Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Independent Auditor Praises County Hall For Finally Balancing the Books

Published on: 14 Nov, 2020

Updated on: 15 Nov, 2020

local democracy reporter

An external auditor found Surrey residents are getting value for money from their county council, except for children’s services.

The independent team from Grant Thornton told the council they had to figure out how to cut transport demand in special educational needs, which far exceeds other council areas.

They also raised concerns about the council’s ability to repay its loans.

But on the whole, County Hall has managed to turn its finances around, after three years of spending more money than was coming in and dipping into reserves to balance the books.

This was achieved by making a whopping £72 million worth of efficiencies in one year, some projects had to be delayed and the £82 million target was still not met.

The audit report on the financial year 2019-2020 said: “Given the overall scale of savings to be delivered, this reflects effective management and delivery of savings plans.”

Some services were cut after a £2.7 million net overspend in children, families, lifelong learning and culture. This department spent 28% (£527 million) of the council’s total revenue budget.

The excess was mainly down to a higher than expected demand for children’s transport, particularly children with SEND (special educational needs and disability).

In addition, a shortage of SEND places in Surrey state schools meant an increasing number of children had to be found independent placements, which exceeded the government grant for schools.

This meant the council carried forward a liability of £30 million, with a risk this may have to be covered by money from elsewhere.

The auditors told SCC they had to “consider ways to mitigate demand in SEND transport”.

Why are SEND transport costs so high and how is the council going to bring them down?

An internal review last year of SCC’s school transport policy, under children’s services director Dave Hill, showed “poor practice and culture driving poor outcomes for children and young people in Surrey and high costs”.

Surrey had one of the highest school transport budgets in England, spending between two-and-a-half and three times more on SEND transport, for those aged up to 17, than Hertfordshire and Essex.

Each year, £33.3 million was spent on transporting children with SEND to school, totalling 5% of all council tax raised in the year.

As a result, Julie Iles, the cabinet member for all-age learning, approved Mr Hill’s recommendations to stop providing free transport to some children where it was not obliged to by law, for under-fives and over-16s.

And a new transport policy from September 2020 is promoting independence by encouraging walking and cycling or using minibus collection points. Cllr Iles (Con, The Horsleys) said many young people had been in taxis from the age of five and when their time at school ended, they should be able to travel independently.

She added: “The auditors’ report speaks to the financial statement of 2019/20 and SCC have, since then, introduced a transport policy which will foster greater independence for our young people.

“Most of them will not have support from social care as they move into adulthood, so being able to travel independently is part of that preparation for life.

“I had a parent last year who was adamant his child could not cycle to college. His son decided he was going to do it, and they’ve never looked back.”

But she said sometimes they still needed to use taxis, “for medical reasons and sometimes by reason of their social interactions”.

The council is still spending £31 million a year on SEND school travel, though plans to reduce this also include creating 213 more specialist school places within the county next year. This will prevent journeys to other counties, and also use of independent schools, more than three times more expensive.

“By investing in specialist places across the county we will be able to educate more of our special needs pupils closer to home and avoid lengthy journeys,” said Cllr Iles. “It’s better for them and better for the environment and speaks to our Surrey Vision 2030 of no one left behind.”

The audit team concluded: “Based on the work we performed to address the significant risks, we are satisfied that, except for the matter we identified in respect of children’s services, the council had proper arrangements for securing economy, efficiency and effectiveness in its use of resources.”

Council leader Tim Oliver and chief executive Joanna Killian said: “This financial year has seen an ambitious step-change in the financial management and resilience of the council.”

How does the future look?

Auditors warned the council on the impact of coronavirus.

A total of £38 million of savings and efficiencies were identified for the 2020-21 budget, about half of what was made in the year before.

This needs to be revised to take into account less business rates income and paying out more for council tax support.

Auditors said the council should review its policy on minimum revenue provision, how much of their borrowing debt needs to be paid off each year, which was lower than suggested by statutory guidance.

They said: “An added degree of uncertainty surrounding repayments exists in the current economic climate so the policy is risky.

“Concern could be raised about the council’s ability to refinance or repay its related £234 million loans [mainly to the central government’s Public Works Loans Board] when they mature, predominantly in the period 2050 to 2065.”

The council was confident of re-financing them, pointing out its Hasley Garton investment properties were worth about £269 million, £35 million more than their debt.

But these property values fell by £27m in the financial year ending March 2020.

Ciaran McLaughlin, key audit partner for Grant Thornton UK LLP, said: “While we believe the [minimum revenue provision] policy to be imprudent, we’re satisfied it’s not unlawful.”

He said SCC should monitor the value of its properties to make sure they did not fall below its level of outstanding debt.

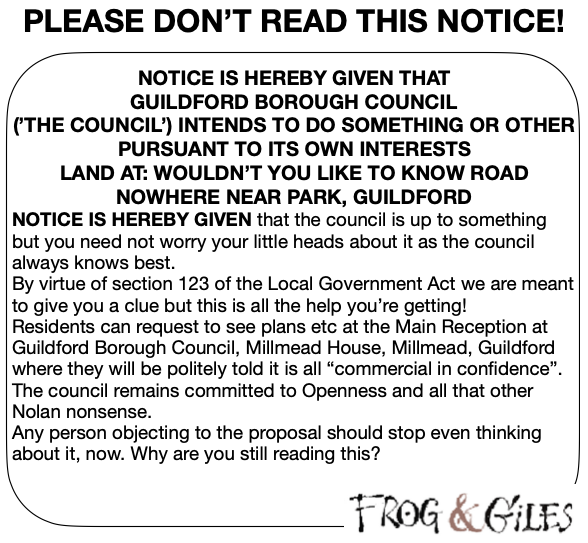

See Dragon story: GBC’s Explanation of Major Land Sale Notice Error ‘Borders on Arrogant’ Says Councillor

Recent Articles

- Guide to Telephone Befriending Services for Older People

- Stage Dragon: Sleuth at the Yvonne Arnaud Theatre

- Guildford Lido All Set for the 2024 Season

- Appointment of Permanent Joint Strategic Director of Finance Confirmed

- Police and Crime Commissioner Candidate Interview – Alex Coley

- New Approach to Mental Health Concerns Reported to the Police

- Letter: Bernard Quoroll ‘s Insight Should Be Heard

- Police and Crime Commissioner Candidate Interview – Paul Kennedy

- Staff Union Warns Surrey University of No Confidence Votes

- Invitation to Join Mass Bike Ride on Saturday, April 27

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments