Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Location, Location, Guildford: An Expert View of the Local Property Market – Autumn 2020

Published on: 16 Nov, 2020

Updated on: 17 Nov, 2020

Guildford estate agent James Quantrell, who has been selling houses in Guildford for over 18 years and who now owns and runs his own estate agency, reports on the local property market.

Is the housing market about to crash?

We all must admit it, when it came to property prices we had it so good for so long. They always seemed to go in one direction in Guildford and most of London, but all good things must come to an end.

We are now coming to the end of 2020. It should have been the best year so far. We were so wrong, it was a roller-coaster ride. 2020 will be remembered for the wrong reasons.

With Covid and the good old Brexit still in the air, the property market has taken a punch in the gut. International buyers into London have been slowly declining for some time but troubles in Hong Kong earlier in the year have seen a boost again into London.

What is more surprising is the smart Europeans investors buying into London, to offset possible losses in Brexit and the Euro. We have seen some interesting purchases from them. What does that tell you about the housing market in Europe? Let’s see how that plays out.

And what about Guildford in the last 12 months?

House sales

We did have a strong market in January 2020 and with a great start it was looking to be a fantastic year but Covid was already out there, the horse had already bolted. Fast forward to October and we are looking down the barrel to the worst year in sales that I have ever seen in my 18 years in estate agency and 25 years involvement with property.

Businesses closing down, people losing their jobs, incomes drying up, separations in families due to lockdown. These have all contributed to the decline of properties coming onto the market which is what we all feed off. No properties, no sales.

We are in what I call the “3D Market”: Death, Divorce and Debt. Unless there is a good strong reason to sell and move, then this is not the best time to sell or buy unless it is unavoidable or there’s a great deal too good to miss. Buyers don’t want to buy in a market when they can see a 10% to 15% drop over the next 12 months.

We are in what I call the “3D Market”: Death, Divorce and Debt. Unless there is a good strong reason to sell and move, then this is not the best time to sell or buy unless it is unavoidable or there’s a great deal too good to miss. Buyers don’t want to buy in a market when they can see a 10% to 15% drop over the next 12 months.

Has the reduction in Stamp Duty until March 2021 helped stimulate the market? Well yes and no. In the early stages, it was very positive and the market was recovering very well. Some sellers took advantage of this by securing a buyer quickly but some other sellers looked at the savings the buyers were making on the Stamp Duty and inflating their asking price, by doing this they missed the window and it is now closed.

Something that has affected the lower end of the market more and more, over the last few months, is mortgage companies pulling products that were very favourable to first-time buyers. With the furlough scheme, most employed buyers are being highlighted as a possible redundancy risk and this has forced the mortgage market to show due care and responsible lending.

Gone are the good old days of mortgages based on your income. Nowadays it is all about your disposable income. If Mr A makes £120,000 a year and has car finance, large mortgages, gym membership, kids in private school and £50,000 on his three credit cards then he might be living beyond his means and have only £1,000 disposable income each month. There’s not much wriggle room when bills mount up. Due care and responsible lending bells ringing in my ears.

Mr B is on £50,000 a year no finance on cars and lives at home with his parents and has £3,000 disposable income per month. A much better bet.

If the market swings by -15% and the buyer only puts down 15% as their deposit, then the property is already in negative equity Basically, the bank owns 100% of the property and all the risk. They will be left holding the baby if things go south. That is why unless you are a good, safe bet then it’s harder to get the best rates at the moment. Don’t give up Mr A, you will be able to get a mortgage but you’ll not get the best rates out there.

The rental sector

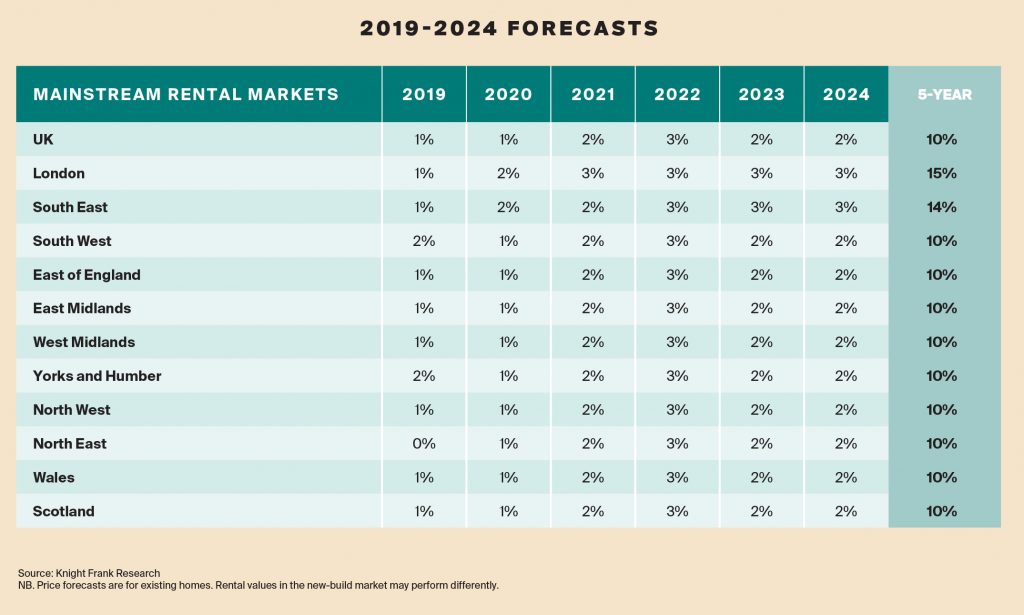

The rental market has been steady for a number of years and has been cheaper here than in most parts of London. The market at the beginning of 2020 was active with most properties being filled by the local market and international students. The London tenants tend to buy in Guildford instead of renting, because it’s cheaper.

Guildford has great links to London and is within the “Golden Hour”, ie door-to-door commute under 60 minutes. If the Guildford buyers are coming from the London area, then it is normal to buy unless they can’t find a suitable property to buy in Guildford that suits their needs and are forced to rent something temporarily. This in itself is a growing market with the lack of decent property for sale coming to the market in Guildford. This trend has been growing over the years.

I will discuss the student lettings market another time, but it is rapidly changing due to a number of factors including the University of Surrey building its own accommodation. This is affecting the local landlords and most of them are evaluating their position.

The Covid lockdown and resulting job losses have caused some rent arrears. A high number of our landlords have given rent holiday to their tenants. It shows they are not all money-hungry owners that don’t care about their tenants. We also have had other landlords that were happy to wait and give their tenants time to make up the rent over time the money owed in arrears.

At Guildford Estate Agents we had a “we are in it together“ attitude. It was good to see. We have been very busy with lettings this year and have had to bring in extra staff to cope with the workload.

This is down to a number of factors, the temporary tenants looking to buy, as mentioned, and tenants staying put because of uncertainty at work. Additionally, with more people working from home, a trend that is likely to continue post-Covid, they want a bigger home with some outside space and such homes are more affordable in the Guildford area.

We have asked James to report back in the new year.

Interesting property

Click here for more information.

If you would like to speak to James and his team about your property requirements as a buyer, seller, landlord or tenant call 01483 339977 or email: info@guildfordestateagents.com.

If you would like to speak to James and his team about your property requirements as a buyer, seller, landlord or tenant call 01483 339977 or email: info@guildfordestateagents.com.

And see its website at: https://www.guildfordestateagents.com/properties/sales

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments