Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Opinion: Surrey Residents’ Increasing Burden of Police Funding Is a Stealth Tax

Published on: 17 Mar, 2024

Updated on: 9 Apr, 2024

By Alex Coley

member of the Surrey Police & Crime Panel and Epsom & Ewell borough councillor (Res Assoc, Ruxley)

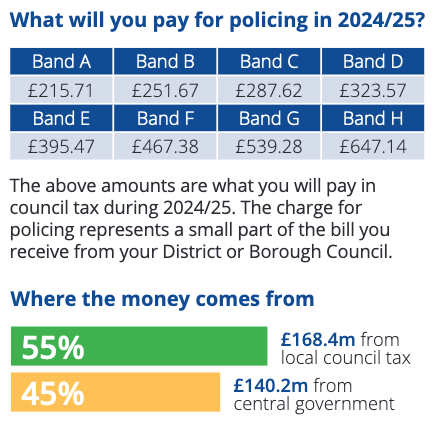

Did you know that Surrey is the only police area in the country where local residents pay more towards policing than central government? The share of the burden is 55 per cent Council Tax precept, versus 45 per cent government funding.

The average Council Tax precept contribution in England and Wales is 34 per cent and is growing faster than any other funding area. Government capital funding and funding for national priorities like serious violence is decreasing.

The average Council Tax precept contribution in England and Wales is 34 per cent and is growing faster than any other funding area. Government capital funding and funding for national priorities like serious violence is decreasing.

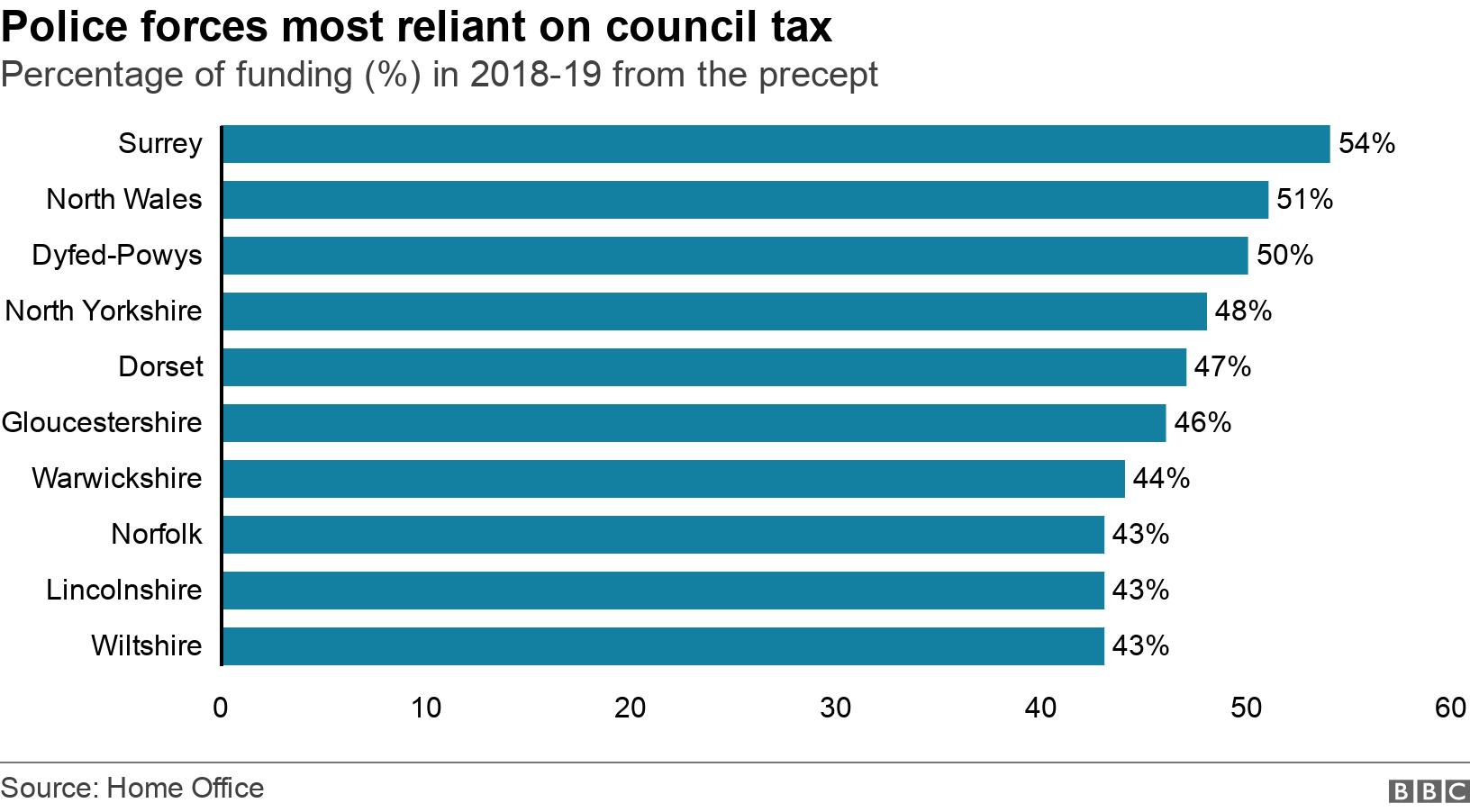

The high level of reliance on Council Tax has existed for some years as this BBC graphic from 2019 shows.

From March 2016 to March 2024 the Council Tax precept nationally has increased by a total percentage of 71 per cent. While government funding from March 2016 to March 2024 has only increased by 29 per cent.

We are approaching a point where other police areas will join Surrey and cross the line where the Council Tax precept provides the majority of funding. Within three years a third of police areas may cross that point, in five years it could be half.

Not only are residents being taxed twice for policing, many will soon face being directly taxed for the majority of police funding contributions where they live, just like in Surrey. A quiet and gradual funding shift by stealth.

We may find ourselves experiencing American-style policing, where your local police are exclusively bought as a service paid for with a property tax. You only have to look at what happened in some US towns and cities when wealthy people moved out and funding collapsed.

Criminal gangs move in sensing weakness and create a cycle of deprivation and self-reinforcing criminality driven by ever-decreasing budgets that deter investment and prosperity. I am determined we don’t end up like that and the government provides fairer funding.

At a meeting of the Surrey Police & Crime Panel [the panel is a committee of Surrey County Council, and consists of one elected councillor from each of Surrey’s 12 local authorities (including SCC) and two co-opted independent members] in February we were asked to vote on the Police & Crime Commissioner’s maximum increase to the precept.

I asked her to consider other funding sources because of the impact of yet another maximum increase on residents suffering from the cost-of-living crisis after years of austerity. She had her staff answer for her: “What do you want us to do, pass a hat around?”

The Police & Crime Commissioner has £43 million in treasury management, she underspent by £8.7 million last year and is forecast to underspend again this year.

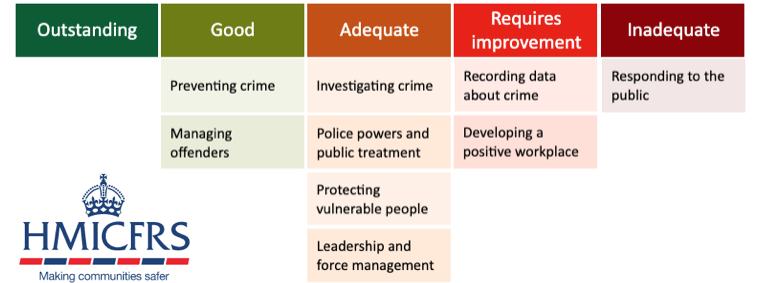

Your Council Tax is going into tyhe PCC’s reserves while police officers are taken off the streets to cover desk jobs for staff vacancies. Little wonder that the recent inspection report assessed Surrey Police as “Inadequate” at responding to the public.

I am petitioning Parliament to change the police funding allocation formula so council taxpayers don’t contribute more to their police force than the government and hope that others who agree with me will sign.

Responses to Opinion: Surrey Residents’ Increasing Burden of Police Funding Is a Stealth Tax

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Recent Comments

- Ian Macpherson on Updated: Main Guildford to Godalming Road Closed Until August 1

- Sara Tokunaga on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Michael Courtnage on Daily Mail Online Reports Guildford Has Highest-paid Council Officer

- Alan Judge on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- John Perkins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- S Collins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Anthony Mallard

March 18, 2024 at 2:20 pm

I totally agree with the sentiments expressed by Alex Coley. The former arrangements of a Police Committee were much less politically biased and, I have no doubt less expensive.

As ever, the public were “conned” by central government by being told, on this and many other formerly centrally provided and funded services, that it would be better and more accountable for decisions that affected local people and communities to be taken by locally elected or appointed individuals.

Funds at the level when such transfers of services were made may have been adequate but times move on and funds never, it appears, match inflation or the increased demand.

but central government is “off the hook” and cannot, in its eyes, be blamed. After all, it is the local decision makers who have the funds and should not waste them but apportion them correctly. Politicians!