Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Surrey’s Phone Frauds: A Guildford Victim Tells His Story

Published on: 23 Jun, 2020

Updated on: 25 Jun, 2020

Police have warned about the surge of phone scams across Surrey, some here in the south-west of Guildford.

See: Guildford Residents Fall Victim to County-wide Surge In Phone and Doorstep Bank Frauds

One local victim wants to warn Dragon NEWS readers by relating his story of how a plausible phone fraudster posing as a policeman constructed a days-long sophisticated swindle to con him out of more than £20,000, his life savings.

This is his story…

Friday, June 12, was just a normal day. My landline rang. Like many these days, I guess, I don’t use the landline much, taking most calls on my mobile.

In fact, most landline calls are just nuisance cold-calls, but I thought this might be from my parents who are abroad.

When I answered a man said it was the police and his name was PC … and that he was calling from Hammersmith police station.

He gave my name and address and asked me to confirm that was the person he was speaking to.

He said they had arrested two people who had been found with my bank details and gave a crime reference number.

I put the phone on the cradle and thought I had closed the call before dialling 999…

He continued: “There have been a number of victims connected with these people and we suspect there has been fraudulent activity involving your bank.

“Would you be able to help us because we need to stop these rotten apples taking advantage of elderly and vulnerable people; we want to catch them? Isn’t it terrible they are even doing this during the Covid-19 crisis?”

I said: “Yes, I am happy to help if there is anything I can do.”

He gave me his “collar number” and told me to put the phone down, call 999 and say I wanted to verify his police identification.

I put the phone on the cradle and thought I had closed the call before dialling 999. When I picked it up, I am pretty sure I heard a dial tone. I dialled 999 and a male voice quickly answered saying “Emergency Service” and went through a script that one would expect. I said I wanted police verification.

The operator asked for a badge number, I gave it. He said that’s fine I am going to put you through.

This surprised me. I was quite impressed they could put me through so quickly.

I was put back to the original “police officer” who gave a detailed description of what was suspected of going on at the bank the police were monitoring and the police method of investigation, as far as it affected those helping them. He added that several other customers were assisting them.

Then he said they had created a “mirror account” in my name that was being monitored by the police. It had a block on it, so withdrawals should not be possible and anyone who allowed any transactions at the bank was probably involved.

He then called my mobile number which I had given him and asked me to go into the bank to make a substantial withdrawal. He asked me to keep the mobile call open.

I made my way into town and into my bank, Barclays in North Street. He asked me to avoid any interaction with other customers and avoid any questions from bank staff about the police, because this might arouse the suspicion of the bank staff, who might be involved in the crime, that a covert investigation was under way. He also asked me to keep everything confidential so as not to compromise the operation.

The bank teller said that they did not have large amounts of cash available as several others had made cash withdrawals that day but he could give me £500, which I withdrew. At the request of the “police officer”, I ordered more than £10,000 to be collected on the following Monday.

Once I had retrieved the money I was to inform the “police officer” that I had carried out his instruction. He asked several questions about the tellers, as if he was interested in them as part of the investigation. Then he said he would contact me on Monday and give me an update on the investigation.

On Monday I had a call at 9am, as he had arranged. He asked me to repeat the process at the bank and collect the money that had been ordered, place the banknotes in a plastic bag and not touch them as they would be wanted it for forensic evidence. He also suggested the money might be counterfeit.

He said the bank shouldn’t give me the money because there was a police block and, in any case, not to worry because this was a mirrored account.

I did as he requested. The bank gave me the money and I returned home with the “policeman” still on the line the whole time. He again asked me what had happened at the bank.

Once I had retrieved the money I was to inform the “police officer” that I had carried out his instruction.

Once I was back at home, he asked me to place the money into a large envelope, write “Mary” on the bottom corner of the envelope and gave me a password. He told me someone from forensics would be with me shortly and asked if I had touched the money. I told him I had not. He seemed pleased because of the forensic evidence.

Whilst he was still on the phone, within five minutes, there was a knock on the door and a tallish rotund woman, dressed all in black, gave her name and the password and took the package.

Once that was done, the police officer said he was going to do some paperwork and would give an update on the case later, at around 2pm, adding that they were just about to make some arrests.

I said I was uncomfortable but he said: “Don’t worry, we have a duty of care but we really appreciate your help. Would it be okay to help us further with a couple of things online?”

I agreed and that led to me making a further online transfer of over £10k which again he said should not go through because there was a police block on it.

When it did go through he said that was very interesting and undertook to give a further update the next day, Tuesday, at 9am, which he did.

He also told me there had been three arrests and there would be possibly two more that evening and that they were going to close the bank down on Wednesday when he would send two female police officers to speak to me at whatever time I liked. They would take any further details necessary and debrief me.

He then said he would call me back in the afternoon and give an update, which he did. During the “update” he said the case might continue the following week and the two PCs had been reallocated to elderly participants who had been shaken and were being given priority, so they would visit me on Thursday instead.

He added that he would call me on Wednesday at 9am, which he did, briefly, saying he had other things on. I did not hear from him again.

On Thursday I was expecting his call but it didn’t come. Then when the two female PCs did not arrive at 12 noon I became concerned. I waited for a further call but at 5pm when that did not come I called Guildford police station.

I enquired about the police officer and the operation but they said, within half a minute, that the man was almost certainly not a police officer. They gave me a crime reference number and told me to contact my bank immediately which I did, realising I had been a victim of an elaborate and clever scam.

…why can’t BT just close the loophole in the system and save countless victims the pain and millions of pounds…

The bank has a standard procedure in such cases. They have opened an investigation which could take up to 15 days. The police had advised me they had opened an investigation as well. I spoke to one PC on Thursday evening and two visited me on Friday.

I am now waiting for the results but I am fearful of a bad outcome.

I have been left feeling angry and embarrassed. I am not stupid but the scam plays on people’s compassion for others and the urge to help. It takes advantage of the pre-existing trust people have for the police force and the method of overcoming any doubts by using the 999 call as a reassuring illusion.

Had I been aware of this weakness in BT landlines I wouldn’t have fallen for the scam and lost my life savings.

I have been left devastated, not just financially but on an emotional and psychological level. I am not sleeping properly and I’ve lost my appetite.

I am very fortunate to have many friends close by at this time who are providing invaluable support but for many victims this may not be the case. I am taking one day at a time and I’m still in a state of shock.

But I saw the story in The Dragon [insert link] and I have decided to tell my story because if I can save one further victim that will be something positive to take from this.

People need to be aware of the security weakness in BT landlines. If the British Telecom system closed calls when one party rings off this particular scam would not be possible.

Also, there could be warning signs at the banks or checklists given to those drawing large sums of cash.

Why can’t more be done to publicise this risk? More importantly, why can’t BT just close the loophole in the system and save countless victims the pain and the millions of pounds being lost each week through banks and defrauded customers, wasting police time, costing peoples lives and livelihoods?

It seems extraordinary to me that BT are providing a service with a serious security flaw which is putting their very own customers including the elderly and most vulnerable at serious risk of physical and financial harm.

It also seems extraordinary to me that banks haven’t held BT liable for damages to themselves and their most vulnerable customers.

BT have been asked to comment.

Update June 23: A CID investigation is underway and others who have been victims of successful or attempted scams are urged to report them to the police.

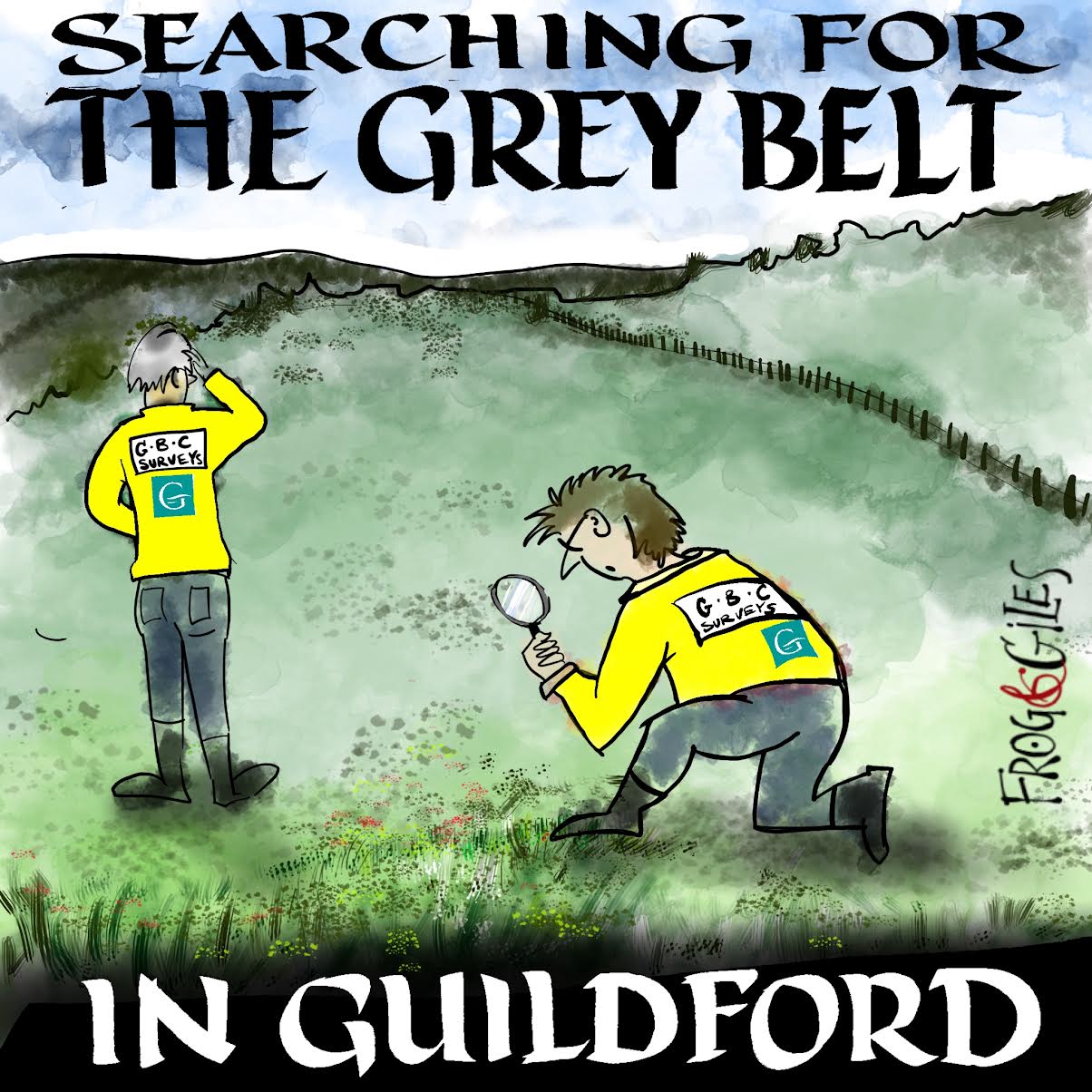

"Found any?" - "Nope, it all looks green to me!" (See Opinion: The Future is Congested, the Future is Grey)

Recent Articles

- Financial Pain Still Only Beginning for Woking

- Sara Sharif Trial Latest – Stepmother’s Silence Doesn’t Prove the Case Against Her, Says Defence

- Updated: Fire at Ash Manor School Tennis Centre Was ‘Accidental’

- Witness Appeal Following Collision on A3 Esher Bypass

- Technical Fault

- Parish Council and CPRE Pleased with MP’s Support for Call In of Solar Farm Decision

- Letter: Memories of Woodbridge Park House and 1950s Guildford

- Letter: The Active Travel Proposal Is the Safest Option for London Road

- Select Committee Votes to Refer London Road Decision Back to SCC Cabinet

- Letter: SCC Chose Not To Verify Our Survey

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments