Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Woking’s Finances Compared with Three Other Challenged Surrey Councils

Published on: 6 Jul, 2023

Updated on: 8 Jul, 2023

local democracy reporter

The scale of the financial problems unearthed by initial forensic exams of Woking Borough Council’s left many shocked.

The council’s accounts had not been signed off by an independent auditor for more than five years as part of a national shortage of qualified accountants that has left a high backlog across local government bodies.

Meanwhile, the borough’s chief financial officer warned things could get worse as they uncover more.

On June 23, the government’s Public Accounts Committee said that delays in publishing audited accounts increases the risk of governance or financial issues being identified too late, and hinders accountability for £100 billion in local government spending, with knock-on impacts for central government and the NHS.

It led to the committee’s deputy chairperson asking “…how many more horror stories such as Croydon, Slough, Thurrock, and more recently the shocking case of Woking council are there remaining undetected?”

Following the report, the LDRS looked at three other Surrey councils with either high levels of borrowing, or that had experienced recent write-downs in the value of their assets and asked if residents can be confident their councils won’t go bust too.

Woking Borough Council – £1.7 billion estimated debt in 2022, expected to rise to £2 billion. There has also been an “absence of external audit opinions on the council’s accounts” since 2018/19

Woking Borough Council – £1.7 billion estimated debt in 2022, expected to rise to £2 billion. There has also been an “absence of external audit opinions on the council’s accounts” since 2018/19

The majority of the council’s debt was built on complicated development deals. It borrowed hundreds of millions to pay companies it owned for town centre regeneration projects. It also funded its own loss-making businesses.

Like many council’s Woking’s central funding fell significantly over the past decade.

According to the National Audit Office its government-funded spending power dropped 69.2 per cent in the past decade. To counter this, it embarked on an investment strategy to cover the deficit, regenerate its town centres, and maintain non-statutory services.

In 2019/2020, the council received £6.7 million from the government, £9.9 million from council tax and £28.7 million from its investments.

The problem was that it spent £17.7 million on services, £6 million on minimum revenue provision, and £33.1 million just on the interest on its debts.

The Public Audits Committee published the “Timeliness of local auditor reporting” on June 23, three weeks after Woking Borough Council issued its section 114 notice declaring it could no longer balance its books.

Chairperson, Dame Meg Hillier MP, said: “Our Committee warned in 2021 that the system of local government audit was close to breaking point.

“Disappointingly, since then the situation has only gotten worse.

“The cases of Croydon, Slough, Thurrock and Woking councils all should serve as flashing red signals for the government, and our report finds that the rot risks spreading to central government finance and the NHS.

Deputy chairperson Sir Geoffrey Clifton-Brown MP said: “How many more horror stories such as Croydon, Slough, Thurrock, and more recently the shocking case of Woking council are there remaining undetected, which ultimately always have to be bailed out at huge costs to the taxpayer?

“The fragility of the number of qualified people and firms tending to carry out these important audits means that the system will only get worse before it gets better.”

Spelthorne Borough Council – £1 billion debt as of 2022, last set of audited accounts signed off: 2017/18

Spelthorne Borough Council – £1 billion debt as of 2022, last set of audited accounts signed off: 2017/18

In 2022, there were nine local authorities with borrowing of more than £1 billion.

They were either major population centres, Transport for London, Birmingham, Greater London Authority, Leeds, Warrington, Edinburgh, and South Lanarkshire, or bankrupt; Woking.

The other is Spelthorne Borough Council, with a debt of £1.1 million and a capital programme under review from central government.

Last week, it emerged that £50 million development plans for Thameside House has now jumped to £80 million – mirroring, albeit on a smaller scale, Woking’s Victoria Square development originally budgeted to cost £150 million but now stands at £750 million and a book value of around half that.

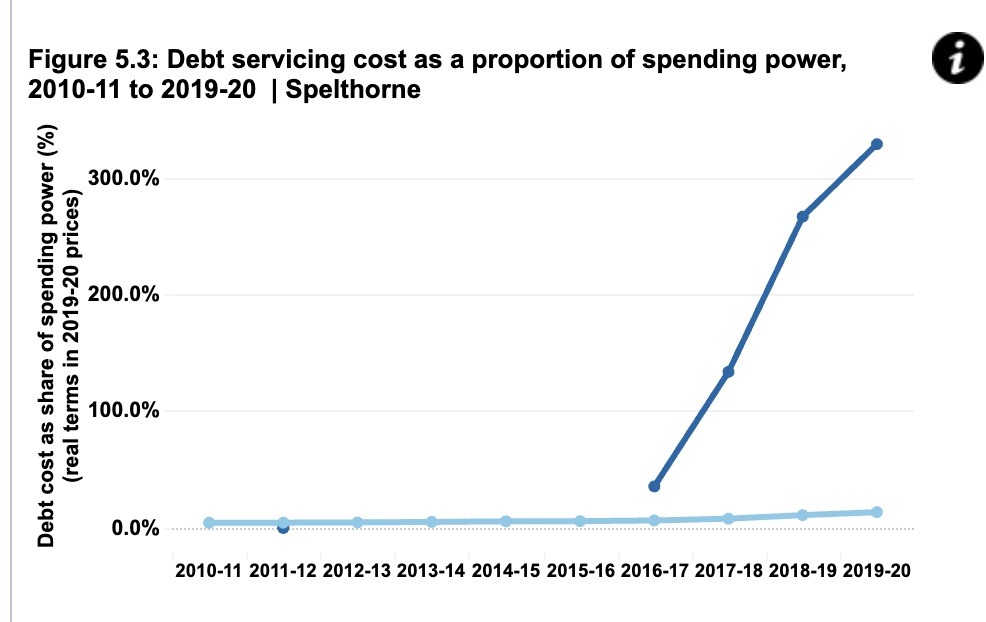

Since 2010, Spelthorne’s government-funded spending power has fallen 66.3 per cent creating the same requirement to find alternative funding or reduce services.

The council borrowed £1 billion over a three-year period from the Public Works Loans Board and income from its investments brought in £55.3 million in 2019/20 – out of a total of £72.8 million.

That allows the council to spend £16 million on services while paying off £24.2 million in interest payments with £11.1 million set aside to pay off the principle.

The sustainability of the strategy is less obvious with the council’s debt servicing as a proportion of spending power climbing to 328.1 per cent, higher than even Woking’s 295.2 per cent for the same 2019/20 year.

A spokesperson for Spelthorne Borough Council said: “The financial situation is significantly different between Spelthorne and Woking Borough Council.

“Spelthorne has taken steps to ensure that the commercial property programme is sustainable, and our investment model is very different.

“We have always taken a cautious approach, paying down debt on a year-by-year basis (like a mortgage) and ensured that the council has fully complied with the CIPFA requirements for Minimum Revenue Provision.

“The council took a long-term strategic view to acquire key investment and regeneration properties in order to generate income to support and fund council services, affordable housing, and regeneration programmes.

“We save up funds over a long-term time frame and have set aside £37.8 million sinking fund to cover potential dips in income.

“Spelthorne Council has the highest ratio of usable reserves to net revenue budget of any district or borough council in the country.”

Runnymede Borough Council: £600 million debt as of 2022, last set of audited accounts: 2018/19

Runnymede Borough Council: £600 million debt as of 2022, last set of audited accounts: 2018/19

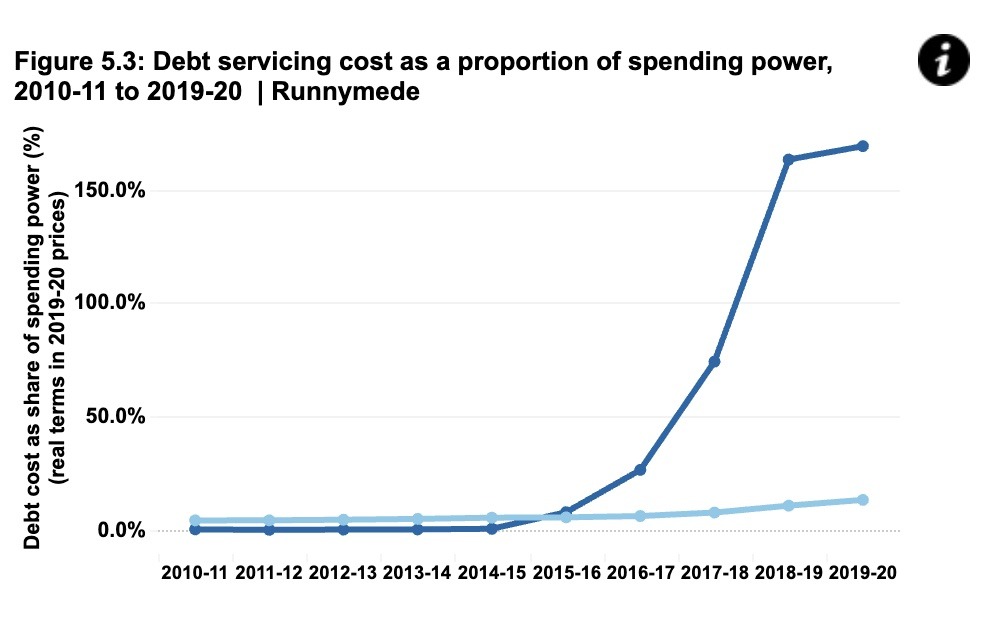

Runnymede Borough Council is awaiting the findings of a Department of Levelling Up, Housing and Committee report into its finances and its strategy to borrow heavily for town centre redevelopment projects.

It is another council that followed the investment/redevelopment route, in part to cover the 55.5 per cent decrease in its government-funded spending power.

High-profile developments such as Addlestone One and the Egham Town Centre have changed their local areas with new shopping centres, hotels and cinemas.

But they have also resulted in the council’s debt servicing costs climbing to 168.9 per cent, about half of the levels in Woking or Spelthorne but still way above the national average of 13.4 per cent for local authorities.

The investments brought in £28.1 million in 2019/20, from a total of £40.8 million in income, which covers the borough’s £13.4 million spending on service as well as its £11.1 million in interest repayments and £3.2 million for the principal.

A spokesperson for Runnymede Borough Council said it “only undertakes borrowing where it is prudent and affordable. Our current capital programme, approved in February 2023, does not include any new major schemes that require additional borrowing.

“We have a robust policy covering the repayment of debt, which is reviewed annually as part of the budget process and is included in all the council’s financial plans. We continue to set a balanced budget and to hold sufficient reserves to manage known risks alongside contingency for unforeseen events.

“The local government sector is suffering from the effects of the backlog in the audit profession. The council is still awaiting final sign-off for its 2019/20 accounts.

“Since 2010 there have been significant cutbacks to local government funding. We calculate the loss of revenue support grant to be in excess of £5 million, which equates to a third of our net budget. This has been partially offset by other grants, but only modestly. To protect services, we have had to raise our own sources of income whilst making efficiencies.”

Surrey Heath Borough Council: £51 million debt at 2022, last set of audited accounts 2018/19

Surrey Heath Borough Council: £51 million debt at 2022, last set of audited accounts 2018/19

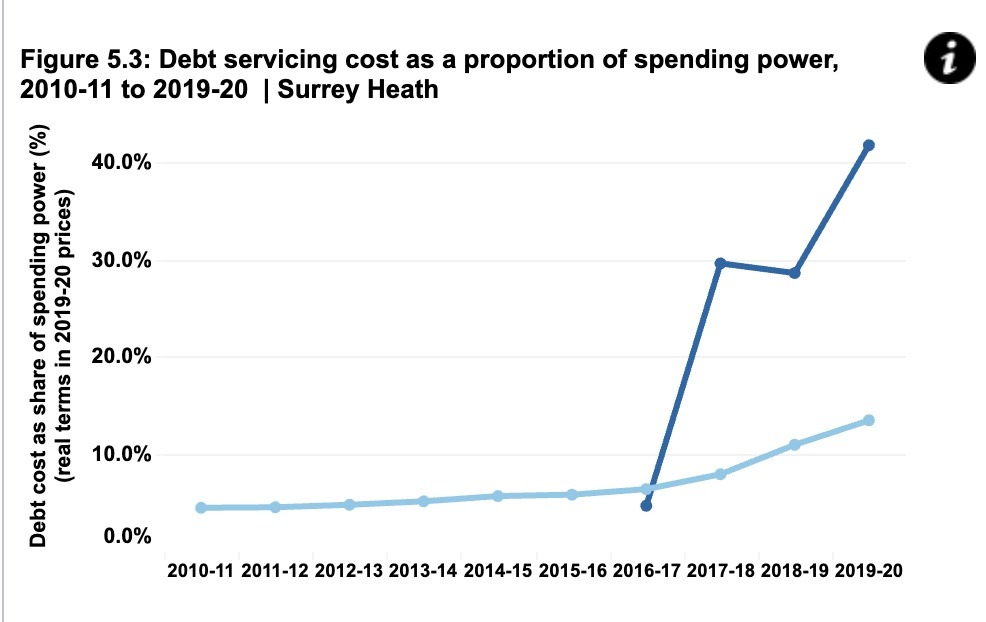

Debt levels in 2022 stood at £51 million, putting Surrey Heath Borough Council in a different position compared with Woking, Spelthorne and Runnymede.

However, it has since emerged in unaudited accounts that its debt grew to £160 million and its biggest asset dropped by £79 million.

This prompted the council to announce it was updating its property acquisition strategy despite its government-supported funding dropping by 60 per cent in the last decade.

This change in approach is taking place even though its 2019/20 debt servicing levels were comparatively low among Surrey peers at 41.8 per cent – although its debt levels have since climbed.

The council balanced its books in a more conventional manner with just £3.3 million of its £15.5 million income coming from its investments that year.

This covered the £9.96 million to run its services, with £2.3 million paid in interest and £2.2 million set aside to pay off the debt.

A spokesperson for Surrey Heath Borough Council it was considered to have a “sound strategy for debt management as per the annual Treasury Strategy agreed at council in February. We are not interlinked with Woking Council and therefore it is considered that no changes are required.

“The Medium Term Financial Strategy approved at February’s council contains a minimum revenue provision for future debt repayment. This has been calculated in accordance with central government and CIPFA guidance.

The spokesperson added: “The council no longer receives any revenue support grant from central government. The council retains business rate income, but also has to pay a tariff on this to central government. It is difficult to put a £ and % figure on this as the real term reduction is a great deal higher than the actual cash reduction.”

The committee report concluded that the backlog of audit opinions for local government bodies remains unacceptably high, and that there is still no plan to reduce it.

Only 12 per cent of local government bodies received their audit opinions in time to publish accounts for 2021–22 within the already extended local authority accounts publication deadline.

Responses to Woking’s Finances Compared with Three Other Challenged Surrey Councils

Leave a Comment Cancel replyPlease see our comments policy. All comments are moderated and may take time to appear.

Recent Articles

- Guildford Institute’s Crowdfunding Project for Accessible Toilet in its New Community and Wellbeing Centre

- Letter: Guildford – Another Opportunity Missed?

- Letter: GBC’s Corporate Strategy – Where Is the Ambition?

- My Memories of John Mayall at a Ground-breaking Gig in Guildford Nearly Six Decades Ago

- Westborough HMO Plans ‘Losing the Heart of the Street’ Says Resident

- College Invests to Boost Surrey’s Economy and Close Digital Skills Gap

- Community Lottery Brings Big Wins for Local Charities

- GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Hospital Pillows ‘Shortage’ at the Royal Surrey

- Updated: Caravans Set Up Camp at Ash Manor School

Recent Comments

- Ian Macpherson on Updated: Main Guildford to Godalming Road Closed Until August 1

- Sara Tokunaga on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- Michael Courtnage on Daily Mail Online Reports Guildford Has Highest-paid Council Officer

- Alan Judge on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- John Perkins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

- S Collins on GBC Housing Plan Promises ‘A Vibrant Urban Neighbourhood’ Near Town Centre

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Ben Paton

July 7, 2023 at 12:06 pm

This article prompts two questions:

1. Where does Guildford Borough Council stand? [We hope to report on this later this month. Ed]

2. How could Woking avoid having its accounts audited for FIVE years:

“The council’s accounts had not been signed off by an independent auditor for more than five years as part of a national shortage of qualified accountants that has left a high backlog across local government bodies.”

Accounts not signed off for five years! Isn’t that against the law? If a publicly quoted company tried that on its shares would be de-listed and the shareholders would fire the management for gross incompetence.

Not getting your accounts audited for five years is down to a lack of scrutiny, competence and responsibility. What are councillors elected to do if not to scrutinise basic housekeeping like getting the accounts properly signed off?

Is there any evidence at all to support the implication that the Woking Council tried for five years to get its accounts audited but simply could not “find” a qualified accountant?

I find it implausible that there is any shortage of “qualified accountants”. I guess many firms of accountants would audit Woking’s accounts for a fee – provided they believed a) they would be paid and b) the reputational risk was acceptable.

A more likely reason for Woking not getting its accounts audited for five years is that the council did not want any independent third party scrutiny of its finances.

There probably was not a “national shortage” of “qualified” accountants only a shortage of firms that the council found pliable, that were prepared to sign off the accounts without qualifications, and that found the reputational and financial risk of signing an unqualified report acceptable.

Claire Morris

July 7, 2023 at 3:11 pm

Since the audit commission was disbanded back in around 2010 local government had the option of appointing its own auditors but to achieve economies of scale in pricing contracts, over 99% of councils and police bodies signed up to an organisation called “Public Sector Audit Appointments” or PSAA Ltd.

Once opted in to PSAA, the procurement and contracting of the audits to firms was run by them and they appoint auditors to local councils. The vast majority of councils therefore do not appoint their own auditors and are not able to do so, they are appointed by PSAA.

The audits are typically contracted to the big firms who all underbid the work and over time started to pull out of the local government audit market because they couldn’t make enough money on it. The situation was combined with a shortage of staff qualified to be able to work on local government audits because not enough firms are training them to be suitably qualified. Add to this a lack of resource in local government finance teams, an inability to recruit experienced public sector accountants (the rules and standards are different to the private sector) and you get a completely broken system.

The result is the majority of councils have an audit backlog and due to that backlog and a lack of resource, a significant number of councils are also behind on producing their draft accounts which then increases the audit backlog further.

Maybe its time to either give local government audit to the national audit office or recreate the audit commission?

Claire Morris is a former finance director of Guildford Borough Council.

Ben Paton

July 10, 2023 at 12:23 am

I qualified as a chartered accountant.

It is nonsense to suggest that local government accounting is either rocket science beyond the ken of ordinary accountants or so arcane that an intelligent auditor could not work it out in an afternoon – or at most a few days.

As for the system described. It looks like the rest of government – deliberately designed to dilute responsibility so that when the house of cards collapses all the civil servants in the house can turn around and say, “Gosh we never saw that coming!”

We now have the ridiculous spectacle of the accounts department in Woking Borough Council calling in outside accountants to tell them what they should already know – what their own systems say.

Plus ca change, plus c’est la meme chose.

Claire Morris

July 10, 2023 at 10:02 pm

Auditors who sign off local government accounts have to hold practising certificates from the Chartered Institute of Public Finance and Accountancy (CIPFA). Whilst it is possible for accountants with other qualifications to convert to CIPFA to suggest it takes an merely an afternoon of training is incorrect.

Ben Paton

July 11, 2023 at 3:38 pm

It only needs one person with the CIPFA qualification to sign the audit report. Multidisciplinary partnerships employ such people. The rest of the team doing the audit could have other accounting qualifications. Some of them might not even need to have passed their exams: they only need to be supervised by someone who is qualified.

Are local government activities particularly difficult to understand or account for? Definitely not. An accountant with any gumption could indeed understand the principles in an afternoon.

This lack of qualified accountants malarkey is just obfuscation and flannel. The public might go along with this as an excuse for five months – but claiming it excuses no audit for five years it taking the mickey.

Ben Paton

July 10, 2023 at 12:32 pm

Getting accounts audited is a bit like getting a car MOT tested.

A 20-tonne truck is a more complicated vehicle to audit than a 50cc motorcycle.

Suppose the owner of a 20-tonne truck drove it around for five years without an MOT. Suppose he then gave as his excuse that he could not find anyone qualified to do the MOT. Would anyone believe that?

Five years is long enough for a lot of people to pass all the necessary exams to do the MOT on his lorry.

Dave Fielding

July 9, 2023 at 7:27 am

Good to read Claire Morris’ informed, factual post which demolishes the previous subjective opinion.

John Cooke

July 10, 2023 at 9:04 pm

I don’t buy into Claire Morris’ assessment. The ‘Big Four’ would want this business, regardless. There are loads of accountancy companies who could audit the books and if PSAA can’t fulfil their part of the contract Woking could get somebody else to satisfy their legal responsibilities.

It sounds like a convenient excuse and if somebody doesn’t chase down this behaviour local government will keep riding roughshod over the electorate.