Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Surrey Council Tax to Rise by 5% – SCC Leader Implores the Government to Recognise Issues

Published on: 23 Dec, 2023

Updated on: 31 Dec, 2023

By Chris Caulfield

local democracy reporter

Taxpayers in Surrey are likely to be hit with a 5 per cent rate rise because the one-year government funding package won’t cover the county council’s £13.5 million budget gap, its leader said.

Surrey County Council will need to make tough decisions on services as it tries to protect money for children, adults and roads, because they “matter most to residents”.

In November the county council passed its draft budget which showed the huge gap between income and the cost of providing services.

Leader of the council, Tim Oliver had hoped to convince government officials of the need to increase funding to local authorities that suffered a decade of austerity.

The government’s decision means the county council must now “see how it gets to a point where its budget is balanced”.

Cllr Oliver (Con, Weybridge), speaking at the Tuesday, December 19 Cabinet meeting, said: “It had been my hope and expectation that money would have come from the government in the form of new money.

“That would have enabled us to have delivered the services that we want to deliver. The improved service.”

He said the government’s offer of a 6.5 per cent increase of the settlement would normally have been “very welcome” but that it had been an “unusual year”.

He told the meeting “I’m afraid for the foreseeable future things are going to be considerably more difficult than they have been.”

Much of that was due to the double-digit inflation figures, huge increases in demand for services, and wage growth which have seen council costs surge.

He said: “We are now faced with the situation where we have the £13.5 million gap and I’m afraid the consequence of that is we will no longer be able to restrict council tax increase by 3.99 per cent which was the proposal in our budget last month.

“We will now have to raise council tax by the maximum we are allowed to do which is 5 per cent, 3 per cent on the base and 2 per cent for social care precept.

“There needs to be recognition from this government, and indeed any future government, that the services we provide are the services that are the most in demand.”

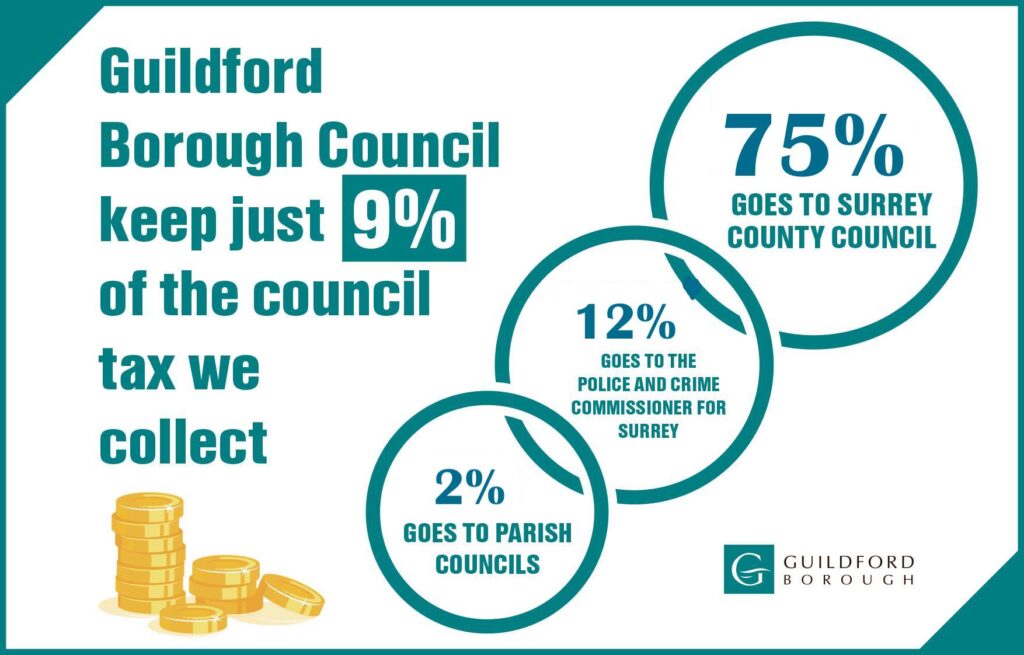

Council tax in Surrey is made up of three parts, the largest goes to the county council, with an additional amount paying for policing. In Guildford, about 9 per cent of the overall bill goes to the borough or district councils.

If the county council were to raise its share by 4.99 per cent it, a Band D property would jump from £1,675.08 to £1,758.67.

That would mean residents in Woking, who are facing a potential 10 per cent increase in their local share would have to pay about £2,338.65 – before any increase from the Police and Crime Commissioner.

Guildford Council, which is still managing to balance its books for this financial year, has assumed it will only be allowed to increase its council tax by 2.99 per cent, the maximum normally allowed without a referendum.

See: R4GV Leader Gives Grim Warning in the Wake of GBC’s Latest Financial Settlement

Cllr Oliver said there simply needed to be more money going into the system, adding: “We are talking about services for the most vulnerable in our communities.

“I would implore this government to recognise the issues we have raised.

“I would implore them to sit down with us and re-evaluate exactly what our needs are

“These are issues that are outside of our control and we can not go on with this hand-to-mouth approach.”

Further investment, he said, simply won’t be possible.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments