Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

More Support Available in Latest Lockdown for Borough Businesses

Published on: 29 Jan, 2021

Updated on: 1 Feb, 2021

More borough business grants are available to cover January’s Lockdown 3 for those who had grants under Lockdown 2 last November and they will be contacted automatically by the council.

More borough business grants are available to cover January’s Lockdown 3 for those who had grants under Lockdown 2 last November and they will be contacted automatically by the council.

Any business forced to close due to government restrictions or supply chain problems is qualified but a new application is not needed for the 42-day lockdown started Tuesday, January 5. They are being contacted by email.

Those forced to close at any point since November 5, 2020 but have not yet applied for a grant can do so at https://www.guildford.gov.uk/

- Rateable value up to £15,000 – a grant of £2,001;

- Rateable value of £15,001 to £50,999 – a grant of £3,000; and

- Rateable value of £51,000 and over – a grant of £4,500.

A one-off payment for recipients of the Local Restrictions Support Grant (Closed) is also available for the same period:

- Rateable value up to £15,000 – a grant of £4,000;

- Rateable value of £15,001 to £50,999 – a grant of £6,000; and

- Rateable value of £51,000 and over – a grant of £9,000.

Businesses which continued to offer takeaway, click-and-collect or delivery despite closure are also eligible for a Local Restrictions Support Grant (Closed). Businesses can apply for one grant for each of their qualifying premises.

Companies which chose to close, but were not required to, will not be eligible, along with those which are in administration, insolvent or have received a striking-off notice. Businesses which have already had grant payments equal to the maximum levels of state aid allowed under the Covid-19 Temporary State Aid Framework will also not be eligible.

Applicants will need to give references from their rate demand, an image of their bank account, showing account name, number and sort code, their company number, charity number and VAT registration number if applicable, and information on any funds received through state aid or a declaration that the level of funds received does not exceed the limits.

A Christmas support payment of £1,000 is also available for wet-led pubs that derive less than 50% of their income from the sale of food. All venues thought to be eligible have been emailed.

Local Restrictions Support Grant (Open) is available to cover the period December 2 to 19 for businesses not forced to close but supply the hospitality, leisure, travel, holiday, airline, cultural, arts and tourism sectors.

A discretionary scheme can help bed-and-breakfast businesses which pay council tax, and businesses which do not have a rateable value but have high business-related property costs, such as rent or service charges.

The scheme can also help businesses in shared premises where they have had to close, and businesses that supply the hospitality, leisure, travel, holiday, airline, cultural, arts and tourism sectors.

Businesses which are not the ratepayer at their premises should supply details of the ratepayer, proof of rent and service charges, and the proportion of the shared premises that they occupy. If a premises has no rateable value, businesses should also provide proof of rent and service charges.

Bed-and-breakfast owners need to provide their council tax bill. Where the business is part of the supply chain to the hospitality, leisure, travel, holiday, airline, cultural, arts and tourism sectors, an explanation of this supply chain and how the business has been affected is required.

Companies in administration, are insolvent or where a striking-off notice has been made are not eligible for funding.

Grant income received by a business is taxable, and will need to be included as income in the business’s tax return.

Cllr John Redpath, lead for the economy, said: “We understand many local businesses are facing ongoing and new financial difficulty due to the continued impact of the global pandemic.

“We are here to support all our local businesses and provide as much help as we can. We have already distributed more than £23 million in government grants and provided business rate relief to businesses in the retail, hospitality and leisure sectors.

“New grants to help businesses are being introduced regularly. All new schemes are published on our website at www.guildford.gov.uk/article/

Cllr Redpath (R4GV, Holy Trinity), added: “We invite all businesses to get in touch because we may be able to help in other ways, including through our assistance to help businesses follow new licensing guidelines.

“We have also been working with the Community Foundation for Surrey’s Coronavirus Response Fund, as the Mayor of Guildford’s chosen charity for 2020-21, to match-fund any donations to support local charities and voluntary organisations helping vulnerable, elderly and isolated members of the community.

“Businesses can also get information and support through the Enterprise M3 Growth Hub, at www.enterprisem3growthhub.co.

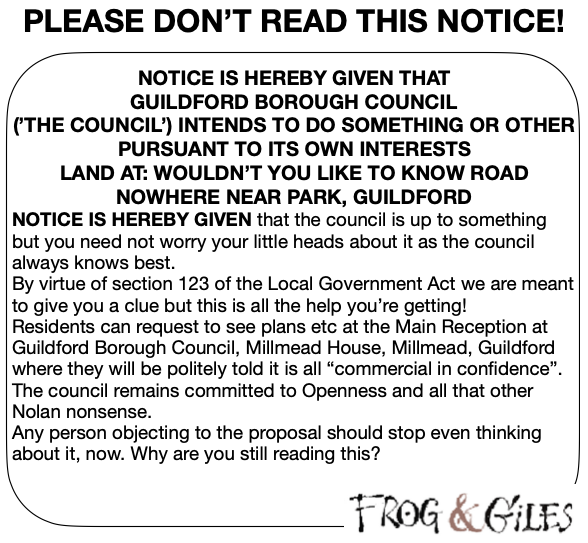

See Dragon story: GBC’s Explanation of Major Land Sale Notice Error ‘Borders on Arrogant’ Says Councillor

Recent Articles

- Latest Figures Show Two in Every Three Burglaries Went Unattended in Surrey

- Dragon Interview: The Thriller Writer Who is a Climate Change Ambassador

- Notice: Guildford Twinning Association Filmfest 2024

- Zero Re-opens Uptown

- Letter: I Hope the New CEO Will Reflect on the Constructive Advice

- Campaign to Encourage Visitors to the Surrey Hills To Go by Train

- Police Commissioner Office Ordered to Remove Social Media Messages

- Police and Crime Commissioner Candidate Interview – Kate Chinn

- Guide to Telephone Befriending Services for Older People

- Stage Dragon: Sleuth at the Yvonne Arnaud Theatre

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments