Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Woking Councillor Says, ‘We Face a Mountain of Unsustainable Debt’

Published on: 23 Feb, 2023

Updated on: 23 Feb, 2023

By Chris Caulfield local democracy reporter

By Chris Caulfield local democracy reporter

and Martin Giles

Woking Borough Council is close to effective bankruptcy after amassing debts worth almost £2 billion to fund a property investment spree.

Annual servicing of Woking Borough Council’s massive £2 billion debt is set to hit an unsustainable £62 million a year, according to its own budget forecasts.

Councils cannot go bankrupt but are required by law to have balanced budgets. If a council cannot find a way to finance its budget then a Section 114 (S114) must be issued. Such a notice means they cannot make new spending commitments and can also lose control of their day-to-day running.

A report to an extraordinary council meeting tonight (February 23) reads: “The council is in the territory of s114 but, as of the date of this report, a s114 notice is not required.

The figures were published ahead of its full council meeting where members are expected to sign off a council tax increase of 2.99 per cent. This is the maximum permitted for the borough council’s share of the council tax charge most of which goes to Surrey County Council

The financial crisis at Woking is such that the borough’s deputy leader said the council needed government support following years of failed borrowing plans under the previous administration.

According to budget papers, the council borrowed about £1.8bn for investment purposes but is only bringing in £38.5 million annually, rising to £43.3 million next year, far below the £62 million in annual interest payments – leaving the council in a financial black hole and under investigation by the Department for Levelling up Housing and Communities (DLUHC).

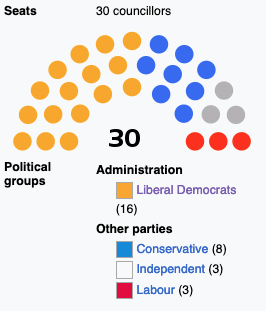

DLUHC has confirmed that no immediate decision is pending, while borough deputy leader Cllr Will Forster thinks the government is unlikely to put the council in special measures, given the recent changes both in its senior officers and political make up.

The department’s report into the council’s finances, investments and related governance will be made available on the government’s website.

Council leader Ann-Marie Barker (Lib Dem, Goldsworth Park) told The Municipal Journal (MJ): “Since my administration gained control of Woking BC, getting its finances under control and presenting a balanced budget for 2023-24 has been our priority.

“It remains unclear how the council will establish future balanced budgets without making difficult decisions around the continued delivery of some services.

“Further cost savings are inevitable to reduce the unsustainable reliance on the council’s financial reserves.”

Portfolio holder for finance, Dale Roberts (Lib Dem St John’s), added: “We face a mountain of unsustainable debt, together with an uncertain and challenging future.

“It will require painful decisions about which services we can deliver.”

Will Forster, deputy council leader (Lib Dem, Hoe Valley) thinks the council cannot get out of its mess without help.

He said: “We are still waiting for a report from the government inspection team which we will check for accuracy and information and it’s too early to predict what it will find.

“However, Woking needs government support, there’s not a problem with decision making and we have full faith in the officers.

“But the council can’t afford to pay off its debt, not even service the debt.

“The papers are quite stark. £60 million a year just to service the debt -repaying the debt is even more.

“We need help.”

Cllr Forster said the council would be in section 114 by the 2024/25 financial year, “at this point I can not see how it can make a sustainable budget, which is terrifying,” he said.

As a comparison, Surrey County Council’s capital borrowing requirement is about £2.4billion. By 2026/27 Woking Borough Council is expected to reach the same level. The difference is that Surrey has an annual budget of about £2 billion, while Woking Council’s is closer to £55 million.

To put it another way, Woking has the equivalent of a £2m mortgage, on an annual salary of £10,000.

Responses to Woking Councillor Says, ‘We Face a Mountain of Unsustainable Debt’

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Recent Comments

- Ian Macpherson on Updated: Main Guildford to Godalming Road Closed Until August 1

- Sara Tokunaga on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Michael Courtnage on Daily Mail Online Reports Guildford Has Highest-paid Council Officer

- Alan Judge on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- John Perkins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- S Collins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Wright Lisa

February 24, 2023 at 10:29 am

We should remember the previous council make up and when the debts were incurred.