Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Opinion: What Does Woking Going Bust Mean for Guildford?

Published on: 9 Jun, 2023

Updated on: 13 Jun, 2023

Joss Bigmore worked in the City of London trading and managing financial risk before becoming a councillor in 2019. His experience offers extra insight into the current financial challenges faced by local authorities.

By Joss Bigmore

leader of the Residents for Guildford & Villages Party and borough councillor for Merrow

The issuing of a Section 114 notice by Woking Borough Council, effectively signalling bankruptcy, is unfortunately not a surprise to many who have looked at their financial situation over the past few years.

The size of the losses are shocking, and taxpayers will be footing the bill for years to come.

The quantum of financial risk that WBC took is terrifying, suggesting failures in governance both locally but also in Westminster, where the Public Works Loan Board authorised loans on a scale that dwarfed the income streams of WBC.

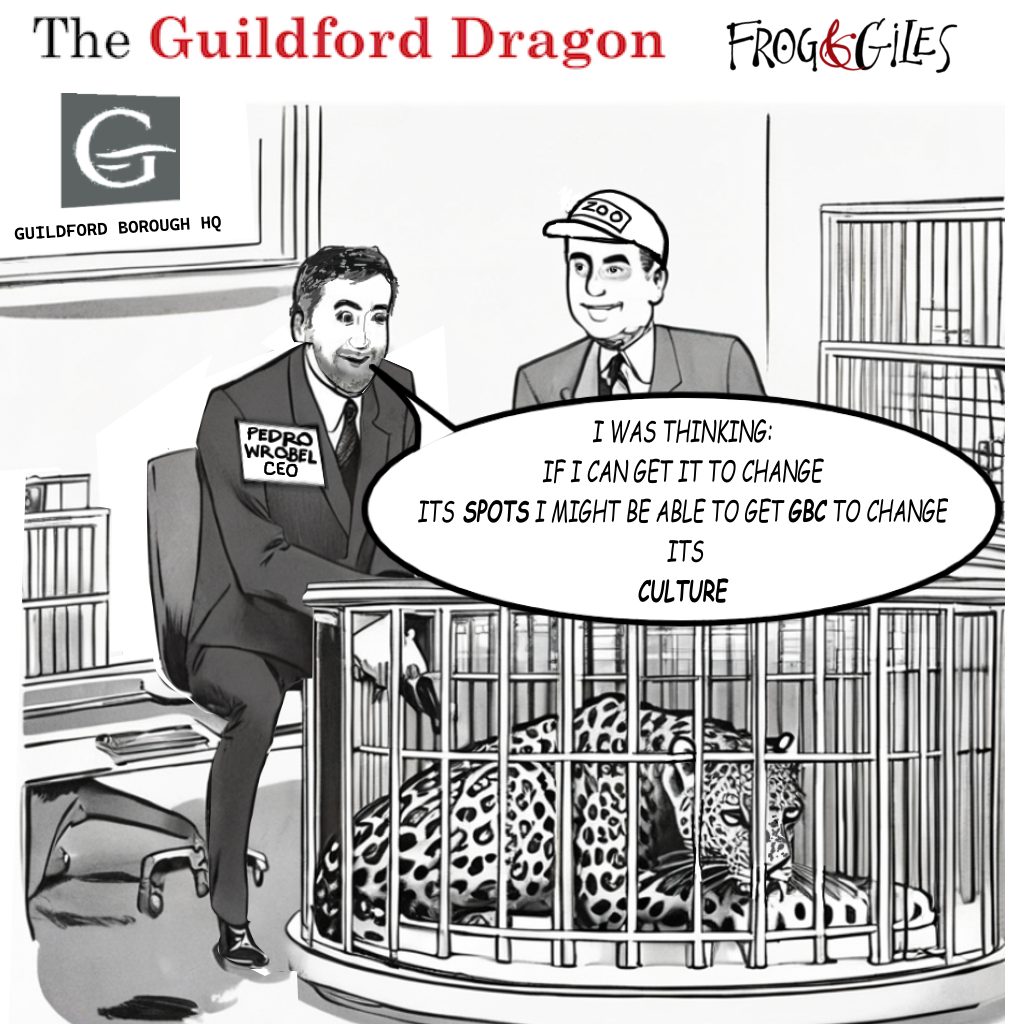

Guildford Borough Council also faces serious financial challenges and naturally, in the wake of the Woking news, attention will turn to those.

Guildford Borough Council also faces serious financial challenges and naturally, in the wake of the Woking news, attention will turn to those.

In Guildford, although current debt levels are small and manageable, the borough council is about to embark on significant expenditure relating to four projects which will be largely financed by external debt in the hope that future receipts from property sales will repay the monies.

These projects have been in the pipeline for years and have been supported almost unanimously by GBC councillors of all parties from a number of historic administrations.

It is an enormously challenging time for all local authorities…”

Weyside Urban Village is a huge undertaking, in volves: moving a Sewage Treatment Facility, building a new GBC Depot, moving and upgrading the Community Recycling Centre at Slyfield, and significant highways works. The aim is to eventually facilitate the building of around 1,500 homes. But it is an incredibly risky project with current value at around £450 million.

GBC is also developing housing on the car park at Guildford Park Road, a project which will be in excess of £100million, building Ash Road Bridge at over £40 million, and a significant repair, and ultimately replace, programme at Guildford Spectrum leisure centre.

I am proud that under my administration, with work led by John Rigg, we added a huge amount of rigour to the governance and programme management of these projects.

We inherited a set of projects with variable governance approaches and an inconsistent approach to contingency and budgeting, which given the size of this capital programme was unacceptably risky.

If interest rates continue to rise and property prices fall, we will see a major impact…”

We also worked hard with our MPs, Surrey County Council, and the Local Enterprise Partnership to ensure we received significant grant funding to help deliver these projects. And we unashamedly employed expert consultants to help advise the council on how to manage the risks of these projects, being acutely aware of the consequence of failure.

But although we worked hard to mitigate the financial risks, they have not disappeared, and GBC is on a knife edge with interest rates at current levels. If interest rates continue to rise and property prices fall, we will see a major impact on the amount of money left to support services.

I hope there is sufficient skill and experience in the new Lib Dem administration to continue our work, although their efforts will be further complicated as the lead finance officer has recently resigned.

I am sure that many will ask why GBC continues with these projects but the reality is that it would cost a significant amount of money to cancel them due to contractual obligations or grant repayments.

Local Authorities are also the only body with the desire to provide the amount of affordable housing our communities need, and also help deliver the infrastructure upgrades we need across the borough.

It is an enormously challenging time for all local authorities, with reserves ravaged by the pandemic and recent inflation, and a government with no leeway for extra funding as it looks to rebuild our public finances.

Guildford is in a far better position than Woking, but poor, or ponderous decision-making in the years to come could quickly see us in a similar position.

Responses to Opinion: What Does Woking Going Bust Mean for Guildford?

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Recent Comments

- Ian Macpherson on Updated: Main Guildford to Godalming Road Closed Until August 1

- Sara Tokunaga on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Michael Courtnage on Daily Mail Online Reports Guildford Has Highest-paid Council Officer

- Alan Judge on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- John Perkins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- S Collins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Jules Cranwell

June 10, 2023 at 6:41 am

The Lib Dem leadership at GBC would be well advised to make use of the experience and intellect of Cllr Bigmore.

They do not seem to have the talent to face the financial challenges facing the borough.

Why not do what’s best for residents, and appoint him to the finance portfolio? There is no law that says only the party with the majority that can hold such positions.

Adam Johnson

June 10, 2023 at 1:02 pm

“GBC is also developing housing on the car park at Guildford Park Road, a project which will be in excess of £100 million”

Is this figure correct or is there a mistake here?

£100m+? How much are these houses going for and how many will there be? It’s not exactly a massive site.

Editor’s response: We have checked with Cllr Bigmore who said: “I am unaware if there have been recent changes to the scheme, however from memory the latest design I saw was for about 200 homes. It was expensive as we were proposing exemplar sustainability in the design to reduce the impact of construction and the expected energy for the number of people living in the development.

H Trevor Jones

June 10, 2023 at 9:15 pm

I believe from anecdotal information that my 3-bedroom terraced house in Guildford Park Avenue (adjacent to the Guildford Park Road development mentioned by Adam Johnson) is worth about £400k, which obviously includes the land value, so rebuilding cost is assumed to be somewhat less for insurance. So how does the new development come to approx £100 million for 200 homes, making £500k each, which I assume are apartments rather than houses? Are they unnecessarily posh homes?

Also, going back to the original article, why do we have to keep worrying about political parties? Why can’t we just find the best and most experienced people for the jobs needing to be done? Nothing wrong with a party as an association of like-minded politicians, but why should they be the be all and end all?

Glenys Palmer

June 13, 2023 at 9:24 pm

I think it would be prudent to put Cllr Bigmore’s expérience to go use and co-opt him on to the Financial portfolio.

Jules Cranwell

June 14, 2023 at 7:39 am

Perhaps the Lib Dems will ask Robin Horsley if he would allow such a move?

Ross Connell

June 16, 2023 at 4:26 pm

What experience does Joss Bigmore have? What are his past achievements to warrant such a view? A retired Credit Suisse investment banker? Where is Credit Suisse now?

M Durant

June 17, 2023 at 4:09 pm

The Weyside Urban Village should be scaled down and phased in. The Bank of England got their figures wrong. We don’t know how high inflation will go to and for how long. It depends also on the war in Ukraine.