summer Evening Spectacular

- Volunteers Are Needed To Test My Wearable Wellbeing Technology

- Mayor’s Diary: May 23 – June 8

- Work to Repair Cottage on Closed A281 Underway

- Letter: Not All PIP Claimants Need It

- AI Technology at the Forefront of Surrey Conservation Project

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments