Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Woking’s £490m Write Down Sparks ‘Worst Fears’ for Council Services

Published on: 19 May, 2023

Updated on: 20 May, 2023

By Chris Caulfield

local democracy reporter

“Worst fears” have been confirmed in newly published accounts that exposed a half-billion pound “black hole” in Woking Borough Council’s finances and plunged the future of many services into doubt.

The figures, released this week on Companies House for 2021, show the council’s biggest investment, Victoria Square, has had £490,479,300 wiped off its value.

Construction on the development began in 2017 after the previous administration signed off on £750 million of loans to cover the investment.

It was billed as one of “the most ambitious developments in the South East” and included 429 apartments, retail and leisure space, a performing arts academy, a four-star hotel, and a medical centre.

It means its fair market value is now hugely below its carrying book value but the scale of the figures, though predicted by councillors, still shocked.

Cllr Adam Kirby (Lib Dem, Horsell) told the LDRS: “We’ve been looking at this for a really long time.

“We’ve taken control of the council a year ago and can now get a better idea of the council’s financial position.

“This is our worst fears come true. We didn’t want to be right about this but in the last few days the Company’s House valuation has been eye-catching.”

“We were told for many, many years that these investments, if you could call them that, wouldn’t impact the budget for council services, but what is likely is it will.

“There are statutory functions we have to provide by law and we could be going into special measures to help us – we are in conversation with a government task force who are working with councillors and the CEO.

“We are trying to protect things people need. Meals on Wheels, the leisure centre, don’t have legal requirements to support them but we do not want to take them away. Stopping them won’t solve the problem.”

He added: “It would be irresponsible to speculate on what changes will be made at this stage, its people’s jobs and residents who rely on these services. People who were told these investments wouldn’t impact them.”

He said there were two ways to look at the problem, cash flow or valuation, but that it was the same problem.

The council borrowed £750 million for the project and, according to the latest valuation report, it is only worth £199 million.

The council borrowed £750 million for the project and, according to the latest valuation report, it is only worth £199 million.

Cllr Kirby added: “There is a black hole in the balance sheet.”

Furthermore, the council’s total debt is expected to hit £ 2.5 billion by 2024/25, up from its current level of £2.1 billion.

The council, he said, was firmly in “section 114 territory” where the government takes over the financial running of a local authority that is effectively bankrupt and unable to pay for even basic services.

Woking Borough Council is running on a budget deficit of about £10 million on a budget of £45 million. There is £11 million collected in council tax with the rest coming from sources such as parking or rent rates.

The Companies House report on Victoria Square Woking Limited (VSWL) indicates the company incurred a net loss of £490,479,300 during the year ended December 31, 2021.

VSWL owns the new shopping centre, residential development, and hotel – backed by a longstanding agreement with Woking Council.

The report adds that its current liabilities exceeded its total assets by over £500 million indicating a “material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern and, therefore, “that it may be unable to realise its assets and discharge its liabilities in the normal course of business”.

Cllr Kirby said: “We are going to find out the impact on the council soon and it’s not going to be good.”

The council has said the £490 million write down not only “confirms its worst fears” but casts “uncertainty on further funding for Victoria Square project beyond May with imminent reports into financial implications for the council itself.”

Cllr Dale Roberts (Lib Dem, St John’s), portfolio holder for finance and economic development at Woking Borough Council, said: “Even though we had fully anticipated massive losses and signalled them earlier in the year, this is still devastating news.

He added: “As soon as we won last year’s elections, we took immediate action to limit the damage. First, we reduced the period for which we would commit working capital to VSWL from ten to five years. Then, we began to put in place the missing systems and processes to properly run a commercial operation – and to protect the long-term interests of all Woking residents.

“Now, these accounts will further inform ongoing work being carried out by public sector finance experts, who we commissioned earlier this year to better understand the sustainability of the council’s own annual budget.

“Looking ahead, it would be irresponsible to speculate on the details and timings of what happens next. However it is responsible to be transparent about the scale of this situation. Only complete transparency will enable our commitment to finding solutions as soon as possible.”

Responses to Woking’s £490m Write Down Sparks ‘Worst Fears’ for Council Services

Leave a Comment Cancel reply

Please see our comments policy. All comments are moderated and may take time to appear. Full names, or at least initial and surname, must be given.

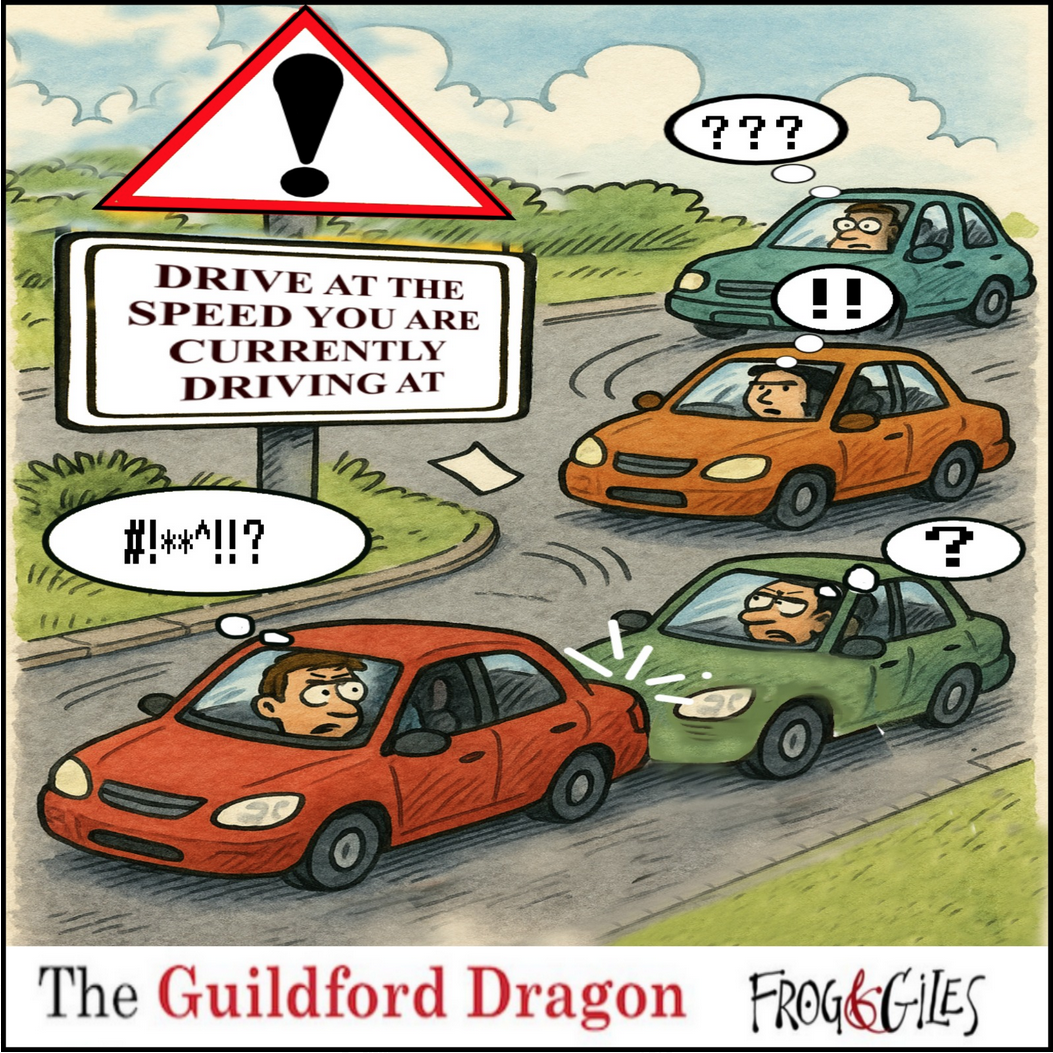

Click on cartoon for Dragon story: Public Asked for Views on SCC’s Proposal for Reduced Speed Limits

Recent Articles

- Busy First Half of 2025 for Scouting in Guildford

- Dragon Interview: MP Zoe Franklin Reviews Topical Issues

- Letter: Front-line Police Officers Are Heroes But Admin and Comms Need Improvement

- Comment: The 10-year NHS Plan – What Is the Challenge for Guildford?

- Wildlife Group Invites Nature Lovers To Spot and Record Threatened Species

- Esme Campbell, Taking the Mantle of the Dragon’s Newest Reporter

- Witness Appeal Following Serious Assault in Guildford

- Notice: Can You Help the University of Surrey Research Elderly Falls?

- Opinion: Waverley Has Failed Spectacularly on CIL

- Highways Bulletin: Smarter Planning for Better Bus Journeys in Surrey

Recent Comments

- Alan Judge on Proposed New Leisure Contract Should Improve Facilities and the Council’s Income

- Tony Harrison on Letter: A Simple Footbridge Should Have Been Affordable to Keep Towpath Over Weir Open

- Graham Hughes on Opinion: Waverley Has Failed Spectacularly on CIL

- Douglas Hainline on Esme Campbell, Taking the Mantle of the Dragon’s Newest Reporter

- S Callanan on Letter: A Simple Footbridge Should Have Been Affordable to Keep Towpath Over Weir Open

- Jeremy Holt on Witness Appeal Following Serious Assault in Guildford

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Ron Brandman

May 20, 2023 at 11:47 am

It’s a pity that the ability to surcharge councillors and officials has been abolished.

The Conservative councillors and the ex-CEO responsible for WBC’s effective bankruptcy carry a huge responsibility for their arrogance, incompetence and denial of the problem.

I am also bound to say that our [Woking] MP also shares the responsibility. He will not get my vote again.

Ben Paton

May 23, 2023 at 5:00 pm

I remember when the Conservative leader of Westminster City Council was surcharged for her party’s policy of selling off council houses at less than full value in some form of gerrymandering.

‘In May 1996, after legal investigation work, the District Auditor finally concluded that the ‘Building Stable Communities’ policy had been illegal, and ordered Porter and five others to pay the cost of the illegal policy, which was calculated as £31.6 million. This judgement was upheld by the High Court in 1997 with liability reduced solely to Porter and her Deputy Leader, David Weeks. After the judgement, the scandal and its effects were discussed in Parliament on 14 May 1996.’https://en.wikipedia.org/wiki/Shirley_Porter

She fled the country – but returned years later after some compromise payment scheme.

Surcharging would help make those responsible for promoting Emperor’s New Clothes schemes (like Guildford’s 2019 Local Plan) pay some of the costs they have inflicted on residents.

Ramsey Nagaty

May 20, 2023 at 12:02 pm

“The bigger they are the harder the fall!”

Sadly councils are not the best or ablest at being developers.

Lessons to be learnt, but that is not to say borough councils should not actively be steering planning, setting the policy and scrutinising the development and performance. That is not the job of council officers or developers, it is the duty of the councillors.

In Guildford, along with the Local Plan 2019, the previous and current administrations inherited an abundance of costly projects, all of which have increased in cost.

Times are difficult and strong active leadership is required to steer GBC through increasingly choppy seas.

Ramsey Nagaty is the chair of the Guildford Greenbelt Group

Dave Fielding

May 20, 2023 at 8:11 pm

Interestingly our MP unfavourably compared GBC’s support of local sports clubs (eg Guildford City) compared to that of Woking. She even mentioned that GBC was Lib Dem-led.

Perhaps she might now comment on Woking’s predicament and mention the political party that got them in this mess.

Ben Paton

May 21, 2023 at 6:18 pm

The curious may care to examine the latest published accounts on the Companies House Website:- https://find-and-update.company-information.service.gov.uk/search?q=Victoria+Square+Woking+Limited

Accounts for the ye 31/12/2021 include investment property valued as at 30/6/2022.

The company has net liabilities of £502 million, investment property valued at £116.5 million and loans from Woking BC of £626.5 million.

Note 15. Going Concern. “The company meets its day to day working capital requirements through the support of its lender, Woking Borough Council. Woking Borough Council will continue to make funds available as liabilities fall due until 31 May 2023”

So what will happen in ten days time?

Will anyone at Woking BC ever be held to account?

Will any bookmaker make odds on it?