Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Mole Valley’s Finance Director Warns ‘All the Low Hanging Fruit Is Gone’

Published on: 15 Nov, 2024

Updated on: 15 Nov, 2024

local democracy reporter

Mole Valley District Council is facing serious financial pressure and must make “very difficult decisions” over the future of its services.

The bleak warning came during a meeting of the scrutiny committee on Tuesday, November 12, when the grim outlook was laid bare to councillors.

Unless the council makes significant savings then “in all scenarios” reserves would fall significantly below minimum levels required in 2026/27 and be exhausted between 2027 and 2029, officers said.

Councils must balance their budgets and failure to do so can lead to section 114 bankruptcy notices being issued. When this happens all new spending must stop.

Anything other than drastic cuts would put Mole Valley “at such significant financial risk” that the council’s chief financial officer would likely be legally bound to consider using statutory powers – with commissioners brought in and the council losing day-to-day control of how it is run.

Mole Valley District Council’s executive head of service (Finance and Strategy), Claire Morris, a former financial director at GBC, said: “Essentially every local authority is facing very challenging savings targets.

“It is difficult.

“I think I need to be really honest and quite blunt with councillors. All the low hanging fruit, the easy wins, have been taken.

“We are now into making some very difficult decisions potentially.

“To achieve that savings target you will be asked to make some very difficult decisions.

“The alternative is equally less palatable. What we see by authorities that got into trouble and issued notices… is that they get taken over by commissioners and you lose control of your council.

“So I cannot give you any confidence that we will definitely achieve those savings targets.

“What I can say is that we will all, councillors included, work very very hard to achieve those savings and identify them.

“We should be honest with our staff and what this might impact on our services.

“It’s the honesty we will now have to face up to.”

The most high profile example of a council going effectively bankrupt locally is Woking Borough Council with debts approaching £2 billion, but other Surrey councils, including Guildford, are facing their own challenges.

Mole Valley District Council must find £1.8 million savings this year but has only managed to achieve £493,000 so far and is expected to fall short by about £1.2million.

Future years look even more challenging with costs expected to increase, and revenues fall.

The council currently makes enough money from its commercial investments to cover the annual interest rates and debt repayment costs, the meeting heard, but “is facing increased tenancy risks and additional costs as commercial leases are approaching break points or end dates and tenants are vacating the properties”, council documents said.

The council also expects any new tenancy agreements to be at lower values than at present.

Additionally there is “the risk of the council needing to incur significant capital costs of refurbishing investment properties but without a commensurate increase in income”.

Short-term cash flows have been hit by a double whammy of the council failing to sell assets, and the being unable to find anyone willing to rent office space in its civic centre.

Short-term cash flows have been hit by a double whammy of the council failing to sell assets, and the being unable to find anyone willing to rent office space in its civic centre.

Claire Morris said: “A key area was around the letting of vacant office space within this building

“We have not yet found a tenant.

“We are still marketing the property, so that is ongoing, but we are continuing to market and hopeful that we will get a tenant.”

As it stands, the council then must find a further £760,000 of savings or income for the 2026/27 financial year.

“It is also recommended that the council starts to develop plans to deliver at least £1.3million of further transformation savings for 2027/28 and 2028/29.”

During that time the council is forecasting its return on assets for decrease, while budgets had inflation forecasts at 2 per cent – adding pressure.

Cllr Gerry Sevenoaks, committee chair, added: “What is in front of us is undoubtedly some very high savings targets.”

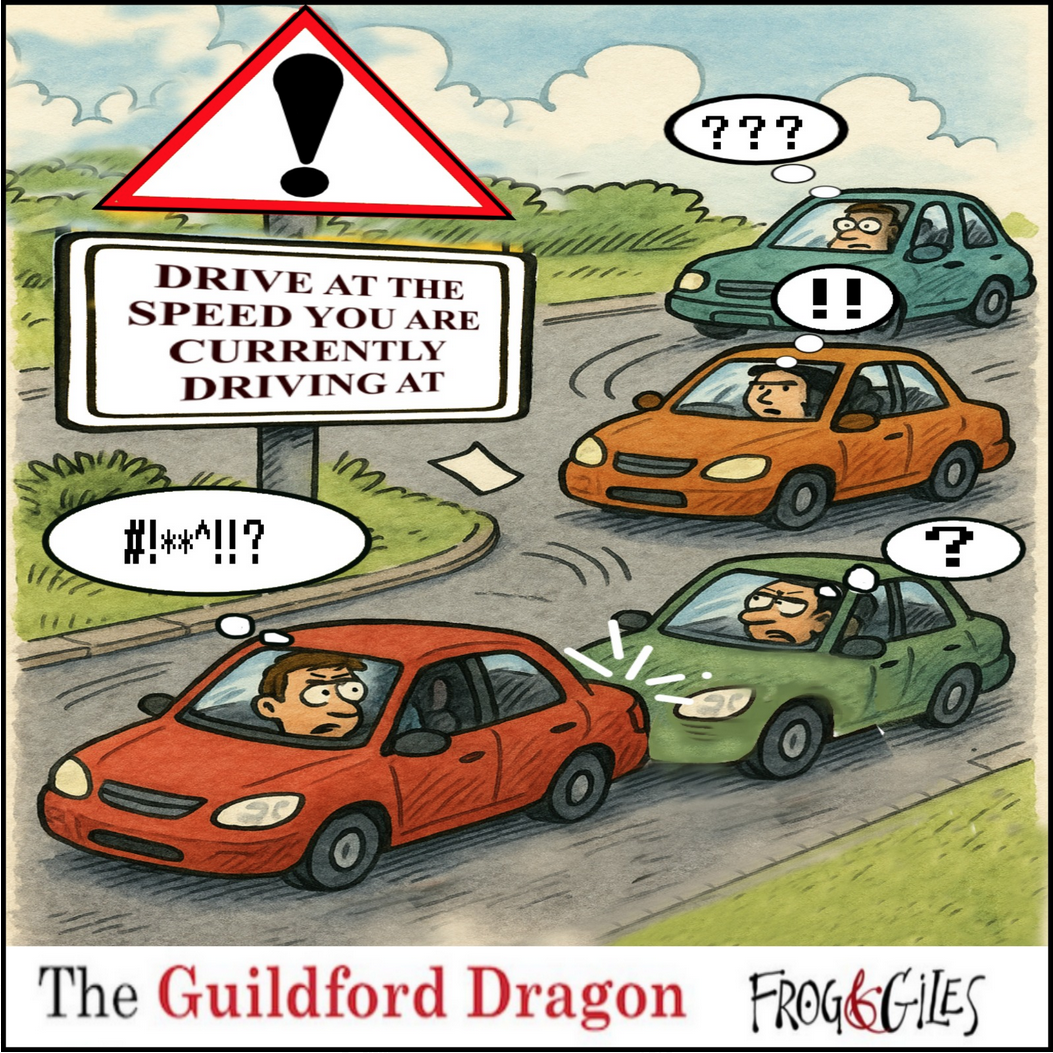

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Letter: How Surveys of Public Opinion Should Be Organised

- Catapult Attacks, Shoplifting and Graffiti – the ASB Problem That Ash Is Facing

- A281 Closure Expected to Continue

- Guildford’s Green Day Shows Commitment to Net Zero by 2030 Remains

- Letter: We Should All Have a Say in How Our Local Government Is Reorganised

- Dragon Review: Madam Butterfly – Grange Park Opera

- Letter: PIP Claimants Under-claim

- Flashback: Council Report Accepts Juneja Case Has Caused ‘Reputational Damage’

- Revealed Survey Shows SCC’s Preferred Two-unitary Option Has Least Public Support

- Highways Bulletin: Junction 10 Closures and Making Strides for Walk to School Week

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments