Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Thames Water in Urgent Funding Talks to Avoid Collapse – How Is Guildford Affected?

Published on: 30 Jun, 2023

Updated on: 5 Jul, 2023

By Hugh Coakley

Thames Water, who provide Guildford’s water supply and sewage treatment, was reported to be in urgent funding talks this week to avoid collapse due to its huge £14 billion mountain of debt.

Local political leaders played down the potential impact on Guildford including on the GBC flagship 1,500 home Weyside Urban Village.

The water company has been accused of an “absolute scandal” by funding excessive payments to executives and shareholder dividends through putting the company in up to 80 per cent of its value in debt, while underinvesting in essential infrastructure, failing to cut water leaks and allowing untreated sewage into rivers.

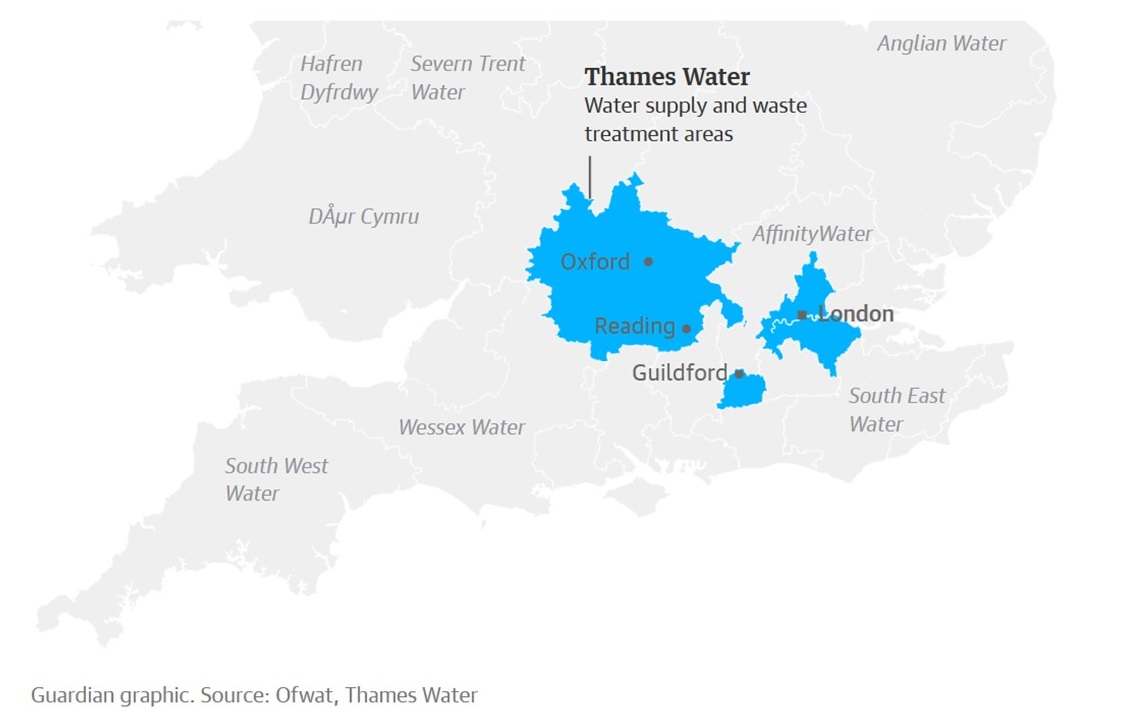

Thames Water serves around 15 million customers with water supply and sewage treatment including Guildford. Guardian graphic sourced from Ofwat and Thames Water.

Local political leaders told The Dragon it was for the company and government to sort out. They did not believe Weyside Urban Village, which is dependent on relocation of the Thames Water operated sewage treatment works at Slyfield and is part funded by GBC, would be affected but said they were “monitoring very closely”.

Deputy leader and lead for regeneration, Tom Hunt (Lib Dem, St Nicolas) said: “We have a legal agreement with Thames Water to relocate the sewage treatment works [in Slyfield]. This agreement was made in 2019 enabling us to develop plans for our Weyside Urban Village scheme. These contractual obligations remain in place.

“The events of this week have not changed our plans for the Weyside Urban Village development. We are liaising with all our partner agencies and continue to monitor the situation closely.”

Leader of the Conservative group at GBC Philip Brooker (Cons, Worplesdon) said: “Keeping my comments specifically on the new Thames Water sewage treatment works at the Weyside Urban Village site, it is hard to see how anything will change as the government has guaranteed future water services.

“When the Conservatives proposed and commenced work on this essential development it included a new, modern sewage treatment complex at neutral cost. This, presumably, will benefit the operator whoever that may be.”

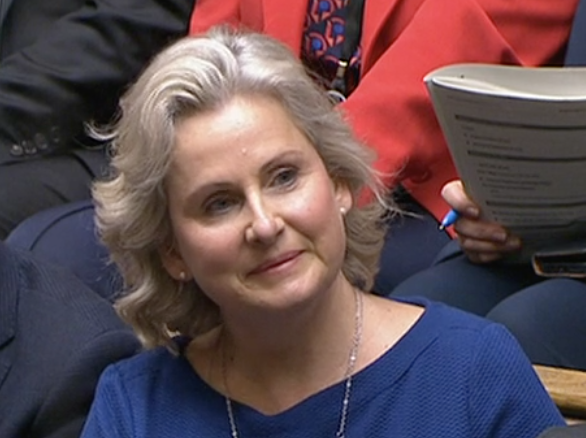

Guildford MP Angela Richardson pointed the finger at Ofwat for not stepping in earlier saying the “water regulator Ofwat needs to provide answers as to how Thames Water and some other water companies were allowed to operate the way they have for many years. They should also be held to account.”

She said the concern over “Thames Water is completely justified” adding, “Today I spent time looking into the financial structure of the company. It is complex, which means there isn’t a simple solution. Government borrowing to bail out or takeover the company should be the absolute last resort.

“In the first instance, I would like to see the large shareholders recapitalise the balance sheet by investing back into Thames Water. If they won’t, then government could potentially take similar steps to those taken by Michael Gove on the cladding issue and force action. This is not without risk, given the international nature of the major investors.

“The way the dividends have been paid to shareholders by bond issuances was not sustainable in changing financial market conditions.

“It is important that a financial solution is found swiftly so that all of us in Guildford have confidence that the water service is reliable, that proposed infrastructure promises made by Thames Water are fulfilled in a timely manner, so that we have a water service fit for the proposed growth of Guildford.”

Zoe Franklin, Lib Dem parliamentary candidate for Guildford said: “Thames Water has been letting down its customers and polluting our waterways, and all the while shamelessly profiteering on behalf of its shareholders.

“This must stop. The executives responsible must be held to account. And not a single penny of our money should be spent to bail out this failing company.”

“England’s water firms are now 70 per cent owned by foreign companies. ”

“Five water company CEOs gave up their bonus this year after a campaign by the Liberal Democrats. However, the party found average water company executive pay and bonuses rose by a fifth compared to last year, with some CEOs still being paid multi-millions of pounds whilst their firms miss leaks and sewage targets.”

Sam Peters from the Green Party said: “We face another inevitable privatisation failure due to corporate greed, and pursuit of shareholder profits above providing a public good.

“Thames Water is one of the worst offenders in terms of debt, astronomical bosses´ salaries, leaks, and sewage dumping. The idea customers and taxpayers should pay once again for their greed and failures with bailouts is absurd.

“Local people face particular uncertainty with the new sewage plant. Who knows whether we´ll be forced to pay for this too, above already committed council funding?

“The cost-of-living crisis continues, while inflation soars in the UK. While partly due to Conservative policy, even the IMF now admit the principal cause is corporate greed, with prices hiked way beyond costs and wages actively suppressed.

“Water privatisation has been, and will always be, a miserable failure for the public and our waterways. We must end this failed system and – like in Scotland and countless other countries – return water to public ownership, run for public and environmental good rather than shareholder profits.”

Thames Water was reported as saying it had “a strong liquidity position” and it was working “constructively with shareholders”.

The Dragon contacted R4GV and the Guildford Labour Party to comment.

Responses to Thames Water in Urgent Funding Talks to Avoid Collapse – How Is Guildford Affected?

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

Recent Articles

- MP Hunt Presses Government Over Ash Vale Station’s Access Problems

- Man’s Body Found in Bellfields Estate – Police Appeal for Witnesses

- Events Celebrating 150th Anniversary of St Nicolas Parish Church

- Letter: Would a Guildford Town Council Simply Be a GBC Version 2.0?

- Approval for Family Home To Be Converted into ‘House in Multiple Occupation’

- The Yvonne Arnaud Theatre Is a Lucrative Asset for Guildford’s Economy

- Notice: Community Safety Meeting

- Letter: All Significant Decisions Will Be Taken by the New West Surrey Council in Future

- Letter: What is the Evidence for the Lib Dem’s Sweeping Statement?

- Family Pays Tribute to James, 21, Following New Year’s Day Tragedy

Recent Comments

- Kevin Rye on Borough Council Launches Second Stage of Town Council Consultation

- Olly Azad on Family Pays Tribute to James, 21, Following New Year’s Day Tragedy

- David Roberts on Borough Council Launches Second Stage of Town Council Consultation

- A Windebank on An ‘Outstanding’ GP Surgery

- Frank Emery on ‘We’ll Make Sure Guildford’s Voice Is Heard’ Says Council Leader

- Jane Hill on ‘We’ll Make Sure Guildford’s Voice Is Heard’ Says Council Leader

Search in Site

Media Gallery

Cllr Townsend on Waverley’s CIL Issue

August 27, 2025 / Comments Off on Cllr Townsend on Waverley’s CIL Issue / Read MoreMP Zöe Franklin Reviews Topical Issues

August 27, 2025 / Comments Off on MP Zöe Franklin Reviews Topical Issues / Read MoreMP Hopes Thames Water Fine Will Be ‘Final Nail in Its Coffin’

August 27, 2025 / Comments Off on MP Hopes Thames Water Fine Will Be ‘Final Nail in Its Coffin’ / Read MoreNew Guildford Mayor Howard Smith

August 27, 2025 / Comments Off on New Guildford Mayor Howard Smith / Read MoreA New Scene for a Guildford Street

August 27, 2025 / Comments Off on A New Scene for a Guildford Street / Read MoreDragon Interview: Sir Jeremy Hunt MP on His Knighthood and Some Local Issues

August 27, 2025 / Comments Off on Dragon Interview: Sir Jeremy Hunt MP on His Knighthood and Some Local Issues / Read MoreDragon Interview: Paul Follows Admits He Should Not Have Used the Word ‘Skewed’

August 27, 2025 / Comments Off on Dragon Interview: Paul Follows Admits He Should Not Have Used the Word ‘Skewed’ / Read MoreDragon Interview: Will Forster MP On His Recent Visit to Ukraine

August 27, 2025 / No Comment / Read MoreDragon Interview: Fiona Davidson on the ‘Devolution’ Proposals for Surrey

August 27, 2025 / No Comment / Read More

Martin Elliott

July 1, 2023 at 1:16 pm

It seems somewhat naive for spokesmen to state, and The Dragon accept without comment, that there are contracts in place to protect Weyside Urban Village works.

As we saw with the Carillion administration, when companies go into administration, contracts lapse and are open to renegotiation.

Surely, GBC should urgently be making contingency plans for all possible outcomes of the Thames Water situation.