Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

The Dragon Says: Government Policy is Largely to Blame for Guildford’s Financial Woes

Published on: 27 Jul, 2023

Updated on: 28 Jul, 2023

The message from GBC’s full council meeting was clear – Guildford is in serious financial trouble. The situation might not be anywhere near as bad as Woking’s but it is bad enough.

The message from GBC’s full council meeting was clear – Guildford is in serious financial trouble. The situation might not be anywhere near as bad as Woking’s but it is bad enough.

Probably the report was extra gloomy, as Cllr Joss Bigmore said it was, because those responsible for the finances want to make it clear to all budget holders that there is a freeze on any new spending without specific approval.

See: GBC ‘Will No Longer Be Able to Afford the Current Range of Services’ Provided

They were also warning the rest of us “expect painful cuts to services”. Churchill could only offer “blood, sweat and tears”. GBC is offering cuts, pain and austerity to achieve the necessary savings of £18.5 million over the next four years.

So what has brought one of England’s most affluent boroughs, in terms of personal wealth, to such a pass?

In 2011, Eric Pickles the Tory Secretary of State for Communities and Local Government in the coalition Conservative/Lib Dem coalition, oversaw the introduction of the Localism Act. The stated aim of the Act was to facilitate the devolution of decision-making powers from central government control to individuals and communities.

“For too long,” said Greg Clark the Minister of State for Decentralisation, “central government has hoarded and concentrated power. He signed off: “I look forward to seeing how local people will use the rights and freedoms the Act offers to make a difference in their communities.”

But following the Act councils were encouraged to be “entrepreneurial”, GBC even listed as a required quality when looking for a new CEO in 2017. The government had come up with the wizard wheeze that they could stop handing out grants by encouraging local authorities to create other income streams.

With cheap government loans available, councils predictably decided to make property investments in order to create new revenue.

Of course, the problem is any investment has risk attached. Property prices, rental income and, most importantly, interest rates can go up as well as down.

In 2012, with an inexorably increasing population, the government introduced the National Policy Planning Framework to pursue a pro-growth and deregulationist agenda.

There is no doubt more houses were needed and the developers, regular contributors to Conservative coffers, were keen to make money by building them with fewer constraints.

New challenging, controversial, and perhaps poorly measured, housing targets for each local authority were set, in Guildford under a formula we were not even allowed to see. But councils, while they could allocate sites, and even remove land from green belt protection, could not insist owners had the sites developed even where planning permission had been granted.

Despite the lack of council power to control the rate of construction, failing to meet housing targets could also affect finances as allowances were to be paid for houses built.

Despite widespread unpopularity in some areas, the Local Plans were introduced by councils, some strangely compliant to government direction and seemingly immune to public opinion. In Guildford, thousands of residents commented on the proposed plan but their views were mostly disregarded.

In line with the encouraged entrepreneurial spirit, major projects were launched by councils, such as Weyside Urban Village here in Guildford, to help meet the targets. But the projects required money in the form of loans commenced at times when interest rates were low and there seemed little prospect of them rising significantly.

Fortunately, the gamble on interest rates in Guildford was not on the reckless scale seen in Woking. However it was critical.

All this would have been bad enough but it was only one ingredient in a disastrous cocktail.

Along with the Local Plan, “Future Guildford” was introduced shortly before the Tories lost control of the council in 2019. It was a programme of cuts and economies, including 100 redundancies, in order to make ends meet. It received support from all parties, at the time.

See: ‘Future Guildford’ Transformation Project Approved Unanimously by GBC Executive

But the cuts went deep, well into the bone. Performance was inevitably affected.

Then in 2020, the Covid pandemic struck. Major amounts of money were given by central government to local authorities to help businesses, organisations and individuals survive financially during the lockdowns and restrictions.

But not all Covid-related council expenses were met by the government grants which only added to the pressure on its budgets.

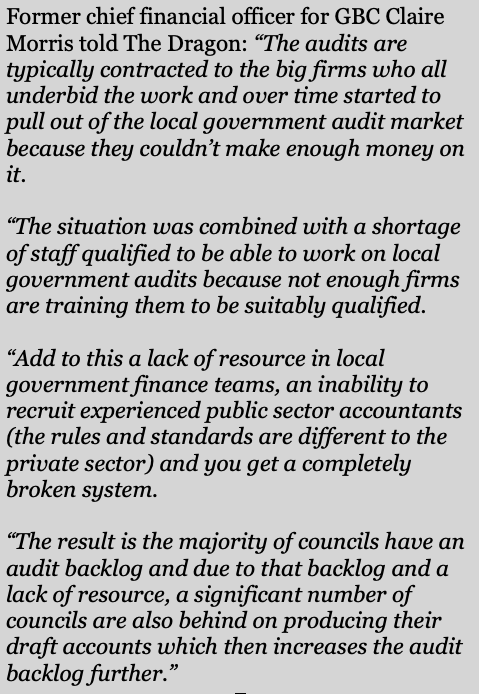

Understandably getting less attention at that time was the delays to the auditing of GBC’s accounts. Claire Morris, the chief financial officer during the period, has given a summary of the factors at play (see right).

Understandably getting less attention at that time was the delays to the auditing of GBC’s accounts. Claire Morris, the chief financial officer during the period, has given a summary of the factors at play (see right).

This was not a problem that only affected GBC. But the ramifications of £10 million pound accounting error, which an audit should have uncovered earlier, have only recently come to light.

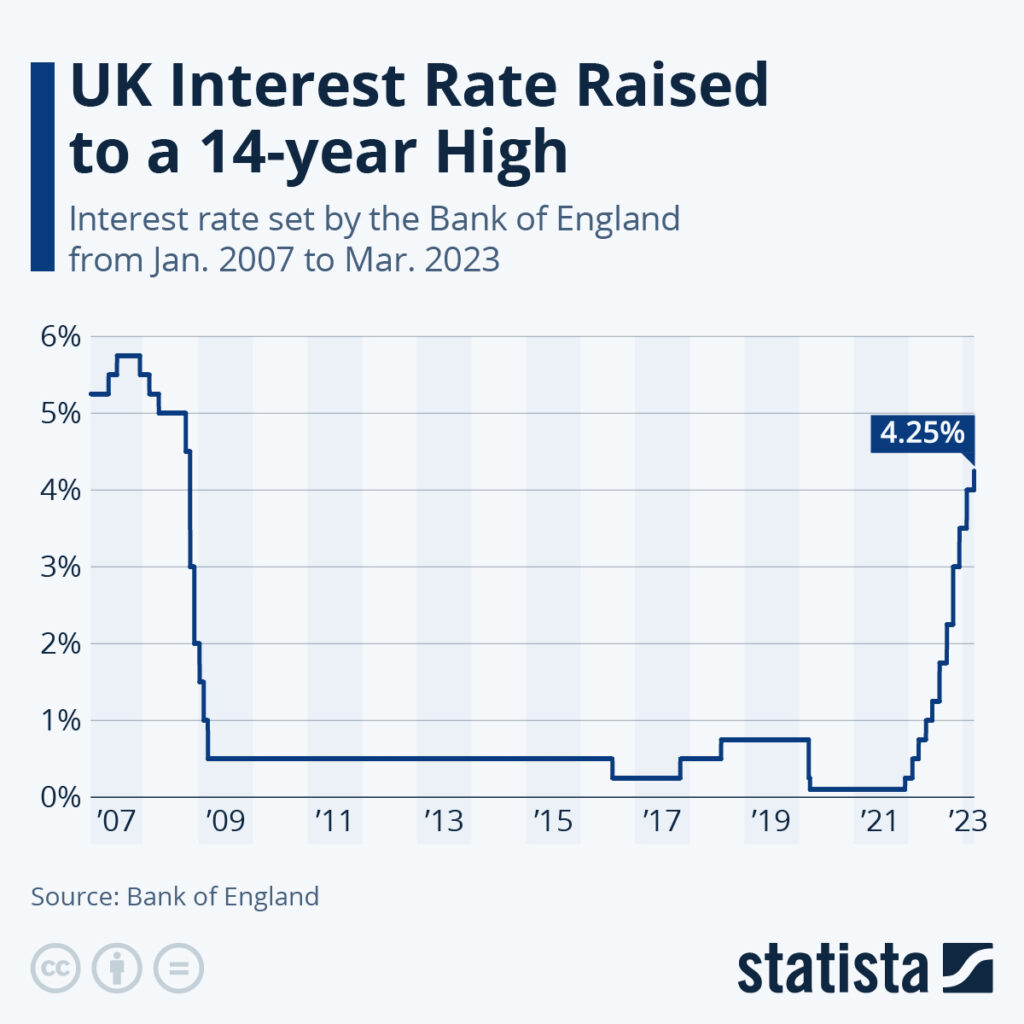

And then there is the real killer ingredient – rising interest rates. Most media coverage was understandably about the impact on mortgage borrowers but it was also having a critical effect on the finances of local authorities who had gambled on interest rates remaining low.

Those of us longer in the tooth know from experience that interest rates cannot be relied on and even experts get forecasts wrong. With a decade of sub-one per cent rates it is understandable that some presumed it was the norm but of course, it could not be relied upon.

Better risk management might have posed the question, “Can we afford this borrowing if the rates go up?”

In an early version of the council’s own update report it was written, tellingly, that: “The [finance] team was not geared up to deal with the scale of the investments made by the council, nor was the function strengthened to effectively manage those investments. The council’s investment and borrowing decisions leave a legacy for the council and pose the biggest threat to its future resilience.”

Recent governments cannot be responsible for the pandemic or the global financial situation which have caused interest rates to rise, although there has been criticism of how both were handled, but its planning policy and local government funding policy have directly caused problems for local authorities and not just Guildford.

Councils at Thurrock, Liverpool, Slough, as well as nearer to home Croydon and next door Woking, are all effectively bankrupt. Another two dozen are said to be “on the brink”.

And to take us back to the beginning, if the stated aim of the Localism Act was to “facilitate the devolution of decision-making powers from central government control to individuals and communities” it has failed.

In fact, the central government has increased the centralisation of planning policy while divesting itself of the responsibility for, and cost of, local government funding. If the former minister for decentralisation, Greg Clark, is still paying attention things don’t seem to have turned out as he expected.

Planning policy and local government financing get little attention during general election campaigns. They should. They have a dramatic and direct effect on our quality of life.

Next time a potential MP comings knocking ask them what they and their party will do. See if it measures up and sounds sensible.

Recent Articles

- Forest Management Can Influence Health Benefits

- Dragon Interview: New Guildford Mayor Howard Smith

- Delaying the Net-Zero Transition Could Have Dire Consequences, Research Reveals

- County Council Leader Appeals to MPs Not to ‘Talk Down’ Children’s Services

- Guildford Plays Its Part in Campaign to Protect Bees

- A New Superdrug is Coming to Guildford’s Ladymead Retail Park

- Two Candidates Compete for Seat on Ash Parish Council

- MPs Unite in Criticism of SCC’s Handling of SEND Cases

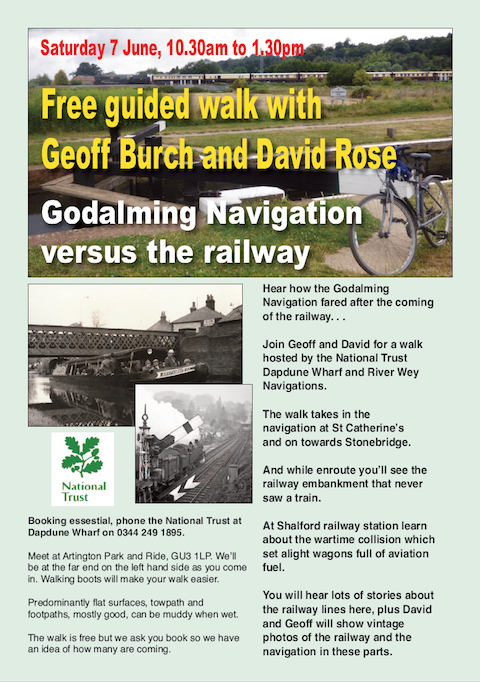

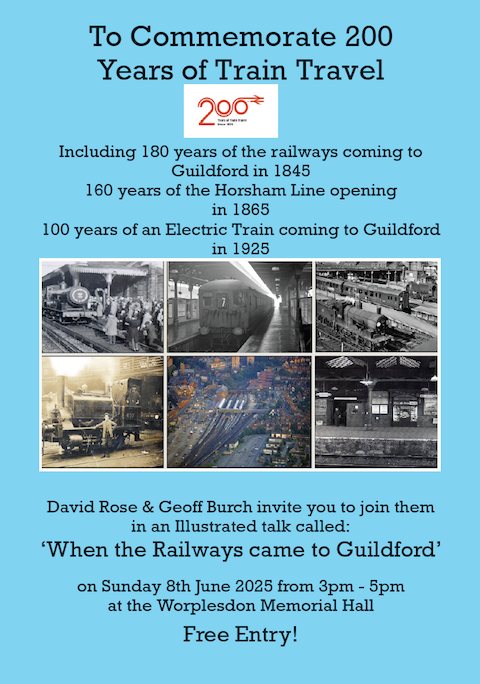

- Guided Walk and a Talk Celebrating Guildford’s Railway Heritage

- EasyJet to Run Its Full Half-term Flight Schedule Despite Strike Action

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments