Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Abraham Lincoln

If given the truth, the people can be depended upon to meet any national crisis...

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Guildford news...

for Guildford people, brought to you by Guildford reporters - Guildford's own news service

Pandemic Forces SCC to Face Whopping £100 Million Loss on Property Investment Portfolio

Published on: 10 Oct, 2020

Updated on: 13 Oct, 2020

By Julie Armstrong

local democracy reporter

Coronavirus is threatening 96% of Surrey County Council’s investment portfolio. Latest figures in March showed a £44.35 (10%) drop in SCC’s original £444 million investment in commercial property, and since then the pandemic has forced a switch to home working.

That left many businesses questioning their need for expensive office space and 96% of the SCC portfolio is office space in Dorking, Guildford, Ashtead and Crawley.

The council also holds a Halsey Garden portfolio, 38% of which is retail and 10% leisure, both sectors badly hit by lockdown and ongoing restrictions inhibiting trade.

In July, the Office for Budget Responsibility predicted the value of offices and commercial buildings will fall by nearly 14% this year. That could cut Surrey’s portfolio by a further £56m, totalling a £100 million loss for the year.

Patricia Barry, SCC land and property director, said they were implementing a long-term strategy “to avoid a knee-jerk reaction to short-term, unrealised valuation losses and work towards increasing income and value over the next five to 10 years.

“We’ve started looking at option appraisals on alternative use for some of our investments should that tenant struggle. We do need to be proactive; where the market is struggling we need to be on the front foot in terms of alternative use.”

The biggest loss was Malvern Retail Park, which dropped £15 million, a third of its purchase price, caused by retail market deterioration. Debenhams in Winchester halved, losing £8 million. Other assets affected include Travelodge in Hatfield and Stratford.

A report to the SCC resources and performance select committee this week reads: “Nine offers have been received on each property, from alternative operators, to break the Travelodge lease and re-let the existing property, which will maintain or increase the current level of income.”

The council also invests in cinema company Vue and their chief executive announced this week, “We have no movies”, after release of blockbusters such as the James Bond No Time to Die are delayed until next year.

John O’Connell, chief executive of Taxpayers Alliance, called the figures “deeply worrying”. He said: “Local authorities up and down the country made many poor decisions on buying and leasing out commercial properties in recent years. The pandemic has brought this to a head.

“As we emerge from the coronavirus crisis, new measures and mindsets will be needed if we are going to make sure this doesn’t become a disaster waiting to happen for local authority finances.”

SCC is creating contingency plans, and some retail assets have not been affected. Ms Barry said: “For instance, we have Waitrose as a retail tenant who fared pretty well in this, but then we’ve also got Debenhams who have not.”

The council had offers to replace Debenhams, which is in debt and entered a Company Voluntary Arrangement last year.

Ms Barry said if a tenant defaults or there’s an issue with their business, “We are looking at what do we do with that asset. This is very much a planning for worst-case scenario that if we can’t find another tenant, what is an alternative use for that site?

“We need to safeguard that investment and safeguard that revenue stream.”

The council says its commercial properties generate a total of £11.6m revenue, equating to £22.91 (1.5%) per year on the average council tax bill, regarded as “doing well” compared with the national average in collecting rents amid the coronavirus fallout.

Nationally, fewer than half of tenants paid rent on time at the end of June, but in Surrey it was 74% for commercial and residential properties combined.

Ms Barry said: “I think that is because we’re working very closely and in constant contact with our tenants.

“While it’s not a fantastic picture overall, the team is doing a really good job in terms of rent collection under the circumstances.”

Strategic finance partner Paul Forrester said: “The Surrey portfolio [within the county] is at a 92% collection already for the September quarter.

“Halsey Garden [outside the county] is at 72% but that does contain some tenants who are on monthly payments rather than quarterly so that will go up across the term of the quarter.”

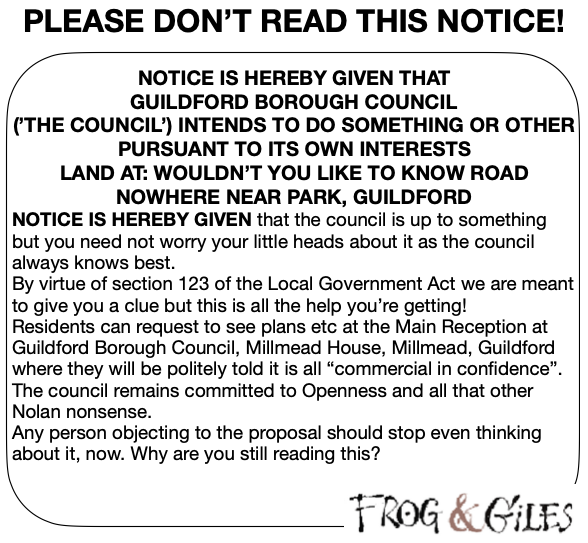

See Dragon story: GBC’s Explanation of Major Land Sale Notice Error ‘Borders on Arrogant’ Says Councillor

Recent Articles

- Birdwatcher’s Diary No.302

- Diocese of Guildford Appoints New Registrar and Legal Advisor

- ‘One in Five’ Surrey Police Officers Seeking Another Job

- Insights: Lead from the Front on Values

- New Investment Will Help Surrey Fire and Rescue Service Improve Training Facilities

- Letter: Are the PCC Candidates Relying on Their Party Labels?

- Notice: Sing Barbershop – Every Tuesday

- Modernised Surrey Police Headquarters Will Require New Access Road

- Notice: Open Mic Night at the Guildford Institute – April 27

- ‘It Will Grow’ Says Councillor About Replacement Tree in Upper High Street

Search in Site

Media Gallery

Dragon Interview: Local Artist Leaves Her Mark At One of England’s Most Historic Buildings

January 21, 2023 / No Comment / Read MoreDragon Interview: Lib Dem Planning Chair: ‘Current Policy Doesn’t Work for Local People’

January 19, 2023 / No Comment / Read MoreA3 Tunnel in Guildford ‘Necessary’ for New Homes, Says Guildford’s MP

January 10, 2023 / No Comment / Read More‘Madness’ for London Road Scheme to Go Ahead Against ‘Huge Opposition’, Says SCC Leader

January 6, 2023 / No Comment / Read MoreCouncillor’s Son Starts Campaign for More Consultation on North Street Plan

December 30, 2022 / No Comment / Read MoreCounty Council Climbs Down Over London Road Works – Further ‘Engagement’ Period Announced

December 14, 2022 / No Comment / Read MoreDragon Interview: GBC Reaction to the Government’s Expected Decision to Relax Housing Targets

December 7, 2022 / No Comment / Read MoreHow Can Our Town Centre Businesses Recover? Watch the Shop Front Debate

May 18, 2020 / No Comment / Read More

Recent Comments