Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Police Launch Op to Tackle Investment Fraud, Fastest-growing Scam in Surrey

Published on: 28 Jan, 2021

Updated on: 30 Jan, 2021

The pandemic has proved a fertile ground for swindlers and Surrey Police are backing the national Operation Giantkind to tackle a 58% jump in investment fraud across the county.

The pandemic has proved a fertile ground for swindlers and Surrey Police are backing the national Operation Giantkind to tackle a 58% jump in investment fraud across the county.

So far, financial fraud has cost Surrey victims an average loss of £21,000 each.

The scam typically starts with an unsolicited phone call from someone claiming to be from an investment company. They try to persuade the victim to invest in materials such as diamonds or rare metals, land or alternative energy, with the promise of hefty returns on their money.

The victim is encouraged to invest large sums, sometimes their pension or life savings, only to lose the lot.

Some of these scams appear authentic, some fraudsters pretending to represent investment firms with which the victim may have invested before. This is what happened last June to James, 75, from Surrey.

He was contacted by a man purporting to be from an investment company where he had been a client. Several emails and phone calls later, the opportunity to invest more money seemed genuine, so James sent £50,000 via bank transfer.

When James contacted the firm to check, they didn’t recognise the transaction and confirmed that he had been the victim of a scam. Fortunately, he was able to get his money back with the help of his bank.

James added: “My friends told me they thought I’d be the last person to fall victim to a scam. And I agreed. This investment opportunity seemed to check the boxes. Looking back now, there were red flags which I should’ve noticed.”

Op Giantkind is spearheaded by partner agencies including the National Economic Crime Centre, City of London Police and the Financial Conduct Authority.

Surrey’s Detective Chief Inspector Rob Walker said: “We’re concerned by the rising rate of investment fraud in Surrey. It’s a heartless crime which often cons the most vulnerable in our community out of their savings, which can’t always be retrieved.

Surrey’s Detective Chief Inspector Rob Walker said: “We’re concerned by the rising rate of investment fraud in Surrey. It’s a heartless crime which often cons the most vulnerable in our community out of their savings, which can’t always be retrieved.

“Prevention is key and Op Giantkind will focus on raising awareness of how to protect yourself and your loved ones from falling victim to these cruel fraudsters. Please look out for one another and act with extreme caution when an investment opportunity is presented to you or a loved one.”

Remember:

- If you want to invest, check that the person or company are who they say they are by using the Financial Conduct Authority’s smart scam list;

- Legitimate investment companies will never cold call;

- If the investment opportunity seems to come from a reputable firm, contact the firm yourself with the phone number listed on their official website to check;

- Fraudsters will contact you repeatedly to build trust. Don’t give them anything and hang up or delete their messages; and

- If a loved one has made large or repeated payments out of the blue, talk to them about the nature of the payments and check they aren’t a scam.

You can report investment scams on Action Fraud’s website or if you feel whoever you’re concerned about is particularly vulnerable, call police on 101. In an emergency, always call 999.

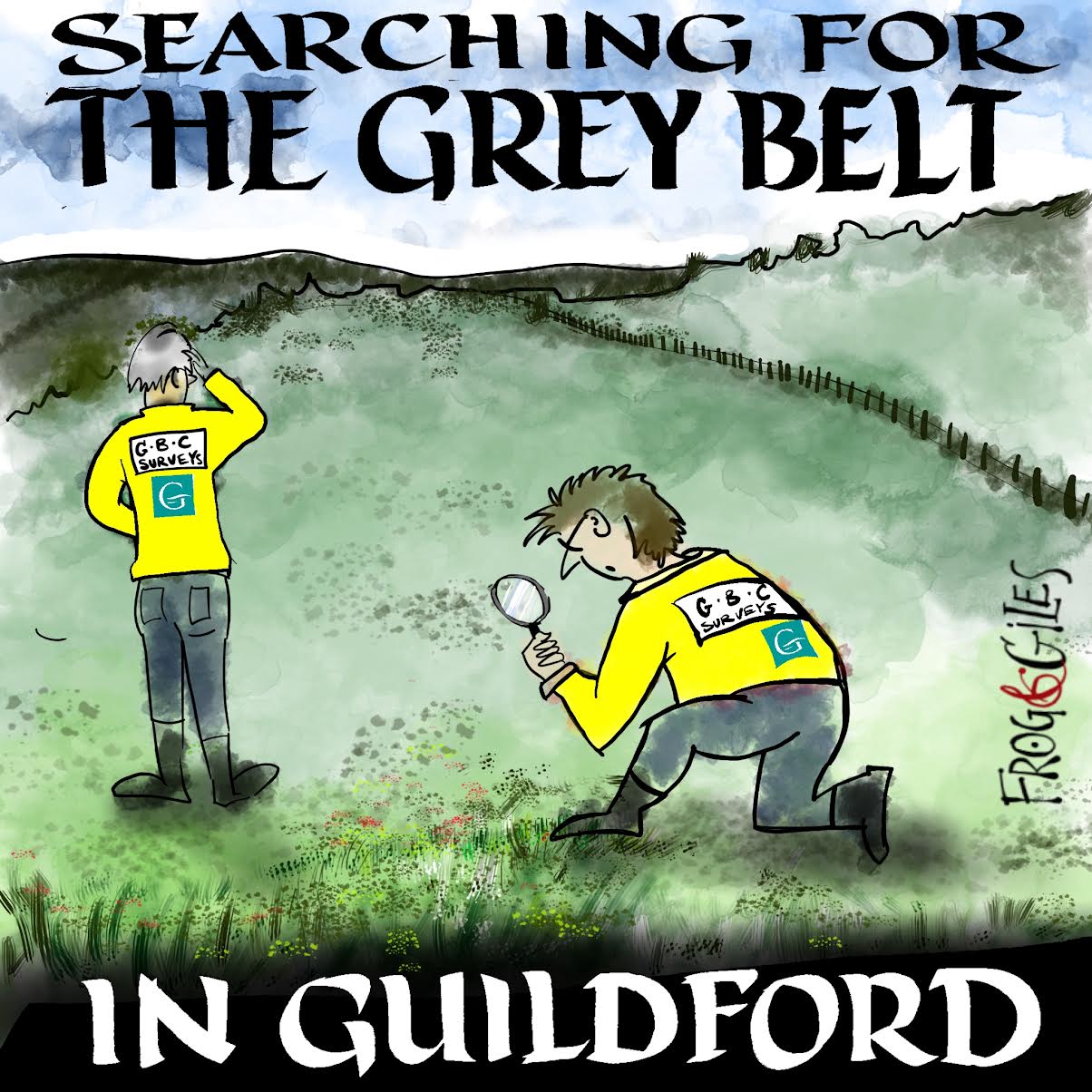

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

Recent Articles

- Financial Pain Still Only Beginning for Woking

- Sara Sharif Trial Latest – Stepmother’s Silence Doesn’t Prove the Case Against Her, Says Defence

- Updated: Fire at Ash Manor School Tennis Centre Was ‘Accidental’

- Witness Appeal Following Collision on A3 Esher Bypass

- Technical Fault

- Parish Council and CPRE Pleased with MP’s Support for Call In of Solar Farm Decision

- Letter: Memories of Woodbridge Park House and 1950s Guildford

- Letter: The Active Travel Proposal Is the Safest Option for London Road

- Select Committee Votes to Refer London Road Decision Back to SCC Cabinet

- Letter: SCC Chose Not To Verify Our Survey

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments